India’s attempts to bring back the derivative volumes in the Nifty index that the country lost to Singapore is yet to bear fruits. Three months after the Singapore Stock Exchange (SGX) and National Stock Exchange (NSE) commenced trading in Nifty at the Gandhinagar-based offshore hub GIFT City, SGX has not passed volumes generated by foreign funds to the GIFT platform as envisaged via the SGX-NSE connect deal.

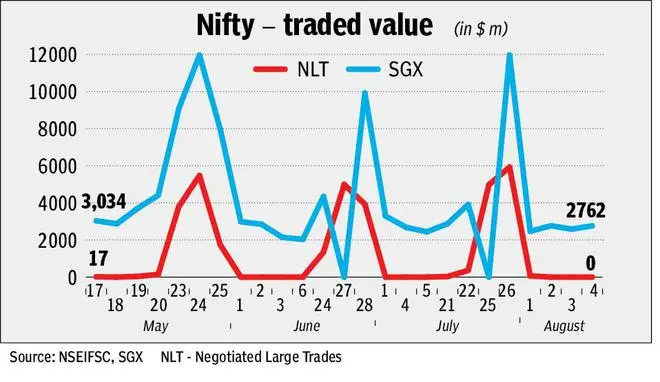

Data shows that the NSE GIFT platform has nil trades in the negotiated large trades (NLT) segment for three months, a window for SGX-linked trades.

‘Chasing the carrot’

Just a week ago, Prime Minister Narendra Modi was called in as the chief guest at an event to mark partnership between SGX and NSE. Since May, when the partnership became operational, there have been a few days that saw trading of Nifty lots reported in the NLT window. Small volumes were reported between May 17 and 31, and trading was for a few thousand dollars. Situation was similar in June and July as well. However, nil volumes have been transacted since Modi’s launch function.

“Nifty trading in Singapore is the most coveted and SGX will keep the carrot dangling. It has been eight years since India launched the GIFT platform and nearly four years since NSE and SGX decided to work on a partnership model to shift Nifty trades from Singapore to India. But the wait keeps getting longer. If one goes by the spirit of the partnership (deal documents have not been made public), SGX has to report all Nifty trades on GIFT platform,” said a regulatory official who was involved with the issue.

Migration process

Experts say, the SGX-NSE deal structure is just the process of migration of volumes to India that were already happening in Singapore. Funds remain registered in Singapore and SGX does all the clearing and settlement, and reports trades on the Gift platform. For this, NSE and SGX have formed a special purpose vehicle.

In 2018, NSE had said it was withdrawing from an 18-year-old agreement to trade its products on SGX. To salvage the situation, SGX had agreed to work on a partnership model after NSE blocked SGX from launching new products and moved the court.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.