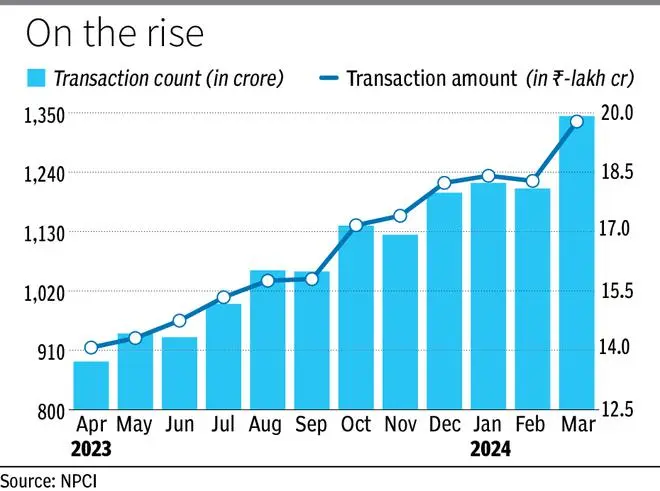

The Unified Payments Interface (UPI) ended FY24 on a strong high, setting new records for both the volume and value of transactions undertaken during March 2024.

This was despite transactions dipping slightly in February 2024 due to the fewer number of days in the month, and increased investment activity ahead of the financial year end.

“March sees a lot of transactions closer to the daily limit of 1 lakh on UPI transactions since merchants, business owners and individuals square off transactions during the month. This translates into higher value and volume in March,” said Vivek Iyer, Partner, Grant Thornton Bharat.

Transactions worth ₹19.78 lakh crore were processed during March 2024, higher than the previous record of ₹18.41 lakh crore set in January 2024. The value of transactions was 40 per cent higher, compared to that in March 2023, according to data from the National Payments Corporation of India (NPCI).

The number of transactions on the UPI network rose to 1,344 crore during the month, from the January peak of 1,220 crore transactions. On year, the volume of transactions was 55 per cent higher. On-year growth in UPI transactions remained over 40 per cent for the value of transactions, and above 50 per cent for volume of UPI trades in 2023 and FY24.

In FY24, the UPI platform processed 13,115 transactions, aggregating to ₹199.29 lakh crore, compared with 8,376 crore transactions worth ₹139 lakh crore in FY23. During the year, the volume of transactions was up 56.6 per cent, whereas the value of transactions was 43.4 per cent higher.

UPI transactions are expected to breach 100 crore transactions per day by FY27, according to a report by PwC India, which projects UPI to dominate the retail digital payments landscape, accounting for 90 per cent of the total transaction volumes over the next five years.