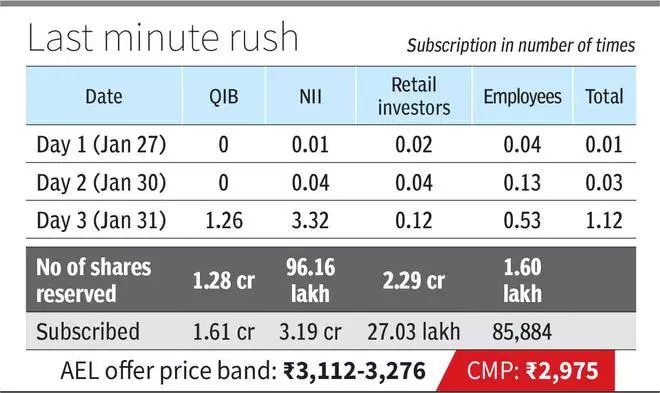

On the last day of Adani Enterprises’ follow-on public offer, the issue was home and dry with the total book getting subscribed 1.1 times, aided by qualified institutional buyers and high net-worth individuals.

Despite the damaging allegations made by short-seller hedge fund Hindenburg Research, which wiped out a considerable portion of promoter Gautam Adani’s wealth and the group’s market capitalisation, the company’s confidence that the FPO would go through was justified.

Tables turned

By noon, it was already clear that the ₹20,000-crore issue would be fully subscribed and as several reports had said, it was the family offices of some high-profile corporate chieftains that seem to have come to the rescue. Social media was rife with names of Airtel’s Sunil Mittal, JSW group’s Sajjan Jindal whose family offices allegedly invested in the issue.

QIB subscription at 161 lakh shares was 1.26 times of the offer for that category. Subscriptions from non-institutional investors were 3.3 times, while within that those bidding for amounts above ₹10 lakh put in bids that were nearly 5 times of the shares on offer.

The bidding from the non-institutional category would have translated into inflows of ₹5,000 crore. On Monday, Abu Dhabi-based International Holding Company had said it would be investing $400 million in the FPO, through a subsidiary. It has already invested about $2 billion in group companies previously.

The price manipulation allegations about the Adani stocks, however, kept away retail investors from the issue with only 12 per cent of the book being subscribed. Ironically, when announcing the FPO, the management had said the issue aimed to widen the subscriber base and give retail investors the chance to participate in the growth of the company.

Stock check

On the bourses, the day started on a dismal note for the Adani stocks, most of which were down 4-10 per cent in opening trades, though the Adani Enterprises stock was up 2 per cent.

At the end of the day’s trading however, most ended 2.6-3.9 per cent higher on the NSE. The fallers were Adani Wilmar, Adani Power and Adani Total Gas.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.