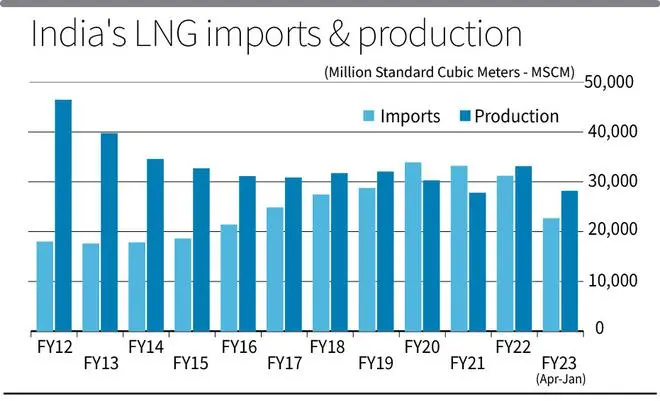

India’s import of liquefied natural gas (LNG) is expected to decline to FY18-FY19 levels in the current financial year ending March 2023 as high international prices impacted domestic demand with industries switching to cheaper alternatives.

In-bound shipments to India, the world’s fourth largest LNG importer, stood at 27,439 million standard cubic meters (MSCM) and 28,740 MSCM during FY18 and FY19, respectively.

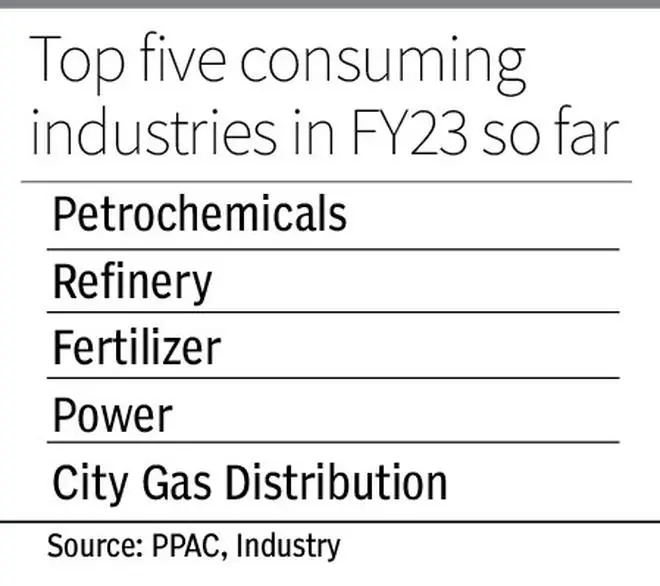

“High global prices made imports costlier impacting demand, particularly for fertilisers, refineries and power. Consequently, FY23 imports are down and are likely to be around 27,500-28,500 MSCM,” a senior government official said.

S&P Global Commodity Insights on Thursday said that India’s LNG imports dropped 19 per cent Y-o-Y to 19.71 million tonnes in 2022, which is the lowest LNG import level since 2017.

Similarly, the International Energy Agency (IEA) on Wednesday said that imports fell 17 per cent Y-o-Y in 2022 (27,161 MSCM), the steepest fall on record and the first decline covering two consecutive years in India’s two-decade history as an LNG importer.

Asia LNG spot prices averaged at $34 per million British thermal units (mBtu) in 2022, which is more than five times the five-year average between 2016 and 2020, as per the IEA.

Rising domestic consumption in households and expanding industrial activity boosted natural gas demand in the world’s third largest energy consumer. A decade ago, gas imports accounted for roughly one-third of the domestic requirement, which has now risen to almost 50 per cent.

Imports & prices in 2023

A senior official from an OMC explained that as Europe nears the end of winters, the demand for natural gas is softening coupled with gas storage inventories in the range of 60 per cent. However, the key to watch out will be US gas inventories and demand from China, besides Europeans will again hit spot markets from July-August 2023 preparing for winters.

S&P Global Commodity Insights Managing Editor (APAC LNG) Kenneth Foo in a webinar on Thursday said “The market situation in India last year (2022) had seen local gas prices at a steep discount to imported LNG prices, reflecting the fact that India had been outcompeted for cargoes by buyers in Europe, North Asia and South East Asia.”

International LNG prices have a significant impact on domestic gas pricing in large importing markets in Asia and Europe. With cargoes starting to shift away from Europe, Asian companies, including Indian importers, could be eyeing cheaper LNG imports this year compared to last year, he added.

On price expectations, S&P Global Commodity Insights Analyst (APAC LNG) Ayush Agarwal said he expects Platts JKM and WIM to average below $15 per mBtu in summer 2023 and below $20 for 2023, however, India’s LNG imports are likely to stay flat compared to the 2022 level of 78 MSCM per day.

“Competition between Asia and Europe is expected to intensify from Q3 2023 onwards as northeast and European countries will try to refill their LNG storages for Winter 2023, which will again push the spot LNG prices above $20 per mBtu,” Agarwal said.

The current volatility in spot LNG prices is expected to normalise after the new wave of liquefaction plants from the US, and Qatar starts to come online from 2025-26 onwards. Until then limited growth of supply is one of the biggest risks for the global LNG market, he pointed out.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.