The microfinance industry (MFI) is expected to grow at about 25 per cent in FY24, driven by steady disbursement growth and an improving macroeconomic environment as the segment is bouncing back after the impact of Covid-19.

MFI experienced a slowdown in growth in FY21 due to the challenges posed by the Covid-19 pandemic. However, growth rebounded in FY22, with NBFC-MFIs (microfinance institutions) growing at 18 per cent Y-o-Y, supported by strong disbursements in the latter part of the fiscal year. This growth momentum is expected to continue, and the MFI industry is likely to record 25 per cent growth in FY24 (vs estimated 20 per cent growth in FY23), according to a report by CareEdge.

During the 9 months of FY23, MFI reported a growth of 12 per cent supported by a favourable macroeconomic climate and renewed demand from tier-III cities, which has led to a surge in disbursements over the past few months.

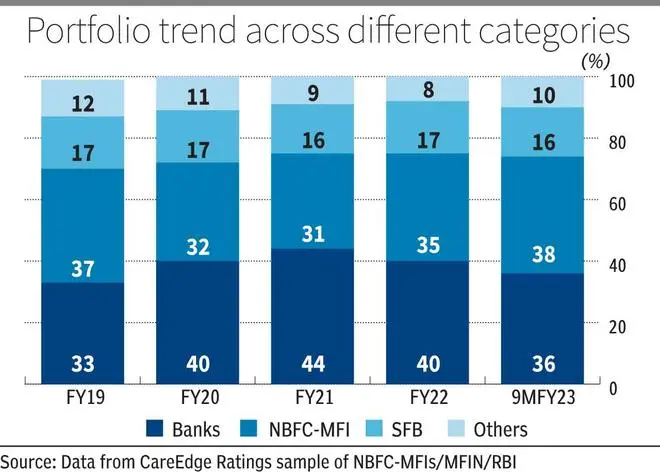

NBFC-MFIs have surpassed banks in the overall microfinancing landscape, constituting about 38 per cent of the total outstanding microfinance loans as of December 31, 2022, compared to 36 per cent for banks.

In terms of capital structure, NBFC-MFIs have managed to raise ₹3,010 crore of equity during 9 months in FY23, when compared with ₹1,506 crore and ₹1,431 crore in FY21 and FY22, respectively, indicating a renewed interest from investors.

MFI’s gross non-performing asset (GNPA) ratio peaked at 6.26 per cent on March 31, 2022, when compared with 2.05 per cent as on March 31, 2020, owing to a steep rise in slippages. However, with better collection efficiency supported by an improving macroeconomic environment along with substantial write-offs, improvement in the NPA trend can be seen.

“The GNPA ratio is expected to decrease to 3 per cent by the end of fiscal 2024 although it will remain high when compared with pre-Covid levels,” it said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.