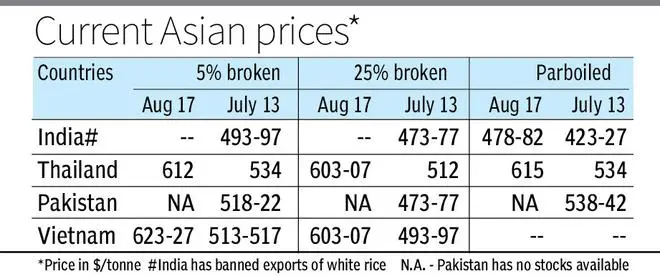

Prices of all varieties of rice in the global market are ruling above $600 a tonne, barring Indian parboiled 5 per cent broken and Thailand 25 per cent broken white rice following India’s ban on white rice shipments from July 20.

The huge surge in prices, seen after almost a decade-and-a-half, has now led to fears among global traders that Thailand and Vietnam could resort to curbs on exports, while India could either ban or impose export on parboiled rice exports, traders have said.

“(Rice) Export prices further increased 3-6 per cent due to the panic buying from foreign buyers (in view of India’s white rice export ban),” the US Department of Agriculture said in its weekly note on rice prices.

Local reports in Bangkok, Thailand, said domestic prices in packets will rise by 3 baht (₹7 approximately) a kg from September after paddy prices have increased to record highs.

20% jump in exports

Exporters and traders said demand for Indian parboiled rice has increased sharply after the ban on white rice export. This has resulted in fears, particularly among traders abroad — especially Singapore — that the Indian government might step in to curb the exports by either imposing a duty or ban it altogether.

Data made available to businessline show that at least 6.5-7 lakh tonnes of parboiled rice have been exported between July 21 and August 17 — a jump of 20-25 per cent — with the Kakinada port accounting for over 30 per cent of the shipments.

During the April-June period of the current fiscal, 2.02 million tonnes (mt) were exported, while in the 2022-23 fiscal, parboiled accounted for 7.85 mt of the 17.86 mt.

“Indian parboiled rice is quoted far lower than parboiled from other origins. So, there is an arbitrage which global traders are trying to cash in on,” said S Chandrasekaran, a New Delhi-based analyst.

El Nino impact

According to the Thai Rice Exporters Association, Thailand parboiled 100 per cent sortexed is ruling at $615, while Indian 5 per cent parboiled is quoted at $478-82 a tonne. Pakistan has no stocks. Thailand’s 25 per cent broken white rice is ruling at $582.

Fears of curbs on rice exports from leading producing countries are high since South-East Asia is currently going through a dry period.

“Thailand is witnessing a dry period as also Malaysia and Indonesia. Things are not looking bright for rice,” said a trade source. The prolonged dry period is seen due to the El Nino impact, which leads to drought and lower rainfall in Asia.

“Things will soon be under control. Parboiled prices have dropped to $450 a tonne in India today (August 17) and arrivals have begun in Nellore,” said BV Krishna Rao, President, The Rice Exporters Association (TREA).

DGFT meet with exporters

However, prices of rice in the domestic market are increasing. “Consumers will have to pay more over the next couple of months,” said Rao.

The USDA said Thai rice export prices have increased by around $120/tonne since the Indian government imposed an export ban of non-basmati (white) rice on July 20, 2023. “Also, domestic rice prices were under upward pressure as local mills reportedly secured rice supplies to build up their inventories and to fulfill contracted shipments,” it said.

Thai rice prices have increased despite the weakening of the Thai baht to 34.75 baht from 34.07 baht to the dollar last week.

Meanwhile, the Directorate-General of Foreign Trade had a meeting with rice exporters, who urged the Centre to permit exports of consignments that had entered the ports on July 19.

“The ban came into effect on July 20 but Customs Department stopped permitting exports the same day even if consignments had entered earlier. The Commerce Ministry wants these shipments to be allowed,” said a Delhi-based exporter.

Ban to control prices

Traders, who attended the meeting, see remote chances of the ban on white rice exports being lifted before February 2024 since the Government wants to review the kharif rice arrivals, which could continue till January.

The Government banned exports of (non-basmati) white rice as part of its efforts to control rising foodgrain prices in a crucial year ahead of the 2024 Parliament elections. The move was a measure to overcome any supply shortage in view of rains damaging paddy crops in Punjab and Haryana, besides deficient rains affecting sowing of paddy in Karnataka, West Bengal, Chhattisgarh, Tamil Nadu, and Andhra Pradesh.

However, the situation has improved since then with the area under kharif paddy increasing nearly 5 per cent as of August 11 to 328,22 lakh hectares. Rice stocks with the Food Corporation of India as of August 1 was 24.3 mt, a four-year low. However, it has an additional 19.61 mt of paddy (13.13 mt of rice), which is higher than 19.45 mt a year ago.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.