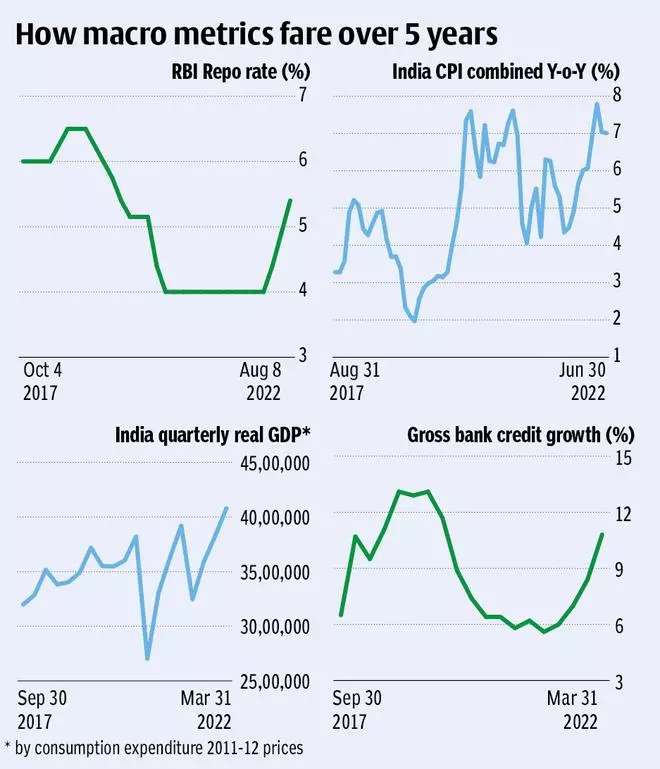

The monetary policy committee (MPC) on Friday pushed the policy repo rate above the pre-pandemic level, with a frontloaded 50 basis point hike, to curb retail inflation, which remains uncomfortably high.

With Friday’s rate hike, which was unanimously backed by all six MPC members, the repo rate is now at 5.40 per cent, against 4.90 per cent earlier. This is the third time on the trot that the MPC has upped the repo rate.

The resolution on “deciding to remain focussed on the withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth” was backed by all members except Professor Jayanth Varma.

The MPC had reduced the repo rate cumulatively by 115 basis points (bps) during the March-May 2020 period from 5.15 per cent to 4 per cent to support the economy in the wake of the Covid-19 pandemic.

The committee has now upped the repo rate cumulatively by 140 bps in the May-August 2022 period from 4 per cent to 5.40 per cent to tamp down retail inflation.

The latest repo rate hike came in the backdrop of June 2022 being the sixth consecutive month when retail inflation was at or above the upper tolerance level of 6 per cent and outsized interest rate hikes by advanced economy central banks leading to portfolio outflows , thereby weakening the Rupee.

The latest round of repo rate increases will be transmitted into lending and deposit rates, which will go up further.

CRISIL, in a report, said: “With an increase of 140 bps in the repo rate so far this fiscal and an additional front-loaded increase in next policy, the cost of deposit for banks is expected to increase by 25-30 bps vis-à-vis an increase in loan yield of 80-90 bps.”

“This difference is because of tightening liquidity, lag in reset of loans, mix of fixed and floating portfolio accounts, borrowing instruments, and competition faced by banks from non-banks and housing finance companies.”

RBI Governor Shaktikanta Das emphasised that at this point of time, there are signs that Consumer Price Index (CPI)-based inflation has peaked. It is expected to moderate going into the fourth quarter of the current year and the first quarter of next year.

“But inflation still remains at uncomfortably or unacceptably high levels, and there are also several uncertainties which are clouding the outlook. Therefore, monetary policy has to act.

“…Steps have to be taken to contain inflation and inflation expectations. Resilient economic activity gives us the space to act. And the aspect of growth is always taken into consideration and is always factored in in MPC’s deliberations as well as its decisions,” Das said.

Whatever it takes approach

The Governor underscored that monetary policy will be calibrated, measured, and nimble depending on the unfolding dynamics of inflation and economic activity.

“The focus will remain on ensuring a safe and soft landing for the economy. It is once again taking a whatever it takes approach for the RBI going into a third year.

“We had it (whatever it takes approach) in the first and second years of the pandemic and also now, given the challenges that we are confronted with,” he said.

Umbrella remains strong

Referring to India being impacted by the global economic situation, Das noted that the country is expected to be amongst the fastest growing economies during 2022-23 according to the IMF, with signs of inflation moderating over the course of the year.

He observed that exports of goods and services, together with remittances, are expected to keep the current account deficit within sustainable limits.

“The decline in external debt to GDP ratio, net international investment position to GDP ratio, and debt service ratio during 2021–22 imparts resilience against external shocks.

“The financial sector is well capitalised and sound. India’s foreign exchange reserves, supplemented by net forward assets, provide insurance against global spillovers. Our umbrella remains strong,” emphasised Das.

State Bank of India Group Chief Economic Adviser Soumya Kanti Das opined that the 50 bps hike is an indication that RBI is more concerned about the rupee and external situation — that is, using interest rate as an defence to protect the rupee.

“Even though the RBI may have frontloaded the rate hikes, it remains to be seen how it influences the trajectory of the rupee over the medium term...in a situation when the current account deficit is likely to cross 3.5 per cent, raising the rates might be the best carry trade bet to finance the large current account deficit, “he said.

RBI retained FY23 GDP and retail inflation projections at 7.2 per cent and 6.7 per cent, respectively.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.