Finance Industry Development Council (FIDC), a representative body of NBFCs, has sought tax parity for returns on market-linked debentures, following the Budget announcement taxing such returns as short-term capital gains tax.

“₹73,000 crore of issuance are impacted by the recent Budget. Assuming an average ticket size of ₹30 lakh, this move may adversely impact around 2 lakh retail investors,” FIDC said, adding that as the announcement will be effective FY25, investors who factored in the current tax rate will have to pay higher tax.

STCG tax

The Budget classified the nature of returns on MLDs as short-term capital gains resulting in higher taxation on such investments. The short-term capital gains tax is applicable regardless of the holding period (even if it is more than three years, unlike debt mutual funds) and the listing status of these instruments.

“Increasing the tax burden would have negative effect on investors, and completely stifle the participation of such investors in the MLD market. Looking at the investor sentiments, the impact gets further accentuated since this amendment seeks to introduce retrospective amendment,” FIDC said in a letter to FM Nirmala Sitharaman.

Market Linked Debentures (MLDs) are structured fixed–income instruments that are usually linked to benchmarks such as the Nifty Index, government securities, prices of commodities or even a basket of stocks.

The industry body has sought tax parity for all debt products, including MLDs and debt MFs, with equities and equity MFs, translating to long-term capital gains tax if the holding period is over one year for listed instruments.

Withholding tax

FIDC has also submitted that the government may confirm that withholding tax will be implemented, and that the new taxation, if implemented, be done prospectively on new investments instead of retrospectively.

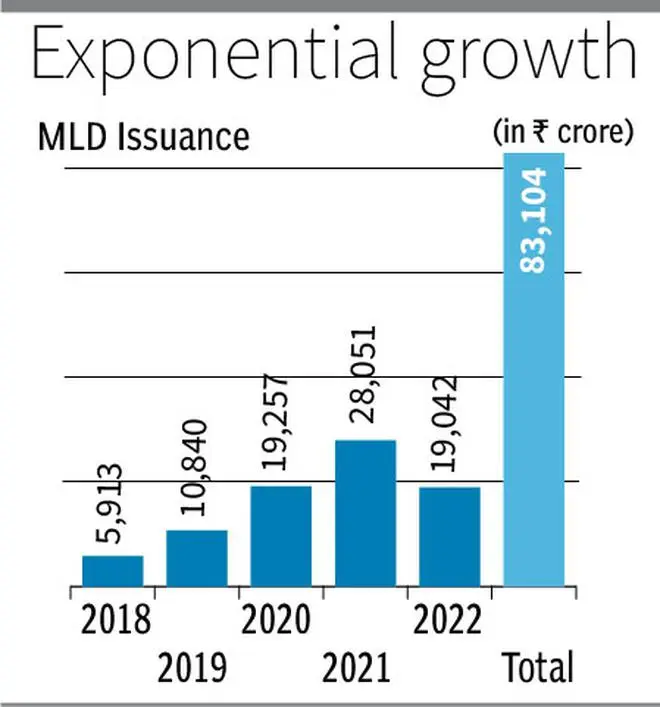

MLDs worth ₹3,800 crore are set to mature by March 31, of which ₹2,400 crore are listed and the holding period is over 12 months. Around 150 issuers have cumulatively raised ₹83,000 crore through MLDs in the past 5 years, with issuance volumes increasing every year. Outstanding MLDs are estimated to be ₹75,000 crore, of which 45 per cent are listed as of January 31.

Currently, long-term capital gains tax is applicable on listed MLDs held for over 12 months and unlisted securities held for over 36 months.

Retail participation

FIDC also said that wider participation from retail and HNIs would help deepen the bond market by reducing issuers’ dependence on banks and institutional investors. This is reflective in the rising share of ‘A’ and higher rated issuances. Of the total issuances of around ₹83,000 crore in the last 5 years, over 50 per cent were rated. Issurances rated ‘AAA’ and ‘AA’ constituted over 75 per cent of the rated MLDs.

Further, the share of MLDs rated ‘A’ and below has increased from 7 per cent in 2019 to above 25 per cent by 2022, which indicates that participation by retail and HNI category has had a positive impact on deepening the market for lower rated issuers, the letter said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.