Iron ore prices have recovered from the five-month low witnessed in May to top $110 a tonne for cargoes with a 63.5 per cent iron content for delivery in Tianjin, China, but uncertainty looms over its outlook. This is because of China’s steel industry performance zig-zagging from the start of 2023.

However, most research houses have lowered their forecast for iron ore prices for the remainder of the year. But the market is keeping its fingers crossed over a Chinese stimulus package to support the industry, in general. Currently, iron ore is trading at $112.48 a tonne.

Also read: Indian steel mills see price cuts on weaker domestic demand

Recently, China rolled out a monetary policy with the People’s Bank of China offering loans and discounts again to support agriculture and small businesses totalling 200 billion yuan (₹28,985 crore).

Data point at recovery

Trading Economics website said surveyors had reported that China’s hot metal production averaged 2.5 million tonnes per day in late June, the highest since October 2020. This suggests that steel mills in the world’s top iron ore consumer are returning to full capacity. Similarly, new trade data showed that Beijing’s iron ore imports jumped by 7.4 per cent annually in June.

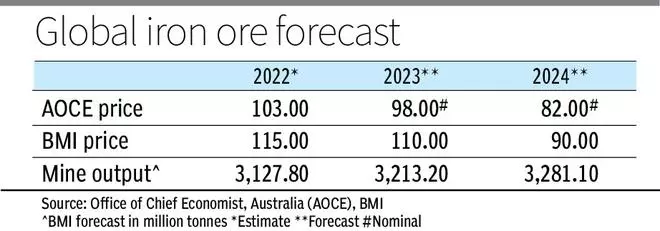

The Australian Office of the Chief Economist said iron ore prices moderated in the June quarter due to slowing global economic growth and an easing in the rate of recovery in Chinese steel production.

“Following a strong rebound in iron ore prices to a peak of over$120 a tonne in March, the benchmark iron ore spot price (basis 62% Fe fines CFR Qingdao) has since fallen to around$105–110 a tonne in June 2023,” it said.

Research agency BMI, a unit of Fitch Solutions, said a lacklustre industrial outlook in China has weighed on prices ever since market optimism died down.

H2 steel outlook

“The slowdown has even led to China requesting steel mills to reduce steel production and implementing curbs to 2022 levels, severely restricting iron ore demand in the market,” it said.

Analysts at Citi Bank said expectations of policy stimulus could support iron ore in the near-term, especially if potential measures appear to support steel demand.

But it said the uncertainty of China’s steel outlook in the second half of 2023 may put pressure on iron ore prices. It maintained its iron ore price forecast at $100/ tonne for three months.

BMI said it was lowering its price forecast for iron ore to $110 from $125. This is in view of a weak rebound in Mainland China’s industrial sector putting pressure on sentiments and demand for ferrous metals.

Supporting policies

But the AOCE said the Chinese economy is expected to recover in the second half. “New infrastructure investment — allocated in 2022 — as well as new government policies intended to alleviate weakness in its property sector, are expected to support construction activity. This should lift steel and iron ore demand in China in H2 2023,” it said.

Goldman Sachs downgraded its iron ore price forecast to $90 from $110 for the current half-year, while Morgan Stanley said the commodity’s prices are expected to slide, “just as it did in 2022 when it reached a low of $80/tonne in October”.

BMI said China’s industries face a weaker recovery compared to services and its property sector still struggles with growth, pressuring iron ore prices. “Manufacturing PMI returned to contractionary territory and signals a bleak outlook for iron ore.” it said.

“On the supply side, we expect a steady production level across major producers. Many have posted stronger productions quarter-on-quarter, while production guidance is expected to grow marginally. We expect greenfield mines to grow production over the rest of 2023,” the research agency said.

Imports up 4%

AOCE said China’s iron ore imports from Australia increased by 4.0 per cent year-on-year in May 2023 -the 13th consecutive increase since the large fall early last year. “This reflects a pickup in steel demand, which is boosting broader iron ore imports to China in H1 2023,” it said.

AOCE seconded BMI’s views that greenfield supply from established and emerging producers are expected to come online over the next few years.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.