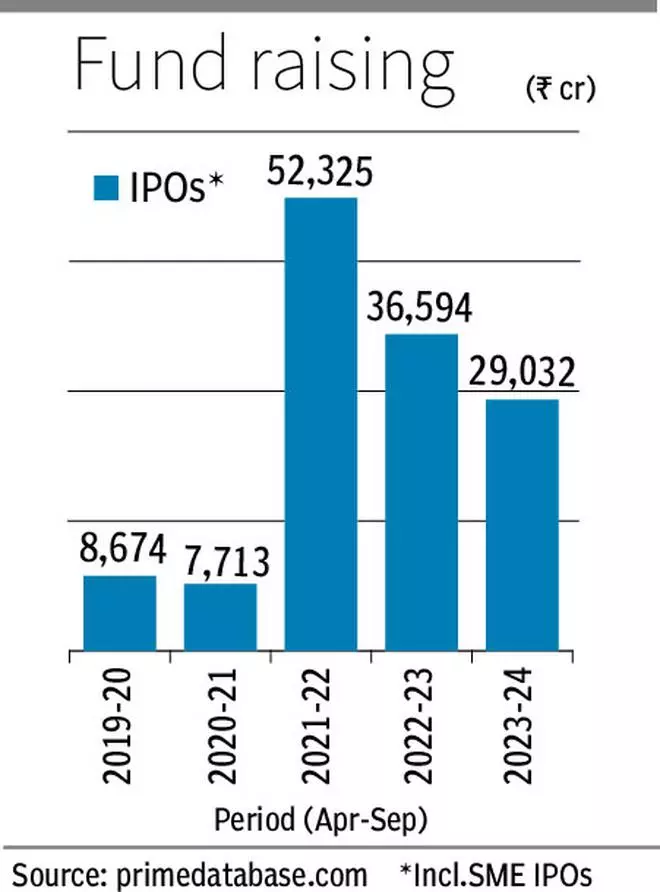

Fund mobilisation through initial public offering on the main board dropped 26 per cent in the first half of this fiscal to ₹26,300 crore as against ₹35,456 crore logged in the same period last year.

Interestingly, the fall in fund mobilisation is despite the increase in the number of IPOs to 31 (14) in the six months ended September, according to PRIME Database.

Of the 31 IPOs, as many as 21 offers hit the market in the last two months with Mankind Pharma (₹4,326 crore), JSW Infrastructure (₹2,800 crore) and RR Kabel (₹1,964 crore) accounting for the lion’s share.

Also read: ICC World Cup 2023: Stocks to benefit

Interestingly, overall equity fund raising including offer for sale, qualified institutional placement and InvITs increased 69 per cent to ₹73,747 crore (₹43,694 crore).

BFSI sector

Pranav Haldea, Managing Director, PRIME Database Group, said a key sector missing in the primary market for the last six months was BFSI with just ₹1,525 crore (or 6 per cent) being raised by companies from this sector (in comparison to 61 per cent in the same period last year).

Similarly, he added just one out of the 31 IPOs (Yatra) was from a new-age technology company pointing towards a continuing slowdown in IPOs from this sector.

Strong listing

IPO response was buoyed by strong listing performance. Average listing gain increased to 29 per cent, in comparison to 12 per cent in the first half of FY23. Of the 28 IPOs, which got listed thus far, 20 gave a return of over 10 per cent. Ideaforge gave a stupendous return of 93 per cent, followed by Utkarsh Small Finance Bank (92 per cent) and Netweb Technologies (82 per cent). And, 27 of the 28 IPOs are trading above the issue price as of Tuesday.

Only 12 out of the 31 IPOs that hit the market had a prior PE/VC investor who sold shares in the IPO. Offers for sale by such PE/VC investors at ₹7,505 crore accounted for 29 per cent of the total IPO amount.

Also read: World’s biggest bond markets hit by relentless selling

Offers for sale by private promoters at ₹5,063 crore accounted for another 19 per cent of the IPO amount. On the other hand, the amount of fresh capital raised in IPOs in the first half of 2023-24 was ₹12,979 crore or 49 per cent of the total amount, the highest (in terms of per cent share) in seven years, said PRIME Database.

The pipeline for IPOs continues to remain strong with 28 companies getting SEBI approval to raise ₹38,000 crore, while another 41 companies are waiting for SEBI approval to raise about ₹44,000 crore.

Out of 69 companies waiting to hit the market, three are new-age technology companies looking to raise about ₹12,000 crore. Notwithstanding the current volatility in the secondary market, the next four-five months are likely to see several IPOs being launched before a pause on account of the general elections, said Haldea.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.