The Centre closed first six months of FY2022-23 with a fiscal deficit of around 37 per cent of Budget Estimate, data from Controller General of Accounts (CGA) released on Monday showed. While capital expenditure as a percentage of Budget Estimate (BE) has gone up in comparison to corresponding period of last fiscal, revenue expenditure has come down.

Fiscal deficit at the end of September touched ₹6.20-lakh crore which is 37.3 per cent of Budget Estimates. It was 35 per cent of BE during corresponding period of last fiscal

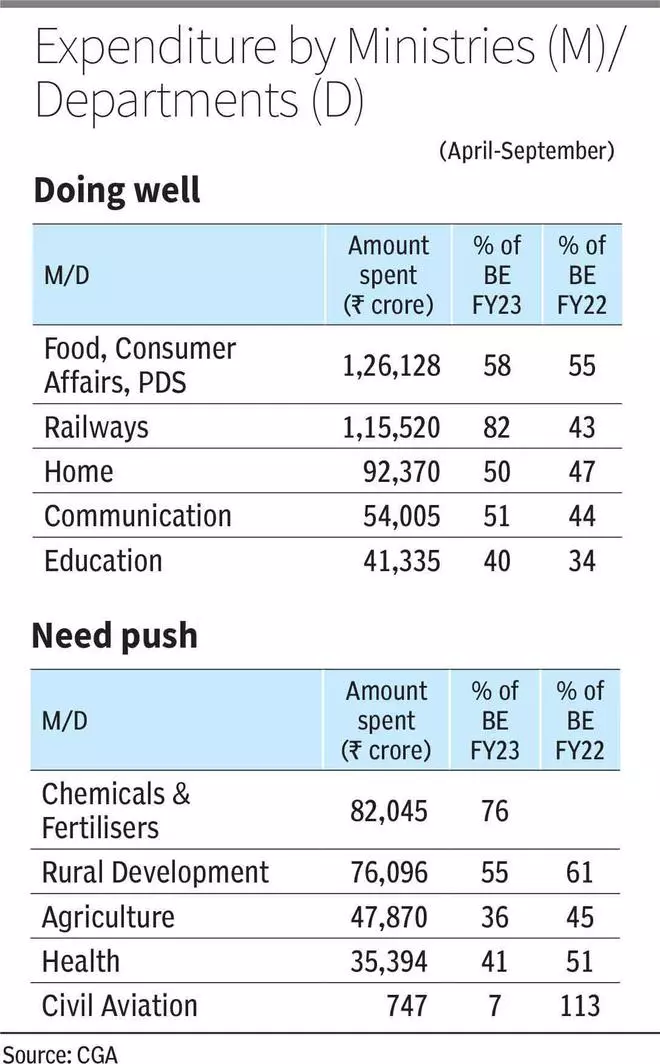

Six-month numbers are critical to finalise Revised Estimate (RE) of a fiscal year. Out of 56 Central Ministries and Departments, 21 including Railway and Education saw higher expenditure, 30 Ministries recorded lower expenditure as a percentage of BE during first six months. While the government is hopeful of limiting the fiscal deficit, experts are doubtful.

CGA data shows, April-September period recorded a capital expenditure of over ₹3.42-lakh crore, which is around 46 per cent of the Budget Estimate. During the corresponding period of FY22, it was ₹2.29 lakh crore or over 41 per cent of the BE. Meanwhile, despite rise in subsidy payout, revenue expenditure reached over ₹14.80-lakh crore or 46 per cent of BE as against around ₹14-lakh crore or 48 per cent of FY22.

Aditi Nayar, Chief Economist with ICRA, said that total expenditure surged by 24 per cent in September, led by an 18 per cent rise in revenue expenditure and a sharp 58 per cent expansion in capital expenditure in that month. The spike in September boosted the average capital spending of the Centre to around ₹57,000 crore per month in April-September (H1 FY2023), which nevertheless trails the required monthly average of ₹62,500 crore to meet the FY23 BE.

“While spending would sharply exceed the budgeted level, driven by fertiliser and food subsidy, and excise revenues will be dampened by the cess reduction on petrol and diesel undertaken in May 2022, we expect the extent of the overshoot in the fiscal deficit to be modest at ₹1-lakh crore, given the considerable upside seen in non-excise tax revenues and savings expected under other expenditure heads,” she said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.