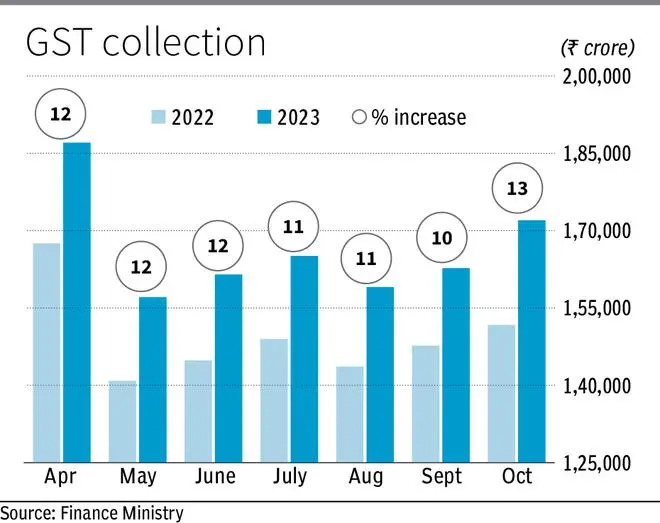

Riding on festive season demand and improved compliance, the government has collected more than Rs 1.72 lakh crore in October through GST, Finance Ministry said on Wednesday. This is the second highest monthly collection after the Rs 1.87 lakh crore netted in April 2023.

Collection in October is related to goods and services consumed in September.

The statement said the gross GST revenue for October is 13 per cent higher compared to the same month last year. “During the month, revenue from domestic transactions (including import of services) is also 13 per cent higher than the revenue from these sources during the same month last year,” it said. Further, it said the average gross monthly GST collection in FY 2023-24 now stands at Rs 1.66 lakh crore, which is 11 per cent higher compared to the previous financial year.

Experts cited various reasons for the rise in collection. MS Mani, Partner with Deloitte India, said strong economic factors, as also the efforts of the tax authorities in deploying tools to compare data sets to determine short payment and evasion have helped in collection. “The growing emphasis on audits led by specific information available on various databases, not only on the GST portal, has led to a significant increase in compliance across sectors and states. This is also reflected in the upsurge in GST collections across key manufacturing and consuming states,” he said.

Parag Mehta, Partner with A Shah Associates, said one of the reasons for this rise is the time-barring period for FY 2017-18. A spate of notices, anti-evasion drive, DGGST investigations, and so on have led to substantial collections, he said. Further, September to December is a festive period that sees substantial consumer spending on high-value items like real estate, vehicles, gold and travel. Echoing the sentiment, Saurabh Agarwal, Tax Partner with EY, said that data analytics, artificial intelligence, and stricter norms, combined with drives by GST authorities across India have contributed to the increased collection. “With stable collection, the Government can now consider rate rationalisation as the next task.,” he said.

Experts expect collections to rise further. “The collections are bound to increase substantially again with the annual returns etc for FY 2022-23 being filed, and any GST missed out for the previous year will be paid along with interest. We will see a rise in collections,” Shah said.

However, Vivek Jalan, Partner with Tax Connect Advisory, has some apprehensions. While the GST figures for October 2023 show a growth of 13 per cent over last year, the cumulative growth of GST revenue for the April-October 2023 period, vis-a-vis a year ago, is 11 per cent as against the budgeted 12 per cent growth of CGST+SGST+compensation cess revenue. “It is important to note that even a 1 per cent deficit in GST revenue from budget can have a 0.03 per cent or so impact on the fiscal deficit target for FY 23-24,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.