CBDT Chairman Nitin Gupta on Wednesday said that that direct tax collection will surpass the Budget Estimates of ₹18.23 lakh crore during FY 2023-24. He also said that cash seizure in poll-bound States is higher than previous election.

“We will exceed the Budget target. The economy is doing well and we will get a better picture of full-year tax collection once the third instalment of advance tax numbers come in by December 15,” Gupta said, while talking to the reporters after inaugurating the taxpayers’ lounge of income tax department set up at the India International Trade Fair in the national capital.

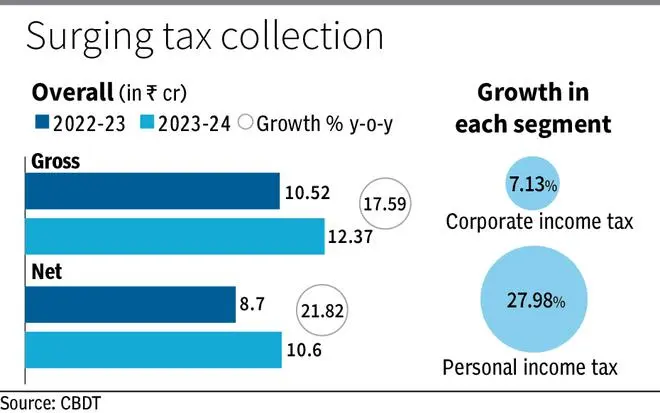

Last week, CBDT had reported net tax collection of ₹10.60-lakh crore, which is over 58.15 per cent of the total Budget Estimates of Direct Taxes for FY23-24. Direct Taxes include corporate income tax (CPI) and personal income tax (PIT).

Also read: Finance Ministry notifies prospective 18% GST on parent company’s guarantees

“On a gross basis, the direct tax collection has been growing at 17-18 per cent, while on a net basis, we are growing at 22 per cent. We are also issuing refunds simultaneously. So, we have no doubt about tax collection exceeding estimates,” Gupta said. Refunds totalling ₹1.77-lakh crore have been issued between April 1 and November 9.

Gupta also said that the income tax department has seized more unexplained cash as compared to elections held in those States earlier. He said that prior to both State assembly and Lok Sabha elections, the enforcement agencies, including the I-T department, increased surveillance and also got information about unexplained cash and jewellery on toll-free numbers created for the purpose.

According to sources, in poll-bound Rajasthan this year, there has been a three-fold increase in the total seizure of illegal cash, liquor, drugs, gold, silver, etc. Such seizures, which were ₹322 crore in 2021 and ₹347 crore in 2022, have risen to ₹1,021 crore till October 2023. Chhattisgarh, Telangana, Rajasthan, Madhya Pradesh and Mizoram are going to poll in November.

Also read: GST authorities raid Aviva Life Insurance over tax evasion allegations

In July, the Central Board of Indirect Taxes and Customs (CBIC), issued a Standard Operating Procedure (SoP) for tax officers to implement the directions of the Election Commission with regard to the use of freebies, illicit cash, liquor and drugs to lure voters, and asked them to share information with other enforcement agencies. Also, movement of saris, shirts, caps, masks, scarves, party flags associated with the candidates or the political party in a poll without an e-way bill may be confiscated.

The SoP aims at stepping up of preventive vigilance mechanism by the CBIC field formations and to prevent flow of suspicious cash, illicit liquor, drugs/narcotics, freebies and smuggled goods during elections. This information has been made public at a time when elections are taking in Rajasthan, Madhya Pradesh, Chhattisgarh, and Telangana within the next five months, followed by the general election in the first half of the next fiscal year

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.