Punjab National Bank (PNB) is confident of closing the current fiscal with a net profit of at least ₹6,000 crore, higher than the earlier guided level of ₹ 4,000 crore, said Atul Kumar Goel, Managing Director & CEO.

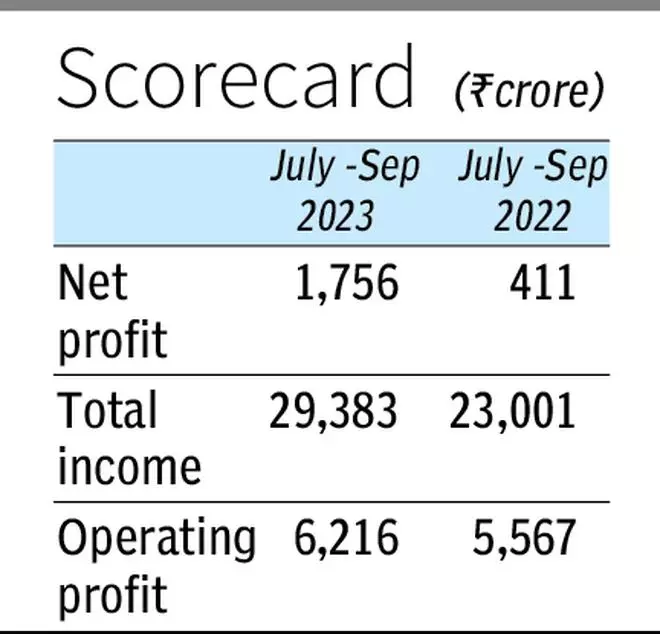

Aided by a fall in credit cost besides other factors, the country’s second-largest public sector bank reported a whopping 327 per cent increase in net profit for the quarter ended September 30, 2023, at ₹ 1,756 crore (₹411 crore). The latest bottom line performance was up 40 per cent over the net profit of ₹1,255 crore in the first quarter of this fiscal.

For the first half of this fiscal, PNB’s net profit grew 318 per cent to ₹3,012 crore (₹720 crore).

“We have already achieved profitability of ₹3,000 crore in first half. I am hopeful whatever we achieved in the first half the same will be maintained in the next two quarters as well. You can calculate what will be the profitability for the entire fiscal,” said Goel after the board meeting of the bank to consider Q2 results.

He was replying to a businessline query on whether PNB intends to revise its earlier guidance of net profit of ₹4,000 crore for the entire fiscal in the wake of the latest robust financial performance.

Goel highlighted that the net profit of ₹ 1,756 crore was the best performance of the bank in the last 14 quarters. For the entire fiscal 2022-23, PNB recorded a net profit of ₹2,507 crore. In the March 2023 quarter, PNB reported a net profit of ₹1,159 crore.

Operating profit for the quarter under review was up at ₹6,216 crore (₹ 5567 crore). In the first fiscal quarter, operating profit stood at ₹ 5,968 crore.

NPA GUIDANCE

For the quarter under review, PNB’s gross non-performing assets (GNPA) declined to 6.96 per cent (as percentage to advances) in Q2 from 10.48 per cent in the same period last year, and the net NPA fell to 1.47 per cent from 3.80 per cent.

Goel said that PNB, encouraged by the latest performance, has set its sights on bringing down GNPA to 6 per cent by the end of March 2024 and Net NPA to below 1 per cent by the end of this fiscal year.

Goel highlighted that PNB is targeting recoveries of ₹22,000 crore this fiscal, of which the bank has already recovered ₹11,000 crore.

PERSONAL LOANS

Goel maintained that the unsecured personal loans book, which stood at about ₹ 17,467 crore out of the total unsecured retail portfolio of about ₹ 25,770 crore, was not a worry for the bank. Of the ₹ 17,467 crore, as much as ₹4,056 crore is digital mode started in June 2022, and net NPA on the digital front is less than 0.5 per cent. “There can be worry if we had a huge unsecured retail portfolio. That is not the case with PNB. There is no worry for us on the unsecured personal loan front,” added Goel added.

Goel was replying to a question on the RBI recently expressing concern over increased stress in the unsecured personal loan segment.

CREDIT GROWTH

Asked about the demand for credit from industry, Goel said there is demand, but not too much. Earlier corporates were not utilising the working capital and term loan limits PNB had sanctioned, but now these are being utilised, he added. Due to the demand for infrastructure, there is some expansion in the steel and cement sectors. Credit growth of 15-16 per cent is achievable for the banking industry this fiscal now that the Indian economy is expected to grow 6.5 per cent.

PNB is eyeing overall credit growth of 12-13 per cent this fiscal. On net interest margin, Goel said that the bank is targeting a 2.9-3 per cent NIM for the fiscal year even as it achieved an NIM of 3.11 per cent in the latest second quarter.

CAPITAL RAISING

With a capital adequacy ratio of over 15 per cent, Goel said the bank was comfortably placed on the capital front. He said there is no immediate requirement for growth capital, adding that PNB has room to raise more capital if needed as the Board had already approved capital raising of ₹ 12,000 crore for the current fiscal.

Of this approved ₹ 12,000 crore, PNB has already this fiscal raised ₹ 6090 crore —₹ 3,000 crore AT1 bonds and ₹ 3,090 crore in Tier II capital.

Shares of PNB closed at ₹ 70.10 on Thursday at NSE, above its previous day’s close of ₹ 69.50.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.