Consumption, clubbed with inflation and compliance, boosted GST collection in key States between February and July of this calendar year. Most of these States have recorded double-digit growth, with Maharashtra maintaining the lead over all States not just in terms of collection but also in growth.

As GST is a consumption-based taxation system and it affects prices of both input (consumed by the producer) and output (consumed by the consumer), both wholesale and retail inflation have an impact on GST collection. Experts find a correlation between Inflation and GST collection. Also, they expect some components of GST to be related to WPI and others to CPI.

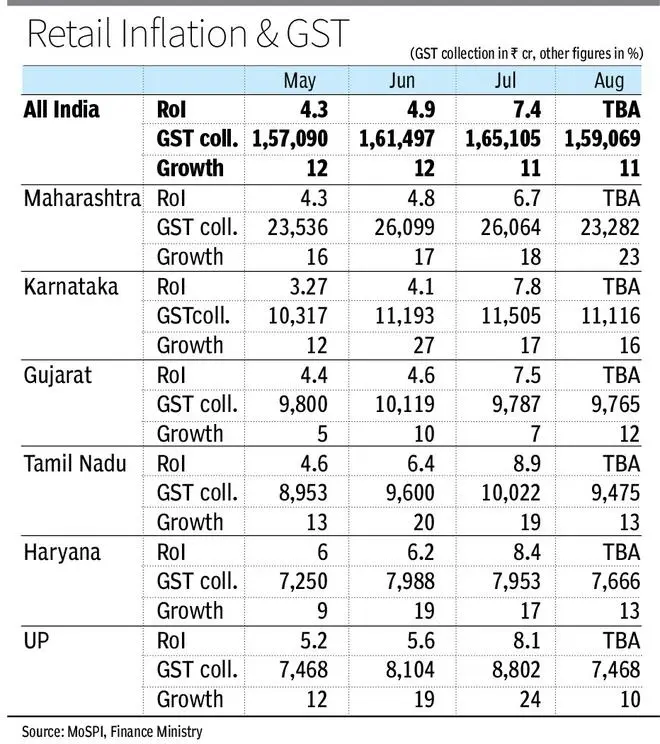

Retail inflation, based on the Consumer Price Index (CPI), was 6.52 per cent in January this year. It then dropped to a low of 4.31 per cent in May before surging to 7.44 in July. During this period, WPI declined from 4.8 in January to (-) 4.1 in June before improving a bit to (-) 1.36 per cent in July. During this period, GST collection was between Rs 1.50 to Rs 1.6 lakh crore, reaching an all-time high of ₹1.87 lakh crore which also had contribution from year end stock clearance.

Anil K Sood, Professor and Co-founder of the Institute for Advanced Studies in Complex Choices observed a very high positive contemporaneous correlation of 0.619 between WPI and GST collection from August 2021 to July 2023. Not surprisingly, the correlation between IGST (Customs) collection and WPI is observed to be even higher at 0.856. This is despite the deceleration in WPI.

- Also read: Fight against inflation is not over

As expected, the contemporaneous correlation between CPI and GST collections is relatively weak at 0.07, but it gains strength at 0.19 if lagged GST collection is considered, with lag being one month. It also supports the hypothesis about the lags being caused by inventory levels and the producers’ ability to pass on price increases to consumers, he said.

Most of the States, having higher than median CPI rate (4 per cent), also recorded higher growth of GST collection. Maharashtra, which contributed the maximum in overall GST collection and has a very high growth rate recorded CPI more than the median rate throughout the calendar year. However, two other big contributors, Karanataka, and Gujarat have not seen growth like Maharashtra.

“At the State level too, we expect the strength of the relationship depends on the nature of its production and consumption structure. For example, a State with a high share of processed food in its consumption basket will see an increase in GST collection with high retail food inflation, as the products have higher GST incidence, and the producers are often able to pass on cost increases to their customers, Sood said.

Furthermore, a State that has a higher share of commodities, particularly imported commodities, in its production and consumption basket would end up with a high degree of correlation between WPI inflation and GST collection. “It would also experience higher volatility in GST collection, as WPI is far more volatile than CPI,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.