India is likely to see a slowdown in the roll-out of solar power capacity additions in the current year due to supply chain issues, according to the International Energy Agency.

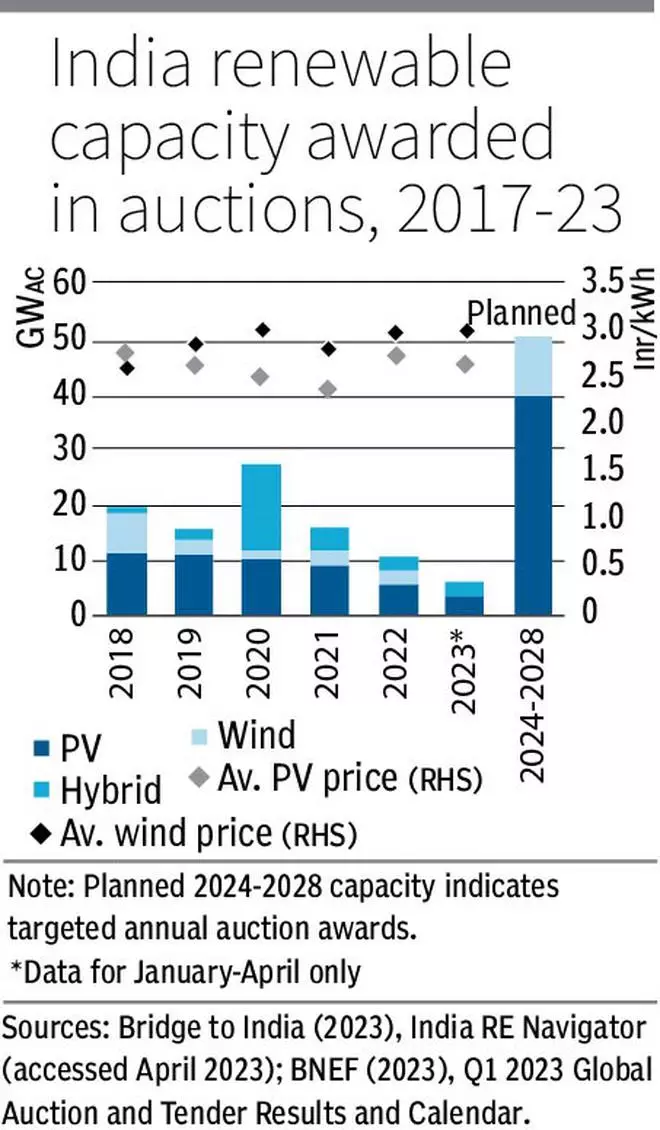

In 2022, India’s utility-scale solar PV capacity additions (made up mainly of capacity awarded in auctions) reached a record-breaking 14 GW, accounting for over two-thirds of renewable energy growth in the country, the report, titled ‘Renewable Energy Market Update – Outlook for 2023 and 2024,’ says. For 2023, lower auction volumes and supply chain challenges indicate that a slowdown of almost 20 per cent is probable, with a possible recovery in 2024, it says.

The supply side constraints have arisen due to India’s push for expansion of domestic manufacturing capacity.

Also read: Cut in solar panel import tax being considered to make up domestic shortfall

Historically, India has imported almost 90 per cent of its solar PV modules from China. However, the government’s production-linked incentives (PLIs) for PV manufacturing aim to increase domestic manufacturing capabilities, to reduce or eliminate imports. Two rounds of the PLI subsidy scheme should allow India to become self-sufficient in solar PV supply in the next four to five years.

However, in the short term, demand for high-capacity modules from large-scale top-tier manufacturers would exceed supply. Although the list of government-approved manufacturers (ALMM) in February 2023 implied a total manufacturing capacity of 22 GW, less than 5 GW was declared by large producers offering modules with over 500 W of power.

Developers demand these high-quality top-tier modules for their cost-efficiency and to more easily secure low-cost financing. Along with supply-demand mismatches, the introduction of higher import tariffs on PV modules and cells in April 2022 led to a 30-40 per cent increase in module prices in the second half of 2022.

“This reduced project bankability, forcing developers to either cancel or delay projects while waiting for PV prices to fall. In response, the government postponed ALMM requirements for all projects commissioned by April 2024 and extended the commissioning deadlines,” the report says.

Although government actions have mitigated some challenges, our forecast nevertheless expects that the temporary supply-demand mismatch for top-tier PV modules will prevent rapid utility-scale PV expansion in 2023 and 2024. However, the Indian market should experience a real deployment boom beyond 2025, with higher auction volumes and lower prices.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.