Pakistan has emerged a strong competitor against India in the global maize (corn) market offering the coarse cereal at a lower price in South-East Asia.

Exporters, however, see the trend as short-lived as the neighbouring country has limited stocks only and is facing several issues.

As a result of Pakistan offering maize at a lower prices, a few buyers in South-East Asia, particularly Vietnam, are trying to outsmart Indian sellers by bargaining after ships reach their shores.

Shipments held up

“Currently, demand for Indian maize is low as Pakistan is offering it at a cheaper price. Two-three of our consignments are held up in Vietnam as a result and buyers are bargaining for a lower price,” said M Madan Prakash, President, Agricultural Commodities Exporters Association (ACEA). His firm Rajathi Group exports agricultural products such as maize, rice and onion.

“There are a lot of issues with Pakistan currently. India has got a bumper maize crop this year. The situation is set to improve as Indian exporters are signing new contracts to South-East Asia and Gulf countries,” said Mukesh Singh, Managing Director of Mumbai-based MuBala Agro Commodities Pvt Ltd.

“Pakistan is benefiting from its currency weakening against the dollar. But it has only limited quantities and is focusing on South-East Asia only,” said Rajesh Paharia Jain, a New Delhi-based exporter.

Lack of govt support

A Delhi-based trade analyst said Indian exporters can’t help with such behaviour of buyers, though such incidents are few and far between.

“But there are problems. No one is extending a letter of credit (LCs) for trade with Pakistan. Also, container availability is a problem,” he said.

Prakash said Indian maize was being offered at $307-15 a tonne, while Pakistan was selling at $293-95 cost and freight. Jain said Pakistan was offering its produce at $280 free-on-board (f.o.b), while India was seeking $295 f.o.b.

“India should be able to wrestle back the advantage, mainly through lower freight rates from the east coast. On the other hand, our maize faces the handicap of a flat Indian currency and lack of government support besides higher handling and storage costs,” Jain said.

Prices below MSP in some mandis

“We don’t have problems with supply. We are getting corn supplied at ₹24,000 a tonne in Chennai as prices have cooled a bit,” said Prakash.

According to data from Agmarknet, a unit of the Agriculture Ministry, the modal price (rates at which most trades take place) of maize at Davangere in Karnataka is ₹2,017 a quintal — down ₹150 since last month.

The minimum support price (MSP) for maize this crop year to June is ₹1,962. Prices in some Maharashtra markets have dropped below MSP.

On the Chicago Board of Trade (CBOT), corn futures are ruling at one-month high of $6.5 a bushel ($255.89 a tonne) on strong demand.

Jain said the quality of Indian maize was better but it is unable to gain as it is being sought for feed purpose and not human consumption.

MuBala’s Singh said he has been able to bag orders from Oman and Saudi, though in smaller lots of 5,000 tonnes. Vietnam and Malaysia, too, were buying good volume.

Demand set to be good

On the other hand, problems have cropped with shipments to Bangladesh, the largest buyer of Indian maize, as Indian LCs are not being honoured.

The analyst said demand for Indian corn will continue to be good in view of problems in the US, where the crop has been affected by weather.

“There is uncertainty over supply from the US. Also, there is a question mark over supplies from Ukraine. Demand for maize continues and India will likely gain from this,” he said.

An estimated record high maize production of 34.61 million tonnes (mt) is likely to come handy to meet export demands.

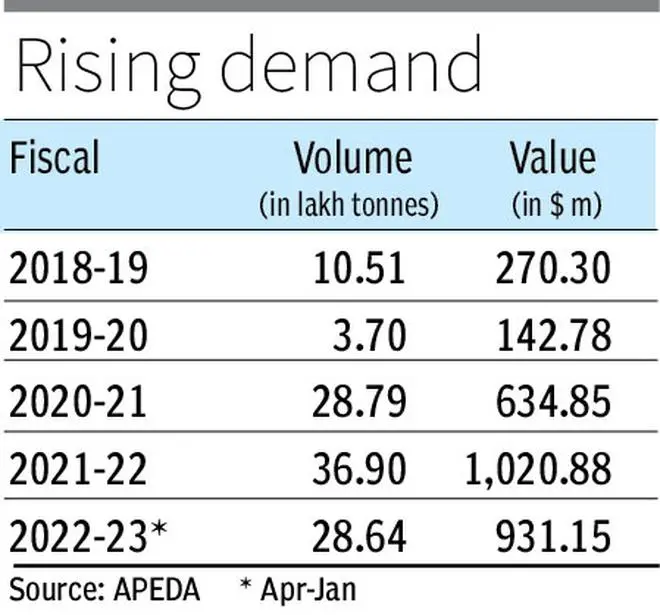

According to data from the Agricultural and Processed Food Products Export Development Authority (APEDA), maize exports during April-January period of the 2022-23 fiscal were 28.6 lakh tonnes (lt) valued at $931 million with Bangladesh accounting for 15 lt of it followed by Vietnam at 5.7 lt. In 2021-22, maize exports were 36.9 lt valued at $1.02 billion.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.