Buoyed by strong equity and debt market performance, National Pension System (NPS) assets under management (AUM) —including the corpus on Atal Pension Yojana (APY) —hit a milestone of ₹ 10 lakh crore on August 25, PFRDA Chairman Deepak Mohanty said on Friday.

This represents a 25 per cent year-on-year growth over the AUM level of ₹ 8 lakh crore as of the end of August last fiscal. In the end of March this year, NPS AUM stood at ₹ 8.98 lakh crore.

Encouraged by this strong show, Mohanty expressed confidence that NPS AUM would by the end of this current fiscal be anywhere between ₹ 11-12 lakh crore.

Elaborating on the NPS journey towards this milestone, Mohanty said that NPS AUM has doubled to ₹10 lakh crore from ₹5 lakh crore in just two years and ten months.

NPS took six years and six months to reach the milestone of ₹1 lakh crore AUM after its implementation in the year, Mohanty noted. It then took four years and 11 months to further increase AUM to ₹ 5 lakh crore.

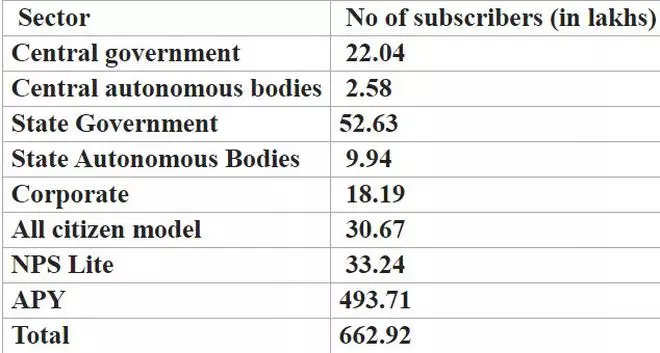

Mohanty said that the Corporate and All Citizen model —which had added one million new subscribers —played a critical role in the sharp jump in overall AUM.

Going forward, he expects an increase in corporate enrolment of NPS for their employees. As of date, the total number of corporates registered in NPS touched 14,027, with 18.13 lakh subscribers. Of this, public sector banks constitute the major portion with 5.20 lakhs plus subscribers.

Mohanty saw much room to increase the number of corporates under the NPS fold. The total subscriber base (corporate + all citizens model) has touched 48.86 lakhs with an AUM of ₹1.82 lakh crore.

Asked what has led to a sharp jump in AUM growth to ₹ 10 lakh crore, Mohanty said there are two main factors —market return and how accumulation has happened. “Both equity and debt markets have done well last year. Since its inception, NPS has returned 12.5 per cent on the equity front. In the last year, equity returns stood at 13.41 per cent”, he said.

PFRDA Chairman also sees the contribution of NPS assets under management as a percentage of GDP record a sharp increase in coming years. Today, NPS AUM, including that of APY, accounts for 3.6 per cent of GDP. “We are currently a lower middle- income country with a per capita income of around $ 2600. If the current trend in per capita income growth is sustained, we will definitely transition to an upper middle-income country sometime in the next decade and aspire to be a high- income country in the following decade. Our NPS share to GDP is bound to go up”, Mohanty said.

The average pension assets in the Organisation for Economic Co-operation and Development (OECD) countries are over 70% of their GDP, with some countries having pension assets over 100 per cent of their GDP.

SYSTEMATIC WITHDRAWAL PLAN

Mohanty, who assumed charge at the helm of PFRDA in March, said that the pension regulator would implement the new feature of Systematic Withdrawal Plans in NPS in October or November this year.

This new feature will give flexibility to NPS subscribers to opt for the facility of systematic withdrawal post-retirement of subscribers at monthly, quarterly, half-yearly and annual rests, Mohanty said.

This flexibility is essentially targeted at non-government sector subscribers — corporate and all citizens model categories — the growth driver for NPS assets last fiscal. The upcoming feature is also significant, given the perceived low annuity returns in the Indian financial system.

NPS DIWAS

Mohanty said that PFRDA has this year —in observance of NPS Diwas on October 1—planned a month-long sequence of digital media and publicity initiatives. These endeavours are strategically designed to commemorate NPS Diwas and effectively commemorate the importance of pension planning to the subscribers.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.