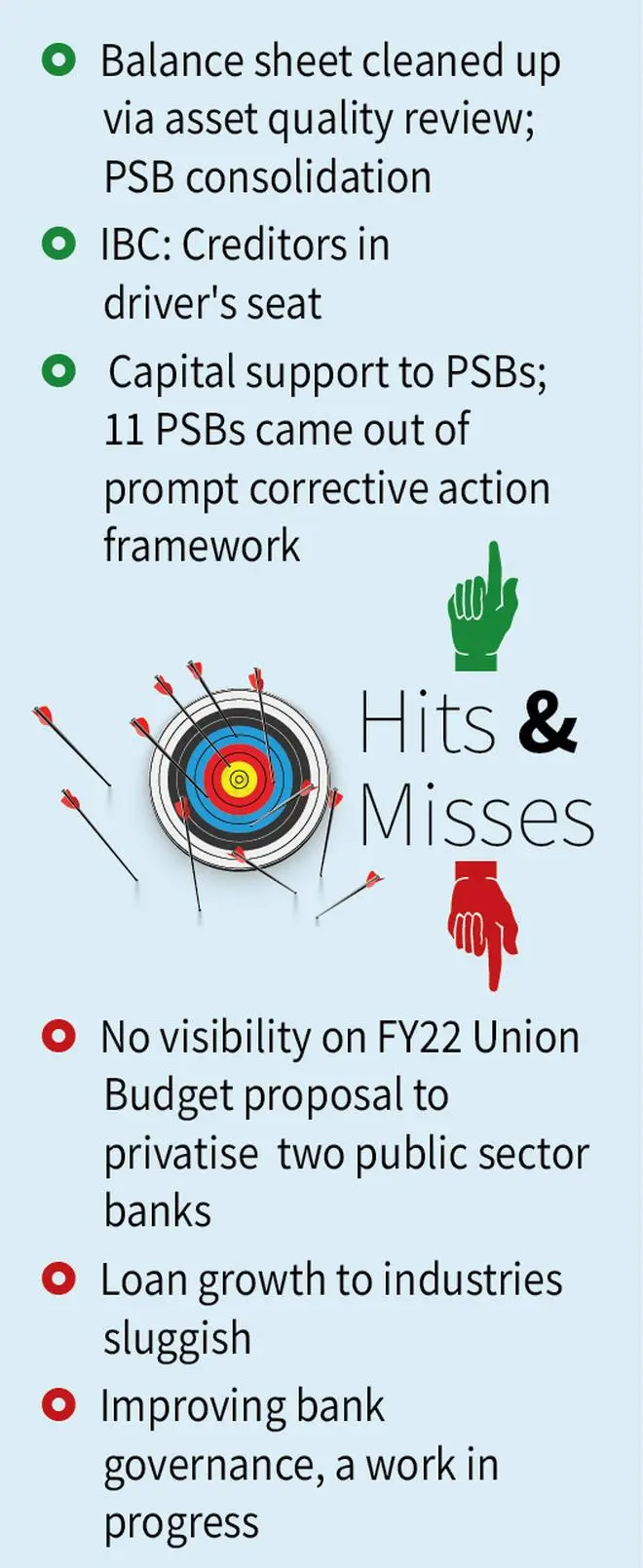

Although not easy, one of the successes of the 10 years of the NDA rule has been the reforms in the banking sector. Measures such as cleaning of bank balance-sheets with asset quality review (AQR), implementation of the IBC code, increasing financial inclusion and bank consolidation have ensured that the banking sector is in much better health than it was 10 years ago.

While there are few issues such as lop-sided credit growth of retail loans and governance problems at some banks, these are not insurmountable.

Cleaning up

In a candid chat with businessline, Arun Jaitley, who was the Finance Minister in NDA I, had said a frequently asked question by the global investors to him was how to deal with banks.

“It is a legitimate concern. Growth has to be supported by bank lending and we cannot allow ourselves to be obsessed with problem of non-performing assets.” Thus, started an exercise of consolidation and cleaning up of the banking system.

The healthy glow that banks now sport is due, in a large part, to the AQR exercise initiated in 2015. AQR was a balance-sheet clean up exercise, which led to re-classification of restructured advances as non-performing assets/NPAs.

This exercise needed large loan loss provisioning and as a result, the banking system’s NPAs rose to 11.6 per cent by March 2018. Public sector banks (PSBs) bore the brunt as they were saddled with higher non-performing assets; their NPA shot up to 15.6 per cent while private sector banks’ NPA rose to 4 per cent. While many PSBs slipped into the red, private sector banks (PVBs) were able to hold up relatively well.

