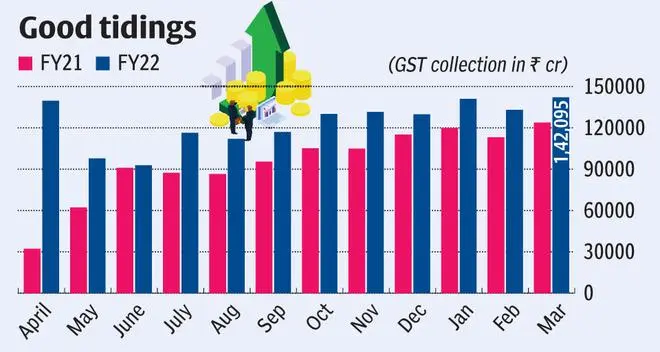

Finance Ministry on Friday reported an all-time high collections through Goods & Services Tax (GST) of ₹1.42 lakh crore in March. Tax deposited is related with consumption of goods and services in February, which is of 28 days as against normal monthly cycle of 30/31 days.

The previous all-time high collection was ₹1.40 lakh crore recorded in January this year.

The Ministry said that the revenues for March are 15 per cent higher than the GST revenues in the same month last year and 46 per cent higher than the GST revenues in March 2020. During the month, revenues from import of goods was 25 per cent higher and from domestic transaction (including import of services) are 11 per cent higher than the revenues from these sources during the same month last year.

“Coupled with economic recovery, anti-evasion activities, especially action against fake billers have been contributing to the enhanced GST. The improvement in revenue has also been due to various rate rationalization measures undertaken by the Council to correct inverted duty structure,” it said.

The total number of e-way bills generated in February is 6.91 crore compared to 6.88 crore registered in January despite being a shorter month, indicating recovery of businesses at a faster pace.

The average monthly gross GST collection for the last quarter of FY22 has been ₹1.38 lakh crore against the average monthly collection of ₹1.10 lakh crore, ₹1.15 lakh crore and ₹1.30 lakh crore in the first, second and third quarters, respectively.

The Ministry said that the gross GST revenue collected in March included CGST of ₹25,830 crore, SGST of ₹32,378 crore, IGST of ₹74,470 crore (including ₹39,131 crore collected on import of goods) and cess is ₹9,417 crore (including ₹981 crore collected on import of goods).

Aditi Nayar, Chief Economist with ICRA assessed gross tax revenues of the Centre likely to overshoot the revised estimate (RE) of ₹27.6 lakh crore by a considerable ₹2.25 lakh crore. She also estimated the net tax revenues (net of devolution to States) in FY2022 at ₹18.6 lakh crore which is ₹0.9 lakh crore higher than the RE

“Netting off the upside to the GoI’s tax and non-tax revenues in FY2022 compared to their RE levels, and the likely miss on disinvestment, suggests a cushion of ₹500 billion. Additionally, we expect capex may undershoot the FY2022 RE by ₹600 billion. This suggests a total cushion of ₹1.1 trillion for higher revex, which is equivalent to the size of the third supplementary demand for grants. Overall, we expect the fiscal deficit for FY2022 to be broadly similar to the revised target of ₹15.9 trillion,” she said.

Table : GST Collection

(Rs crore)

| Month | 2020-21 | 2021-22 |

|---|---|---|

| March | 123902 | 142095 |

| February | 113143 | 133026 |

| January | 119875 | 140986 |

| December | 115174 | 129780 |

| November | 104963 | 131526 |

| October | 105155 | 130127 |

| September | 95480 | 117010 |

| August | 86449 | 112020 |

| July | 87422 | 116393 |

| June | 90917 | 92800 |

| May | 62151 | 97821 |

| April | 32172 | 139708 |

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.