Factory output growth surprised on the upside in April hitting an eight-month high of 7.1 per cent as compared to 2.2 per cent in March.

The sharp increase in industrial growth comes after data released last month showed that the country’s eight core industries grew 8.4 per cent in April, up from a level of revised 4.9 per cent in March. The eight core industries have a weightage of 40.27 per cent in the Index of Industrial Production (IIP).

Low base factor

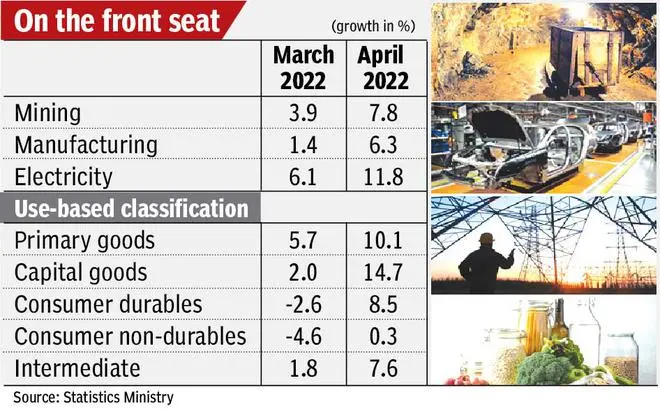

This was bolstered by sharp growth in manufacturing at 6.8 per cent, while mining and electricity showed an output growth of 7.8 per cent and 11.8 per cent, respectively, according to official data released by the Statistics Ministry on Friday.

It maybe recalled that IIP growth in April 2021 had come in at 133.5 per cent, largely due to a statistical effect when compared to the base period of April 2020 — when the entire country was in lockdown due to the Covid-19 pandemic. Meanwhile, the ministry said the growth rates in April 2022 over corresponding period of 2021 are to be interpreted considering the unusual circumstances on account of the pandemic since March 2020.

On use-based classification, both capital goods and primary goods did well last month, recording growth rates of 14.7 per cent (2 per cent) and 10.1 per cent (5.7 per cent), respectively. While consumer durables sector grew 8.5 per cent (-2.6 per cent), consumer non-durables grew a tepid 0.3 per cent (-4.6 per cent). The lacklustre show on consumer non-durables sector is a reflection that consumers are wary to spend amid high inflation.

‘Positive sign’

Madan Sabnavis, Chief Economist, Bank of Baroda, said: “While it is the first month over an unusually high base effect, the fact that growth is 7.1 per cent is impressive. It is a positive sign given that this month was associated with the war in Ukraine being at its peak as well as the sanctions being imposed.”

He highlighted that the number buttresses the confidence given by the PMIs and GST collections during this challenging period. “We need to see if this momentum can be sustained as it would be a prerequisite for growth in GDP to be sustained at over 7 per cent this year. Sustenance will be the mantra because Q4 also saw corporates finish the year on a good note. Demand from consumers and investment by corporates will hold the clues in the coming months,” Sabnavis said.

May expectations

Aditi Nayar, Chief Economist, ICRA, said the low base of the second wave of Covid-19 bumped up the IIP growth, although it trailed ICRA’s expectation (9.2 per cent), led by a weaker than anticipated performance of mining.

The weak showing of capital goods output relative to the pre-Covid level confirms ICRA’s view that the uptick in capacity utilisation in Q4 FY22 will not trigger a rapid private sector capacity expansion in light of the geopolitical uncertainties, she added.

“Given the sharp y-o-y expansion displayed by most high frequency indicators in May, we expect the IIP growth to rise further to 17-19 per cent in that month, on the back of a falling base related to the second wave of Covid-19 in May 2021,” Nayar said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.