Private sector banks (PVBs) have been more aggressive in writing-off bad loans than public sector banks (PSBs) to rid their balance sheets of these loans and improve the impaired loans ratio.

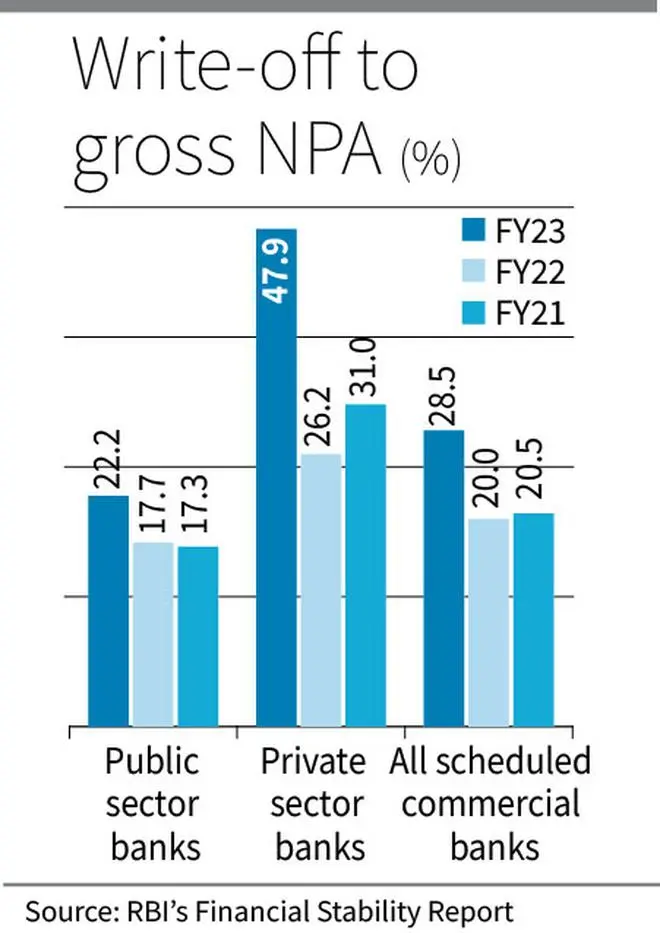

This is underscored by the fact that the write-offs to gross non-performing assets (GNPAs) ratio of PVBs at 47.9 per cent in FY23 was much higher than 22.2 per cent of PSBs, per Reserve Bank of India’s latest financial stability report.

In fact, both the aforementioned categories of banks stepped up write-offs vis-a-vis preceding two years. The write-offs to GNPAs ratio is the ratio of write-off (including technical/prudential write-offs and compromise settlement) during a financial year to GNPA at the beginning of the year.

The write-offs to GNPAs ratio of PVBs in FY22 and FY21 was at 26.2 per cent and 31 per cent, respectively. The write-offs to GNPAs) ratio of PSBs in FY22 and FY21 was at 17.7 per cent and 17.3 per cent, respectively.

Write-off does not preclude recovery

“A write-off is an accounting term for the formal recognition in the financial statements that a borrower’s asset no longer has value. Usually, loans are written off when they are 100 per cent provisioned and there are no realistic prospects of recovery.

“These loans are transferred to the off-balance sheet records,” Karlis Bauze, Senior Financial Sector Specialist with the World Bank’s Financial Sector Advisory Center, said in a 2019 article.

Bauze emphasised that a write-off does not preclude the bank from enforcing, selling, or transferring the credit to another entity.

“Writing-off a loan does not entail forgiving the debt. The borrower still owes money to the bank; however, the bank has de-recognised this asset from its financial statements due to uncollectibility.

“In case the borrower resumes servicing its debt, or the exposure is sold, a recovered amount would be directly recorded in the profit and loss (P&L) account,” per the article.

Balance sheet management

Banking expert V Viswanathan opined that technical write-offs are resorted to by banks since reduced GNPA ratio helps improve market sentiments towards their stock.

This is an important tool for PVBs as they raise capital in the form of equity or debt more often than PSBs.

“Strong private sector banks, with higher net interest margin and non-interest income accounting for 30 per cent of total income, are able to post higher operating profit. So, they are in a position to make higher provisions. Technical write-off after provision is more of a norm for these banks,” he said.

Viswanathan observed that unsecured advances, including credit cards, are progressively written-off once they are identified as non-performing.

PVBs may write-off an unsecured account even in the first year of it becoming impaired. However, in the case of PSBs even if provision is available, write-off usually happens only after two years.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.