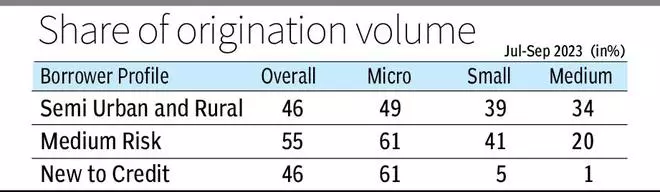

Semi-urban and rural regions accounted for 46 per cent of MSME loan originations during Q3 FY24, within which they comprised 49 per cent of micro segment loans and 39 per cent of loans to small enterprises.

“One of the key factors contributing to this expansion is the improvement in credit profiles of MSMEs” as per the quarterly MSME Pulse Report by TransUnion CIBIL and SIDBI. The share of high risk MSMEs has reduced to 13 per cent from 15 per cent a year ago, whereas that of medium risk MSMEs continues to be the highest at 55 per cent.

“Lending to the MSME sector continued in H1:FY2024, despite the conclusion of the Emergency Credit Line Guarantee Scheme (ECLGS) scheme, indicating underlying growth momentum of the sector. Technology is aiding in lending to the MSME sector,” said Sivasubramanian Ramann, Chairman and MD of SIDBI.

Total value of new MSME credit originations was ₹2.4-lakh crore, with small enterprises accounting for largest share at 42 per cent. MSME loan portfolio for the sector grew 11 per cent y-o-y to ₹28.2-lakh crore across 80 lakh MSME entities as of September 2023.

“Increased economic activity has spurred the demand for commercial loans, which grew 29 per cent y-o-y. Supply volumes grew 20 per cent y-o-y in July-September, indicating improved lender confidence,” the report said.

Overall balance-level delinquencies, measured as 90 days-past-due to 720 days-past-due and those reported as ‘sub-standard’, improved to 2.3 per cent from 3.0 per cent a year ago.

Delinquency rate

“MSME portfolio performance improved across all borrower segments as delinquency rates declined. In the quarter ending September 2023, we saw the lowest delinquency rate in the last two years,” said Rajesh Kumar, MD and CEO, TransUnion CIBIL.

Loan originations from large states such as Maharashtra, Gujarat, Delhi, Tamil Nadu, and Uttar Pradesh continued to be high, accounting for 47.2 per cent of the origination value. Uttar Pradesh and Tamil Nadu too saw high growth rates. These states account for around 42 per cent of New-to-Credit (NTC) originations in the micro segment.

Sectorally, manufacturing accounted for the most credit output at 37 per cent of the value of the loans sanctioned during the quarter. Textiles was the highest contributing sub-sector, with most loan originations in the medium entity segment and catered to by private banks.

It was followed by the ‘trades’ sector which comprised 28 per cent in terms of the value of the loans but was the highest in terms of volume, making up 39 per cent of the number of the loans sanctioned whereas manufacturing was only 25 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.