In an indication of shifting priorities, the monetary policy committee (MPC) on Friday said that it is putting inflation targetting ahead of economic growth in the backdrop of escalating geopolitical tensions and elevated commodity prices.

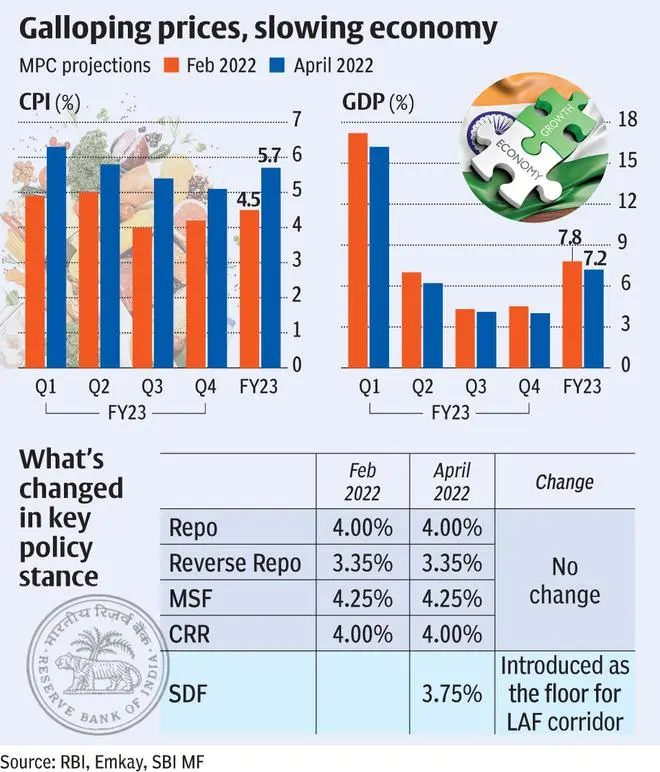

The six MPC members on Friday unanimously chose to keep the policy repo rate unchanged at 4 per cent even as RBI sharply revised the FY23 inflation projection upwards to 5.7 per cent from 4.5 per cent earlier. The FY23 real GDP growth projection has been cut to 7.2 per cent from 7.8 per cent earlier.

RBI has assumed crude oil price at $100 a barrel for its projections. MPC also unanimously voted to remain accommodative while focussing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.

Inflation before growth

RBI Governor Shaktikanta Das said: “In the sequence of priorities, we have now put inflation before growth…For the last three years, starting February 2019, we had put growth ahead of inflation in the sequence. This time we have revised that because we thought that the time is appropriate and that is something which needs to be done.”

This is in contrast to the Covid pandemic period leitmotif of “continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis…”

According to Das the external developments during the past two months have led to the materialisation of downside risks to the domestic growth outlook and upside risks to inflation projections presented in the February MPC resolution.

“Inflation is now projected to be higher and growth lower than the assessment in February. Economic activity, although recovering, is barely above its pre-pandemic level,” Das said.

Shifting gears

Experts said RBI is prepping the ground for a shift in gears vis-a-vis policy stance to neutral and eventually hike repo rate. . “The April review was decidedly more nuanced and cautious in the assessment and guidance with the RBI acknowledging upside risks on inflation and taking measured steps to exit from the extremely accommodative policy stance” said Rajeev Radhakrishnan, CIO-Fixed Income, SBI Mutual Fund.

Madan Sabnavis, Chief Economist, Bank of Baroda said the credit policy has surprised the markets with aggressive changes in projections for both GDP and inflation. “There is a clear hint that the accommodative stance though retained will change as there will be a gradual withdrawal of liquidity keeping in mind the trends in inflation. There are clear indications of the repo rate being increased during the course of the year and we do expect at least 50 bps increase this year. The markets have already reacted with the 10-year bond going up past 7 per cent and we expect the rate to go up to 7.25 per cent this year.”

Pankaj Pathak, Fund Manager-Fixed Income, Quantum AMC said the 5.7 per cent average CPI for FY 23, with the first two quarters at above 6 per cent would mean that the RBI can no longer hold the repo rate at 4 per cent. “We would expect, a change in stance and a 25 bps hike in the June policy. If the current conditions of 100$/brl oil and elevated food prices continue, we would expect the Repo rate to be around 5 per cent in FY 23.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.