IBC implementation

Cut to FY24. Most banks are now in the pink of health, with bad loans at multi-year lows (GNPAs at 3.2 per cent as of September-end 2023), with well-provisioned balance-sheets, loan recoveries outpacing impairments, strong capital buffers and robust loan growth.

The decline in bad loans in the banking system could also be attributed to the implementation of the Insolvency and Bankruptcy Code (IBC) and write-offs.

In a speech in January this year, RBI Governor Shaktikanta Das noted that creditors realised ₹3.16-lakh crore out of the admitted claims of ₹9.92-lakh crore as of September 2023, which works out to a recovery rate of 32 per cent.

“It needs to be emphasised here that significant value destruction would have already happened in these assets prior to their admission under the IBC. ....When evaluated from the prism of...the liquidation value and the fair value, the realisation rates are 169 per cent and 86 per cent respectively which appear quite encouraging,” he said.

Capital infusion

The government, on its part, ensured that the banks owned by it didn’t fall short of capital. It injected about ₹3.26-lakh crore in PSBs between FY17 and FY22.

Capital infusion was the silver bullet that not only helped PSBs to provide for bad loans, but also maintain capital above the minimum regulatory threshold so that they could step up lending. PSBs have been sailing under their own steam (raising capital from the market) since FY23.

The NDA government gave a big push to consolidation among PSBs to create strong and competitive banks. This was kicked off with the merger of five State Bank associate banks and Bharatiya Mahila Bank with State Bank of India in 2017.

This was followed by the merger of Vijaya Bank and Dena Bank with Bank of Baroda in 2019 and the mega consolidation of 10 PSBs into four in 2020.

The PVB space saw two banks — Yes Bank and Lakshmi Vilas Bank (LVB) — get into trouble. As per government notified reconstruction scheme, Yes Bank was rescued by State Bank of India, other banks and financial institutions, with a capital infusion of ₹10,000 crore. Lakshmi Vilas Bank was merged with DBS Bank India Ltd.

The merger that caught the attention of all stakeholders was of HDFC with HDFC Bank in July 2023. In the co-operative banking space, Punjab and Maharashtra Co-operative Bank, which was hit by a massive fraud in 2019, was resolved by amalgamating it with Unity Small Finance Bank in January 2022.

Demonetisation

While demonetisation (withdrawal) of ₹500 and ₹1,000 banknotes (from November 10, 2016, to December 30, 2016) proved to be operationally intensive for banks, with branches working well beyond normal business hours and even on holidays, it also resulted in significant growth in deposits, surge in the opening of Pradhan Mantri Jan Dhan Yojana accounts, pick up in digital transactions, among others.

Following AQR, banks’ changed tack, focussing more on growing RAM (retail, agriculture and MSME) loans vis-a-vis corporate loans.

On an average, RAM loans now account for about 60 per cent of banks’ overall loan portfolio against about 40 per cent a decade ago, with balance being accounted for by corporate/ wholesale loans.

Banks have stepped on the gas on retail loans since the pandemic. Between September 2021 to September 2023, banks’ retail loans (housing loans, vehicle loans, loans against property, education loans, loans against FD, loans against shares, personal loans, credit cards, consumer durables and other retail loans) grew at a compound annual growth rate (CAGR) of 25.5 per cent, which exceeded the headline credit growth of 18.6 per cent, per RBI data. However, lenders exuberance in retail lending has come even as loans to the industry has slowed down.

While financial inclusion has improved in the last three years with the onset of fintech based lending, it has also resulted in greater competition among banks and some sharp practices which need to be checked.

Unfinished agenda

Karthik Srinivasan, Senior Vice-President, Group Head - Financial Sector Ratings, ICRA, observed that after an eventful last 10 years, with an estimated tier 1 of 14.5 per cent, solvency of 6 per cent and return on assets of 1.2 per cent for FY24, the banking system is well poised to navigate the future though adherence to regulations in letter and spirit is needed.

The unfinished agenda would be the banking sector transitioning to an expected credit loss (ECL) framework and closure of the stake sale in IDBI Bank. A couple of years ago, Finance Minister Nirmala Sitharaman said that India needs at least four or five banks of State Bank of India’s size to meet the growing needs of the economy. It remains to be seen if the government will encourage another round of consolidation among PSBs to achieve this goal.