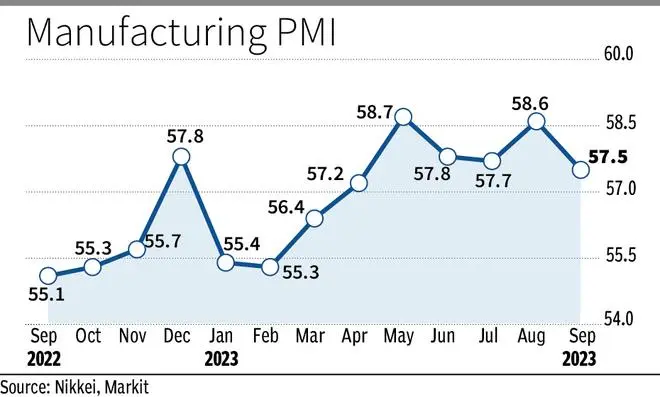

Ahead of the festival season, the manufacturing sector slowed down a bit as Purchasing Managers’ Index (PMI) dipped to a five-month low of 57.5 in September, a report released by S&P Global Market Intelligence on Tuesday showed. It was 58.6 in August. Drop in PMI was mainly due to ‘’softer increase in new orders.’

However, the good news is that job creation improved during the last month.

Manufacturing is considered the biggest job creator, with a share of around 15 per cent in Gross Value Added (GVA).

“Although the lowest for five months, the latest reading remained firmly above the no-change mark of 50.0 and its long-run average (53.9), therefore signalling a sharp rate of expansion,” the agency said.

This index is prepared based on a survey among purchasing managers of 400 companies engaged in manufacturing activities.

According to Pollyanna De Lima, Economics Associate Director at S&P Global Market Intelligence, India’s manufacturing industry showed mild signs of a slowdown in September, primarily due to a softer increase in new orders, which tempered production growth.

Nevertheless, “both demand and output saw significant upticks, and firms also noted gains in new business from clients across Asia, Europe, North America and the Middle East,” she said.

On job scenario, the report highlighted that the positive outlook for production and demand strength resulted in another round of job creation in the manufacturing industry. Employment growth picked up since August and was strong by historical standards.

“Upbeat forecasts continued to drive job creation efforts and initiatives to replenish input stocks. Together, these indices point towards a favourable trajectory for the Indian manufacturing industry,” De Lima said.

The report added that ongoing increases in new orders continued to underpin production growth at the end of the second fiscal quarter. Output rose slowly in five months, albeit substantially above the long-run series average.

Indian manufacturers were confident that output volumes would increase over the coming 12 months, with the overall positive sentiment improving to its highest in 2023. According to anecdotal evidence, buoyant customer appetite, advertising, and expanded capacities all boosted optimism.

September data showed a let-up in the recent surge in costs faced by Indian goods producers. After quickening to a one-year high in August, the inflation rate receded to its lowest mark in over three years. Panellists indicated paying more for copper, electronic components, foodstuff, iron and steel but noted lower costs for aluminium and oil. Nevertheless, reportedly driven by higher labour costs and demand strength, average prices charged by Indian manufacturers rose at a solid and faster rate that outpaced its long-run average.

However, “while robust demand was supportive of production growth, it added to price pressures in September. The solid increase in output charges signalled by the PMI data, which occurred in spite of a notable retreat in cost pressures, could restrict sales in the coming months”, De Lima concluded.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.