The month of September will see the most number of initial public offerings in the past 13 years amid a buoyant rally in mid- and small-cap stocks.

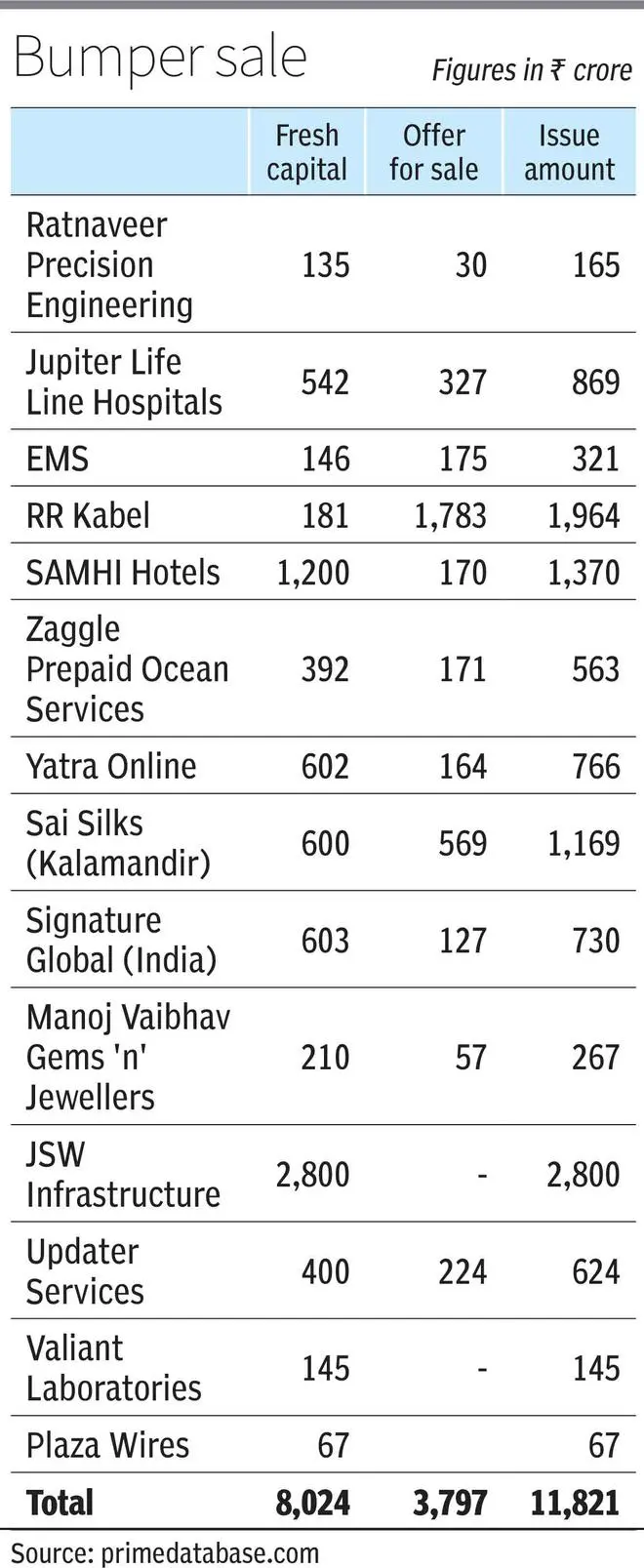

As many as 14 companies will tap the market this month, the most since September 2010 which saw 15 offerings. The amount mopped up through these offerings will be about ₹11,800 crore, the most since May last year when eight issues mopped up ₹29,511 crore.

Most of the issuances are small in the range of ₹300-1,000 crore. There are four offerings over ₹1,000 crore, with JSW Infrastructure’s ₹2,800 IPO the largest of the lot. Nearly 68 per cent, or ₹8,023 crore of the money raised this month is fresh capital and ₹3,797 crore offer for sale.

Dry spell

The IPO market went through a dry spell early this year with only five issuances between January and May. The pace picked up in August with seven issuances mopping up ₹4,759 crore.

“Some of these companies have been trying to tap the market for 15-18 months and finally found a favourable window amid the buoyant mood and rally playing out for small and midcap stocks,” said Ajay Saraf, executive director and head of investment banking at ICICI Securities. “Several small and midcap funds have seen robust inflows in the past few months, some of which has found its way to these offerings.”

Investors have put in over ₹28,000 crore in mid- and small-cap funds this financial year, of which ₹13,906 crore has come into small cap funds in the last three months alone.

Experts believe that there is enough liquidity and demand for quality issues that are reasonably priced.

“It’s still not a market like it was in 2021. Investors are driving the market, which is why several companies have reduced their issue size from what they had planned earlier and gone easy on valuations,” said Pranjal Srivastava, partner-investment banking, Centrum Capital.

Tapping the market before September 30 would also allow companies to come to the market with March financials. Those exceeding this timeline will have to include the June numbers.

Indices rally

The benchmark indices have rallied about 4.7 per cent in the past three months. FPIs have been net sellers this month but pumped in $20.7 billion between March and September.

Despite some correction, the Nifty Midcap 100 and Nifty Smallcap 100 have moved up 14.8 per cent and 17.4 per cent in the last three months, respectively.

Experts believe the mood in the primary market will remain buoyant for the next 3-4 months. Another 28 companies are holding approvals for their IPOs and can potentially mop up ₹38,000 crore.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.