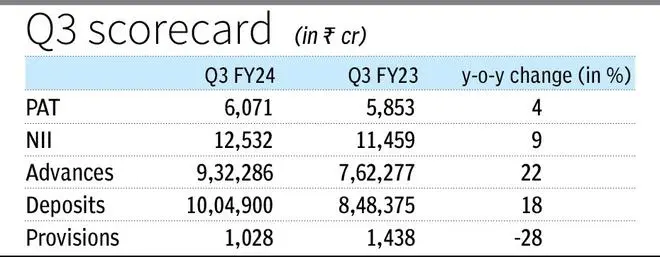

Axis Bank posted a net profit of ₹6,071 crore for Q3 FY24, up 4 per cent both year-on-year and quarter. A 32 per cent year- on-year increase in operating expenses to ₹8,946 crore weighed on the bottomline.

“As long as the operating environment on the credit side remains benign, and we are able to deliver in and around our aspirational RoE of 18 per cent, we would continue to invest in the franchise, which is playing out through the opex. It’s an investment for the future and we believe that’s the right kind of investment to be making today to create a sustainable franchise,” CFO Puneet Sharma said in the earnings call.

Net interest income (NII) grew 9 per cent y-o-y and 2 per cent q-o-q to ₹12,532 crore. Net interest margin (NIM) for the quarter was 4.01 per cent, lower than 4.11 per cent a quarter ago and 4.26 per cent a year ago.

Sharma said given the liquidity scenario, deposit growth will be a constraint on advances growth in the short to medium term and loan growth will converge with deposit growth in the long term.

Advances grew 22 per cent y-o-y and 4 per cent q-o-q to ₹9.3-lakh crore. Domestic net loans were up 25 per cent y-o-y, led by 27 per cent growth in retail loans to ₹5.5-lakh crore, comprising 59 per cent of net advances. Of the retail loans, 75 per cent were secured and 30 per cent were home loans.

Personal loans grew 28 per cent y-o-y, credit cards by 92 per cent, small business banking loans by 40 per cent, rural loans by 34 per cent, SME loans by 26 per cent, corproate loans by 15 per cent, and mid-corporate loans by 30 per cent.

The bank said 80 per cent of the personal loan customers are existing customers or those sourced through digital partnerships and growth has continued from the previous quarter, being led by some “transformation projects” undertaken by the lender without compromising on the quality of the portfolio.

Deposits grew 18 per cent y-o-y and 5 per cent q-o-q to ₹10-lakh crore , led by 16 per cent growth in savings deposits, 5 per cent in current account deposits and 24 per cent in term deposits. CASA ratio stood at 42 per cent lower than 45 per cent a year ago.

Cost of funds

Sharma said liabilities are expected to continue to reprice through FY24 and possibly through Q1 FY25. As such, marginal cost of funding has stabilised for the system, and the pace in increase in cost of funds is moderating and should stabilise in FY25, he added.

Provision and contingencies for the quarter were ₹1,028 crore, which included provisions of ₹182 crore against the bank’s AIF investments. Cumulative provisions stood at ₹11,981 crore as of December 2023.

Gross slippages during the quarter were ₹3,715 crore, which Sharma said were largely due to seasonal delinquencies in the agriculture portfolio. Slippages were largely off-set by recoveries and upgrades were at ₹2,598 crore and the bank wrote off loans worth ₹1,981 crore.

Gross NPA ratio of the bank improved to 1.58 per cent from 1.73 per cent a quarter ago and 2.38 per cent a year ago. Net NPA ratio at 0.36 per cent was flat q-o-q but better than 0.47 per cent a year ago.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.