Private sector lender Axis Bank will acquire Citi’s India consumer businesses for ₹12,325 crore or about $1.6 billion in cash consideration. The transaction comprises the sale of the consumer businesses of Citibank India, which includes credit cards, retail banking, wealth management and consumer loans.

The deal also includes the sale of the consumer business of Citi’s non-banking financial company, Citicorp Finance (India) Limited, comprising the asset-backed financing business, which includes commercial vehicle and construction equipment loans as well as the personal loans portfolio.

Through the deal

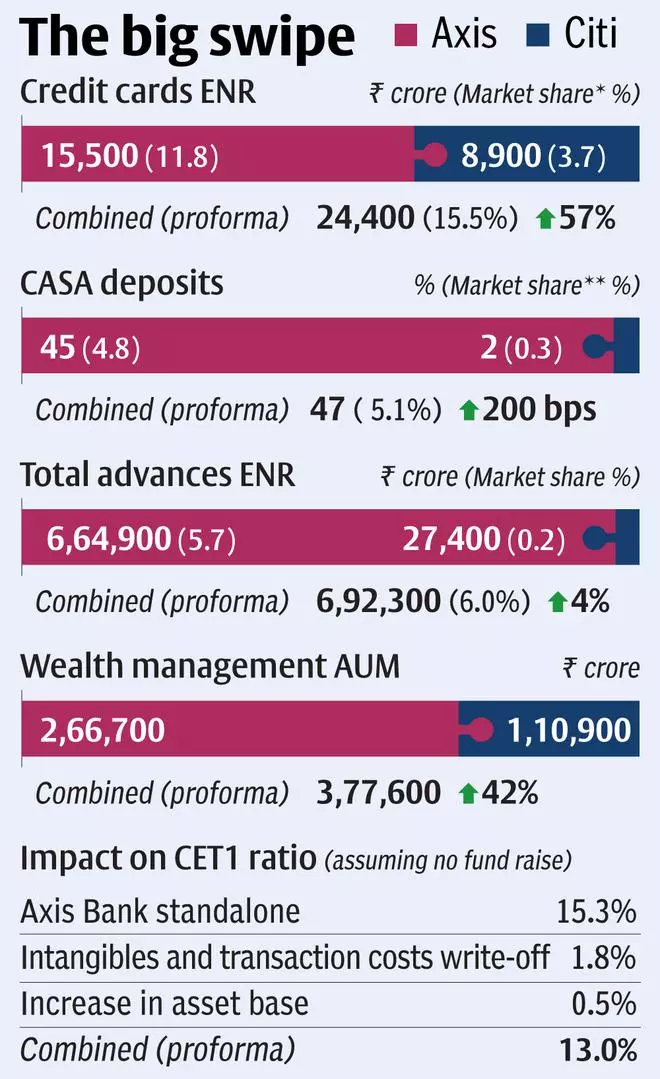

The acquisition will help Axis Bank to get about 30 lakh unique customers of Citibank India. Its cards balance sheet will grow by 57 per cent with an additional 25 lakh Citibank cards, making it one of the top three cards businesses in the country. It will also add ₹1,10,900 crore assets under management from Citi Wealth and Private Banking products and get aggregate deposits of ₹50,200 crore, of which 81 per cent is CASA.

Post the acquisition, Axis Bank will have about 2.85 crore savings accounts, over 2.3 lakh burgundy customers and 1.06 crore cards. The bank will also gain access to seven offices, 21 branches and 499 ATMs across 18 cities and will absorb about 3,600 in-scope consumer employees of Citibank.

On an overall basis, the proposed transaction will add about 7 per cent to the bank’s deposit base (with 12 per cent increase in CASA) and 4 per cent increase in advances.

Done deal by Q4 FY23

Amitabh Chaudhry, Managing Director and CEO, Axis Bank, said he expects all regulatory permissions for the merger to be in place in the next nine to 12 months. The integration will be completed in 18 months. The closing is expected to be achieved in the fourth quarter of 2022-23, subject to regulatory and other customary conditions.

The total purchase consideration has an implied PE of 18.7x on normalised calendar year 2020 standalone financials.

‘Strategic thrust’

Underlying the bank’s larger aspirations, Chaudhry said, “The deal gives a strategic thrust to close the gap between Axis Bank and its peers.”

The acquisition comes nearly a year after Citigroup had, in April 2021, announced its decision to exit its consumer banking operations in India. This was a part of an ongoing strategic review that was part of strategic actions in global consumer banking across 13 markets. Citi India CEO, Ashu Khullar said, “We continue to remain committed to contributing to India’s growth and development as we deepen our presence through our institutional businesses and our community initiatives.”

Most domestic banks are bullish about retail banking as well as credit card business and are looking to expand their portfolio in the segment. “Axis Bank looks at this acquisition as a healthy strategic fit. It will gain access to the large and affluent customer franchise of Citibank,” the private sector lender said.

Losing customers

Citi has however, been losing customers since its announcement. By February 2022, it had 25.5 lakh outstanding credit cards and 14.4 lakh debit cards as against 26.21 lakh outstanding credit cards and 16.48 lakh debit cards in April 2021. A number of leading domestic banks including Kotak Mahindra Bank had evinced interest in acquiring the business.

The payment will be made when all the assets and liabilities are transferred to Axis Bank. The deal will be funded by the bank’s capital resources and it may look to raise capital further, Chaudhry said. “We hope to retain all the employees. We will ensure they get offers which are more favourable or the same as what they are getting today,” he said.

Axis Bank’s scrip closed 1.72 per cent higher at ₹750.2 apiece on the BSE on Wednesday.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.