The Indian life insurance sector has been a bright spot in the Asian region as life insurers in the country have received higher valuations than in other countries such as China, Japan and Taiwan, according to a report by McKinsey.

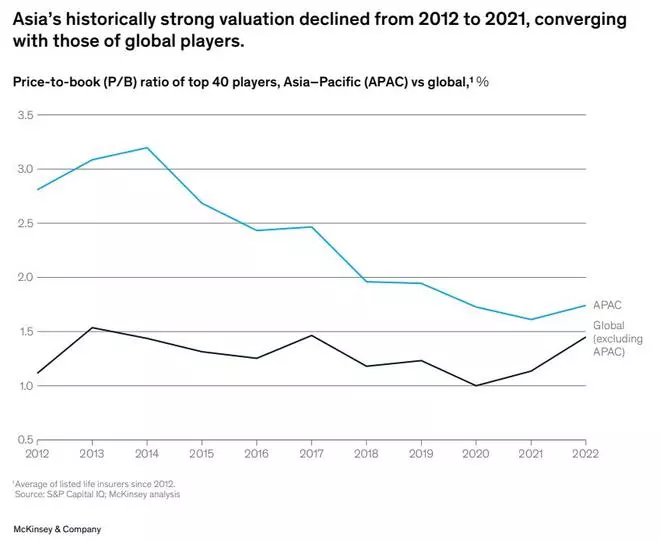

Valuation of life insurers in the region declined between 2012 and 2022, converging with that of global insurers, due largely to slower growth and a declining population in markets such as Japan and Taiwan. The deceleration in China’s growth also negatively affected valuations.

But positive growth momentum and strong underlying factors have supported higher valuations in the Indian market.

Countries in South-East Asia are somewhere in the middle: growth, which stalled during the pandemic, is slowly rebounding, with each country recovering at a different speed. This reflects a challenging environment for life insurers in a region where market sentiment and investor perception are closely intertwined with economic, technological, and regulatory dynamics.

Domestic and international insurers continue to compete for market share in developed and emerging markets. Over the past five years, large multinationals in Asia have shown steady growth, consistently gaining market share from smaller multinational companies and domestic insurers.

This trend is particularly evident in emerging markets such as Malaysia and Thailand, where MNCs dominate in terms of market share.

China and India are outliers, dominated by domestic players such as Ping An Life and the Life Insurance Corporation of India (LIC), respectively. But leaders in these countries have been losing share to foreign insurers and other domestic and joint venture insurers.

Distribution agency

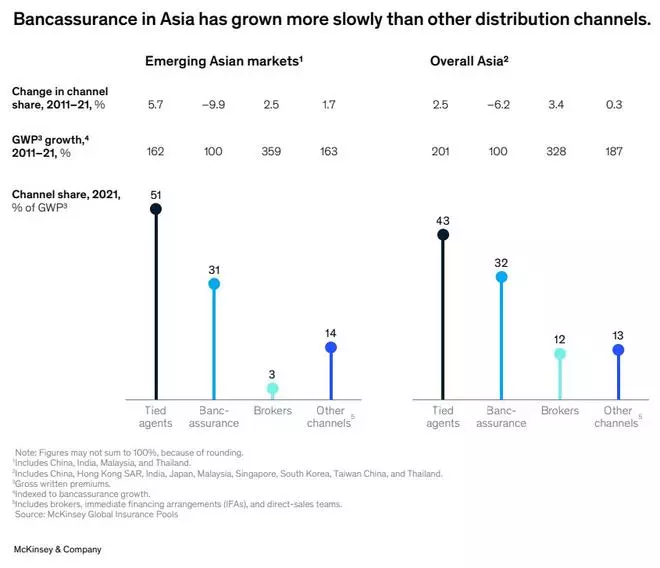

Many insurance markets in Asia that are still emerging, such as India, China and Indonesia, tend to have a substantial tied-agency force, which has been the main channel to reach out to large populations spread across dispersed and sizable countries.

However, insurers are facing challenges in engaging their tied-agency workforce. According to estimates, 60 and 80 per cent of agents leave the system in the first four years after recruitment. The agency channel in Asia is set to evolve significantly. Insurers can prepare for that future by defining the target segments they want to serve in and organising their distribution channels around the optimal approach to serving their customers.

Asia leads in insurance distribution via banks, accounting for about 48 per cent of bancassurance premiums globally. In markets such as India, Hong Kong, Indonesia, and Taiwan, more than half of premiums come from this channel. However, most insurers and banks have yet to reach this level of bancassurance success.

In India, the bancassurance space accounts for 55 per cent of individual business premiums in the private sector, according to ICICI Prudential Life Insurance Company, a leading private life-insurer in the country.

Banks in India are increasingly adopting anopen architecture in which they can partner with up to nine life insurance companies, nine non-life insurance companies, and nine standalone health insurers, further fuelling competition.

This enables them to offer their customers a range of insurance options from mulitple providers. As a result, insurers are being compelled to innovate and offer attractive products. This benefits consumers, who have more options to choose from, and can tailor their insurance coverage to their specific needs,” it pointed out.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.