As foreign portfolio investors (FPIs) resumed their selling spree, India’s benchmark equity indices Sensex and Nifty gave up the majority of their sharp gains registered at the start of the week. According to analysts, it was the worry of quantitative tightening, where liquidity is being sucked out by the US Federal Reserve, that was the major cause of concern and there was nothing to decouple Indian markets from this. On Thursday, Sensex fell 770 points or 1.29 per cent to close at 58,766. The Nifty declined 216 points or 1.22 per cent to close at 17,542.

As per provisional figures, FPIs sold stocks worth ₹2,300 crore in the cash equity segment. Derivatives figures were not updated by exchanges. Rupee declined by 9 paise at 79.55 against Dollar and touched a low of 79.29.

“Since Indian markets have been resilient to the global market fall, due to its domestic money flow, a theory is doing the rounds that we were decoupling from the happenings in the US. Thursday’s market fall, after Tuesday’s gains seen from the lens of historic perspective, is enough to debunk the theory,” said Rohit Srivastava, strategist at IndiaCharts.

Srivastava added, “Charts show that India’s markets are in a similar situation to the dot-com bubble crash of 2001, the Nifty index was making higher tops while the Nasdaq index of the US was hitting lows between November 2000 and February 2001. Then too, India’s rally was backed by domestic sentiments and volumes ratcheted up by operators but it only lasted for a few months and ended in a massive crash. Juxtapose this with the current situation and it is more likely to end like 2001 if you go by the market internals.”

Global indices down

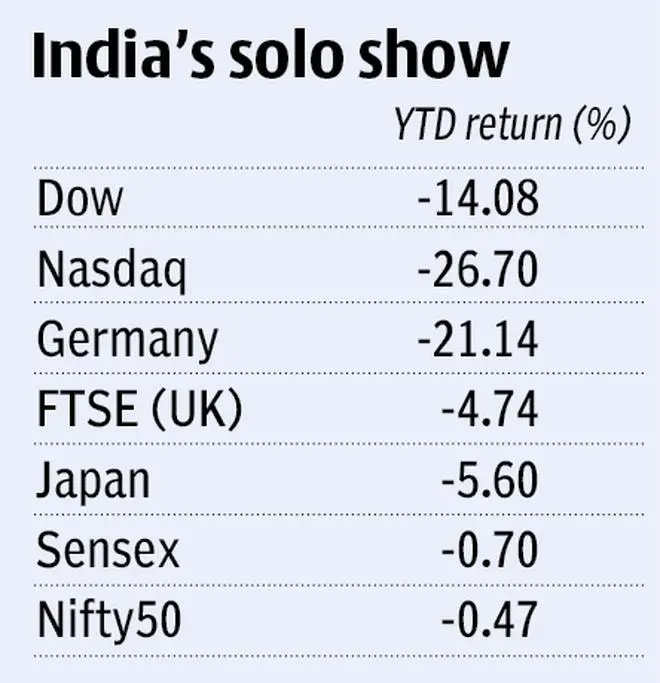

Just this week, the Dow Jones, S&P and Nasdaq indices are down 3-4 per cent with no sign of recovery. All three US market indices are down between 8.5 per cent and 12 per cent from the recent high levels, but Nifty, Bank Nifty and Sensex have managed to outperform the world since they are down less than 3 per cent from the recent highs.

Germany’s Dax is down 9 per cent, Japan’s Nikkei 7 per cent, UK’s FTSE 6 per cent, Hong Kong’s Hang Seng 5 per cent and South Korea’s Kospi index is down more than 6 per cent from highs in August.

“Mid-caps are outperforming the large-caps and giving a breakout signal. But bulls will regain if the Nifty closes above 17,850 this week,” said Rishi Kohli, Managing Partner and CIO Hedge Fund Strategies at InCred Alternatives.

Anindya Banerjee, Vice-President, Kotak Securities, said: “Over the near term, Dollar Rupee will continue to trade within a range due to contrasting factors: lower oil prices but higher US Dollar Index. Expect a range of 79.20 and 79.85 on spot the near term.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.