The majority of the portfolio management services (PMS) schemes outperformed the Nifty50 in October.

Nearly 63 per cent, or 205 of the 326 PMS schemes, were able to beat the returns generated by the benchmark, data from PMS Bazaar shows. The 326 schemes collectively delivered average returns of -2 per cent, higher than the -2.7 per cent given by the benchmark.

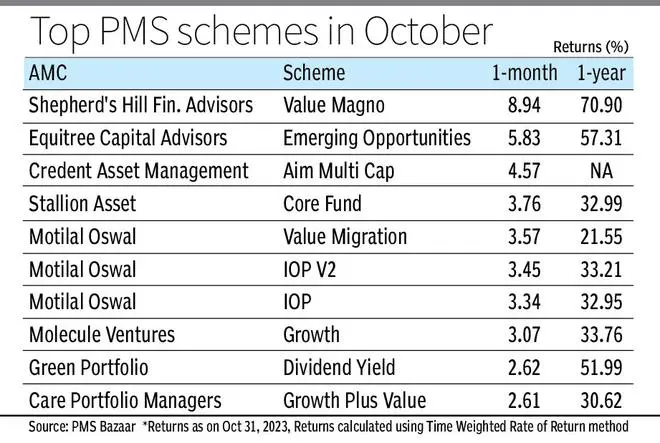

Shepherd’s Hill Financial Advisors’ Value Magno, a flexi-cap strategy, was the top performer for October with returns of 8.9 per cent, followed by Equitree Capital Advisors’ Emerging Opportunities (5.8 per cent) and Credent Asset Management’s Aim Multi Cap (4.6 per cent).

Aequitas Investment Consultancy’s India Opportunities Product, a small cap strategy, is the top performer for a one-year period with returns of 81.3 per cent, followed by Shepherd’s Hill Financial Advisors’ Value Magno (70.9 per cent) and Samvitti Capital’s PMS Active Alpha Multicap (68.3 per cent).

Marcellus’ Little Champs is the worst performer in the past year with returns of -12.6 per cent. Two other schemes from Marcellus — Rising Giants (-4.4 per cent) and Consistent Compounders (-1.5 per cent) — are also among the worst performers.

Most of the PMS schemes tend to adopt concentrated portfolios, which can work both ways. If few of the calls go wrong, it can hit overall performance, said experts.

PMS schemes managed ₹24.9 lakh crore under the discretionary portfolio, ₹2.3 lakh crore under the non-discretionary portfolio, and ₹2.5 lakh crore under advisory, the latest regulatory data showed.

The PMS segment invests money on behalf of wealthy individuals. The minimum investment that regulations allow is ₹50 lakh.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.