Retail investors seemed to be divided on the prospects of the shares of Life Insurance Corporation of India, as one set completely quit even as another kept accumulating the shares.

Retail investors are adopting cost-averaging or buy-on-dips strategy in the country's biggest insurance major, as the share price kept falling every month. Currently, LIC shares are ruling near their lowest point since listing at ₹595 against the issue price of ₹904 (for retail investors) and ₹889 (for policyholders).

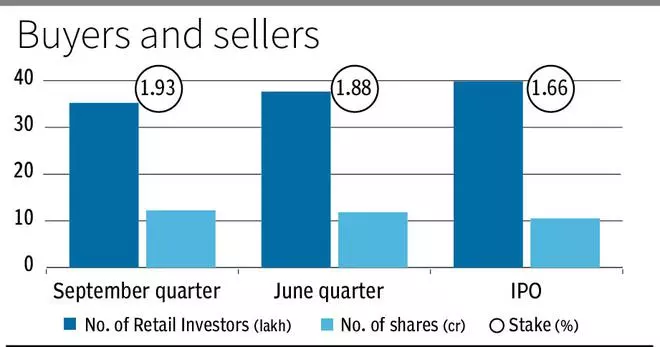

According to the latest shareholding pattern, July-September quarter also witnessed an exodus of over 2.65 lakh retail investors from LIC. However, the number of shares held by 35.23 lakh retail investors has increased to 12.21 crore shares from 11.86 crore shares (q-o-q). This is an addition of 35 lakh shares or 0.05 per cent to 1.93 per cent (1.88 per cent).

In the IPO, 39.86 lakh investors garnered 1.66 per cent stake or 10.51 crore shares. That means, since IPO, over 1.7 crore shares were added by existing retail investors.

This clearly indicates that some retail investors indulged in cost-averaging, believing in a turnaround in LIC scrip.

Buy mode

Foreign portfolio investors too seemed to have faith in LIC, as they added 33 lakh shares, hiking their stake marginally to 0.18 per cent from 0.12 per cent. However, mutual funds reduced their holding to 0.64 per cent (0.74 per cent).

Despite the stock not performing well, analysts expect the stock to recover 25-40 per cent.

Citi expects ₹1,000

Foreign brokerage Citi, the most bullish among them, recently initiated coverage on LIC with a buy rate and a target of ₹1,000. Despite market-share moderation, LIC has unparalleled dominance in India’s under-penetrated life insurance market, said Citi and added fund-bifurcation that led to an elevated equity mix in non-participating funds has raised concerns.

"However, our Deep Dive suggests comfortable ALM in guaranteed return products backed by sovereign long-tenure debt instruments. We believe good medium-term market potential, robust core operating ROEV, negligible high-risk assets (real estate, foreign securities) and lack of legacy liabilities with high guaranteed returns will support LIC’s premium over Asian peers with similar vintage," said Citi

Motilal Oswal has retained buy rating with a target of ₹830 while for Emkay Global, its still a hold with a target of ₹800.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.