Billionaire Gautam Adani’s ascent to rank as the world’s second-richest person has helped fuel a world-beating jump in the nation’s stocks and bolstered their clout among emerging-market equities.

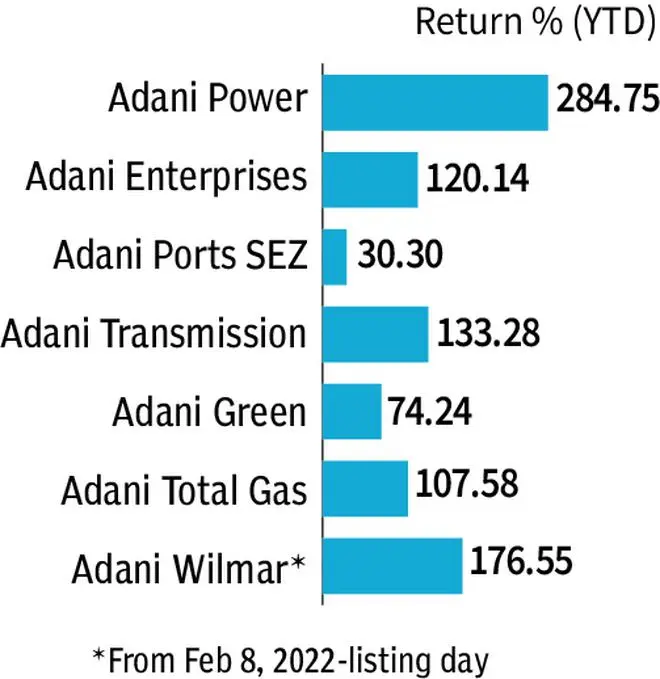

Eight firms controlled by Adani’s ports-to-power conglomerate, including recent cement acquisitions, have contributed more than a fifth of the 109-member MSCI India Index’s surge since end-June, data compiled by Bloomberg show.

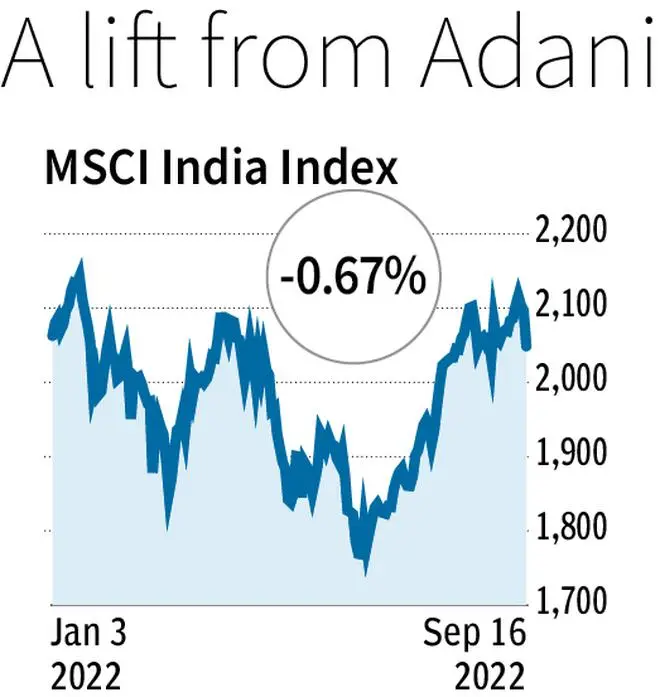

The index has outpaced Asian and emerging market peers during the period with a 12 per cent jump.

Just behind China

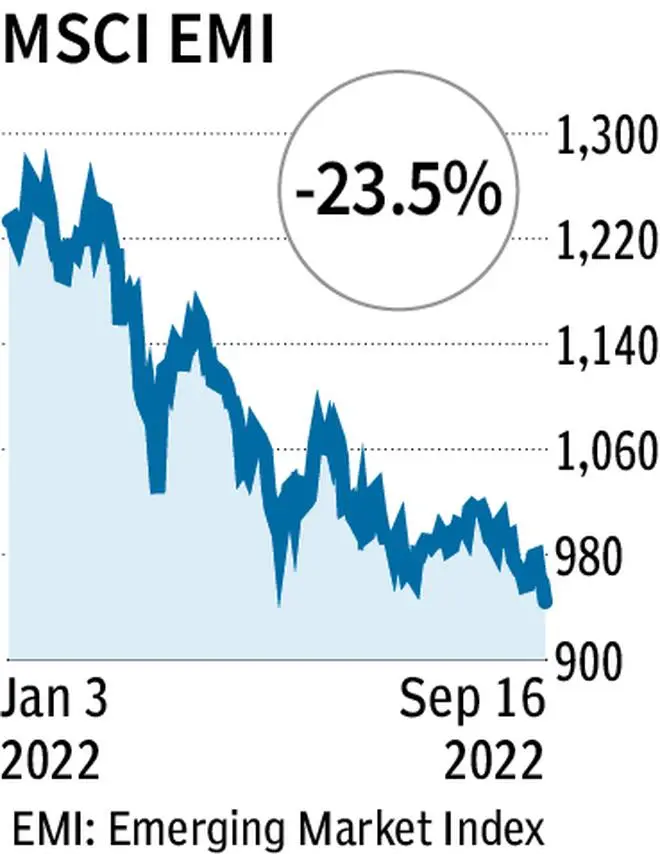

The eight Adani stocks are also a part of the MSCI Asia Pacific Index and the MSCI Emerging Market Index, in which only China outweighs India, showing the growing influence of the tycoon’s companies.

Beats Bill Gates

The equity gains have helped Adani’s wealth surpass that of Bill Gates and France’s Bernard Arnault in the past two months, making him the first Asian to feature in the top echelon of the Bloomberg Billionaires Index.

The jump in the MSCI India index’s market capitalisation during the current quarter has also been primarily dependent on Adani firms, which contributed more than one-third of the surge, data compiled by Bloomberg show.

M-cap at ₹186-lakh cr

The gauge’s valuation rose to a record-high of ₹186-lakh crore early last week before easing amid the global equity sell-off. Edible oil and fast-moving consumer-goods maker Adani Wilmar Ltd, one of the best performing IPOs in India in the last year, is the only Adani Group firm that is not yet included in the MSCI India Index.

Stocks rose in India on Monday, with the benchmark S&P BSE Sensex gaining as much as 0.5 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.