Passenger vehicles (PVs) sales are expected to see growth with new product launches and stable market sentiments by original equipment manufacturers. However, at the same time, caution should be exercised regarding access inventory, Federation of Automobile Dealers Associations (FADA) said on Monday.

“The market is hopeful about improved vehicle availability and demand driven by new models, with many OEMs launching their electric vehicles (EVs). However, caution should be exercised regarding excess inventory as well as the need to match production with actual market demand,” said Manish Raj Singhania, President, FADA.

In the two-wheeler (2W) segment too, the sector expects a boost from new model launches, especially in the first half of the year, and an overall better economic condition coupled with higher EV participation. Improved customer sentiments, due to factors like lower fuel prices and crop payments to farmers, are likely to drive demand, he said.

In the commercial vehicle (CV) segment, a positive outlook is driven by expectations of increased government spending due to elections, infrastructural projects and demand in key industries like coal, cement, and iron ore, he said, adding, “The market is also expected to benefit from the replacement of older vehicles.”

“Each sector within the auto retail industry is positioned for growth, navigating through the dynamic market conditions. Nonetheless, the pivotal role of meticulous supply and inventory management cannot be overstated. These elements will be key in fully leveraging the positive trends that the new calendar year (CY) promises,” Singhania said.

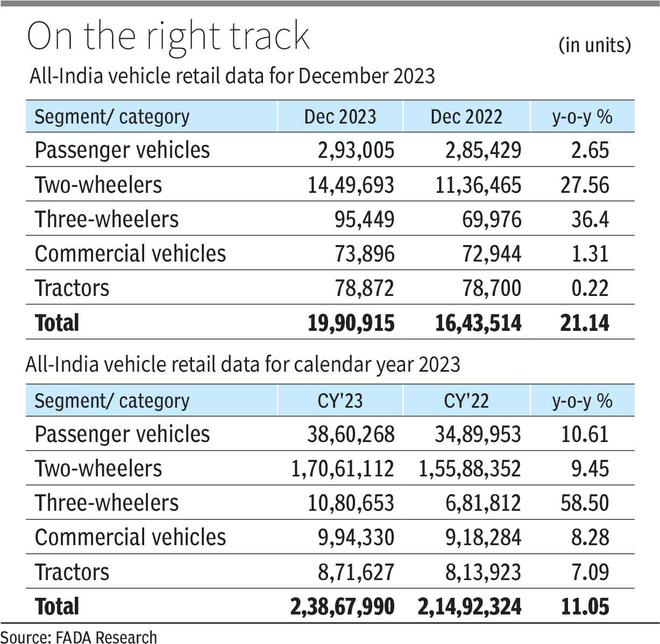

Meanwhile, in the monthly retail sales, the PV segment reported a y-o-y growth of 2.65 per cent to 2,93,005 units in December 2023 as compared with 2,85,429 units in the corresponding month of 2022.

“In the PV category, SUVs, in particular, saw strong demand, with extended waiting periods for key models. This surge was fuelled by aggressive year-end promotions and the introduction of new models. However, a significant concern was the high inventory levels, reflecting over-supply. This ongoing issue of high PV inventory, despite a slight decrease by the year’s end, remains a critical area for OEMs to address, emphasising the need for further moderation in inventory management,” Singhania said.

- Also read: Vehicle retail sales across categories record significant growth in festive season 2023: FADA

Two-wheeler sales grew by 27.56 per cent y-o-y to 14,49,693 units during last month as compared with 11,36,465 units in December 2022.

Three-wheeler sales also grew by 36.40 per cent y-o-y to 95,449 units in December as against 69,976 units in the same month the previous year.

Retail sales of commercial vehicles reported a growth of 1.31 per cent y-o-y to 73,896 units in December as compared with 72,944 units in December 2022. Tractor sales grew marginally (0.22 per cent) to 78,872 units last month as against 78,700 units in the corresponding month of 2022.

Grand total of all vehicles grew by 21.14 per cent y-o-y to 19,90,915 units in December as compared with 16,43,514 units in December 2022.

On the calendar year basis, the PV sales grew by 10.61 per cent to 38,60,268 units in CY2023 as compared with 34,89,953 units in CY2022.

Similarly, 2W sales grew by 9.45 per cent to 1,70,61,112 units in CY’23 as against 1,55,88,352 units in CY’22, the FADA report indicated.

Three-wheeler sales grew by 58.50 per cent y-o-y to 10,80,653 in CY’23 as compared with 6,81,812 units in January-December 2022.

CV segment also grew by 8.28 per cent to 9,94,330 last year as compared with 9,18,284 units in 2022.

Grand total of all vehicles grew by 11.05 per cent in CY’23 to 2,38,67,990 units as compared with 2,14,92,324 units in CY’22.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.