Private sector banks (PvSBs) generated more employment than their public sector bank (PSB) counterparts over the last decade or so, even as digitisation of customer journeys and processes gathered steam in both bank categories and the PSB space saw consolidation and closure of branches.

For example, in FY23 alone, PvSBs added a net of 98,518 jobs, while PSBs head count declined by 3,385, per RBI data.

With the rate at which PvSBs are expanding operations, it won’t be a surprise if they become the biggest employer among all bank categories in FY24, according to experts.

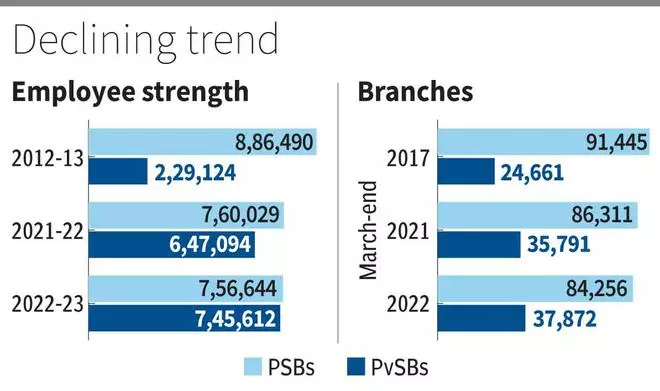

As of March 2023, PSBs and PvSBs employee counts stood at 7,56,644 and 7,45,612, respectively. Currently, there are 12 PSBs and 21 PvSBs in the country.

PSBs head count is going down even as their average business per employee is higher than that of PvSBs. In FY23, PSBs average business per employee was ₹23.80 crore vis-à-vis PvSBs ₹15.02 crore, per data compiled by the Indian Banks’ Association.

Massive Consolidation

With the banking sector witnessing fast-paced digital transformation PSBs’, which saw massive consolidation in the 2017–2022 period, saw branch counts decline by 7,189, while that of PvSBs went up by 13,211 in the five years up to March–end 2022.

As of March-end 2022, PSBs and PvSBs had 84,256 branches (91,445 as of March-end 2017) and 37,872 branches (24,661), respectively.

Banking expert V Viswanathan observed that the number of PSBs has come down from 27 to 12 due to amalgamation, starting with SBI and its Associates in 2016–17. This was followed by the mega-consolidation of 10 PSBs into four in 2020.

“This resulted in the rationalisation of branches as there was overlapping in many places. So branch expansion was nil or limited. Added to that, a good number of branches were also closed. On the other hand, private sector banks have been on a branch expansion spree in the last three years.

“Outsourcing of recovery and recruiting staff for branches on contract by major PSBs through outsourcing (they do not count in the total staff of a bank) also resulted in less new recruitment as full-fledged staff,” he said.

S Nagarajan, General Secretary, All India Bank Officers’ Association, observed that the trend of declining employee count, restricted branch expansion, and an increase in business per employee is an indicator that the government is preparing some of the PSBs for privatisation.

“With the number of bank customers increasing manifold and business volumes rising, there has been a sharp increase in employee workload at PSBs. However, recruitment has been inadequate,” said CH Venkatachalam, General Secretary, All India Bank Employees’ Association. (AIBEA)

AIBEA has given a call for an agitation programme, including bank-wise and State-wise strikes, culminating in a two-day all-India bank strike on January 19 and 20, to press its demand for adequate recruitment and to oppose outsourcing of regular jobs at public sector banks.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.