The government’s decision to impose an export tax on petrol, diesel and jet fuel shipped overseas by firms like Reliance Industries Ltd, and a windfall tax on crude oil produced locally by companies such as ONGC will have downside risks for the sector, according to analysts.

“Higher cess on domestic crude production of $40/bbl for ONGC and OIL was a negative surprise and should imply downside risks for the sector over the medium term. It impacts ONGC and OIL’s earnings for FY23 by 36 per cent and 24 per cent, respectively,” said analysts at Morgan Stanley.

Impact on margins

The government will tax exports of gasoline at ₹6 per litre ($12/bbl) and diesel at ₹13 per litre ($26/bbl). Export-oriented units like RIL will have to sell 30 per cent of diesel locally to not attract this tax. RIL currently, via its petrochemical, B2B and retail fuel stations, sells about 40-50 per cent of its products locally.

“However, the sales are heavily naphtha-weighted and we still await details on RIL’s diesel sales locally. Assuming the full impact of the regulations on both diesel and gasoline, RIL’s gross revenue margins (GRM) would be negatively impacted by $6-8/bbl realistically compared to last week’s margin of $24-26/bbl. Every $1/bbl impacts RIL’s earnings by 2.5-3 per cent,” the Morgan Stanley report added.

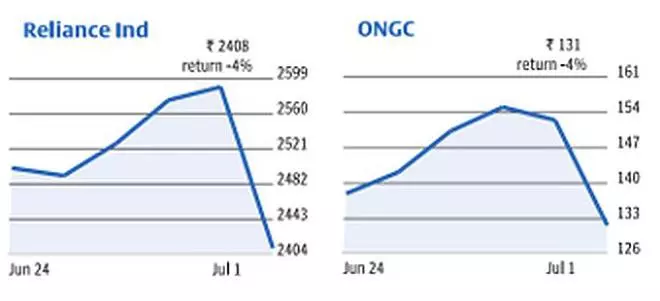

Shares of RIL, ONGC and Oil India Ltd were hammered on Friday. RIL shares were down 7.14 per cent at close on BSE, while stocks of ONGC and OIL nosedived 13.40 per cent and 15.07 per cent, respectively.

Entry opportunity

JPMorgan, however, termed the stock reaction as excessive. In a note to investors, it said the fall offers an attractive entry opportunity. It said RIL would have strong underlying cash flows and earnings even after paying export tax.

Ramesh Sankaranarayanan, Consultant and Senior Research Analyst, Nirmal Bang Institutional Equities, said this is prima facie, a move by the government to raise additional revenue from the extra profits upstream companies are earning on domestic oil production. “This implies additional revenue of ₹52,400 crore from 22.5 million tpa of ONGC and Oil India’s combined oil production and ₹67,400 crore if we include the production from JV also (29 million tpa).“

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.