Thanks to affordable high-speed internet, the proliferation of mobile devices, and the bull run post the Covid-induced lockdown, the interest of Indians in the stock markets has grown exponentially. Research & Ranking conducted a study across 2,000+ respondents to understand the patterns of Indian investors across the country - especially their demographics, portfolio sizes, etc.

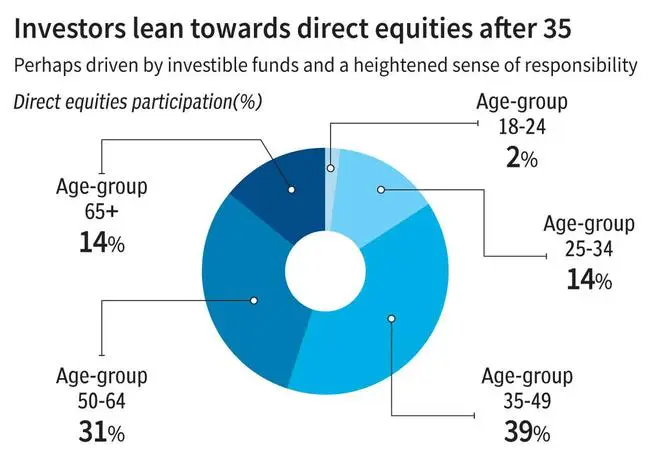

What is the age profile of investors?

Data shows investors lean towards direct equities after 35, driven by substantial investible funds and a heightened sense of responsibility. Contrary to conventional investing norms that suggest reducing equity exposure with age, it is observed a noteworthy number of senior citizens directly investing in equities.

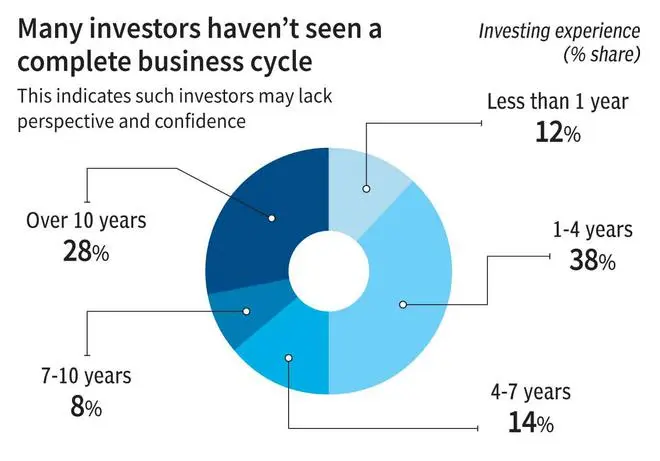

How experienced are investors?

Less than four years of investing experience is held by 50 per cent of investors, with 12 per cent falling under the category of having less than one year of experience. This implies that one investor out of every two is yet to witness a complete business cycle.

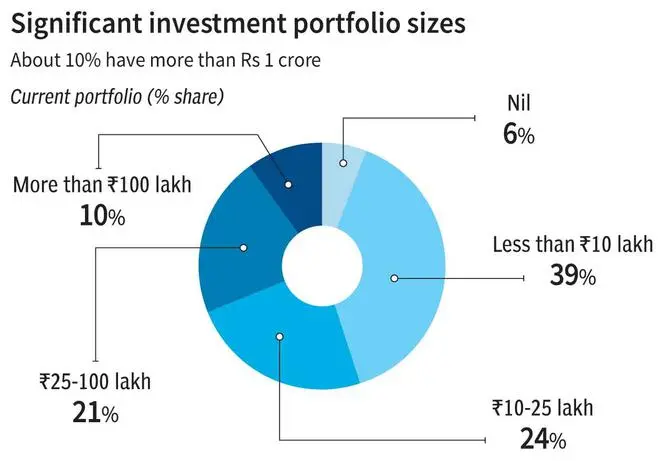

Lakhpati investors

A significant 31 per cent of respondents have portfolio exceeding ₹25 lakh. Within this cohort, an awe-inspiring 10 per cent proudly assert ownership of portfolios surpassing the coveted ₹1-crore mark.

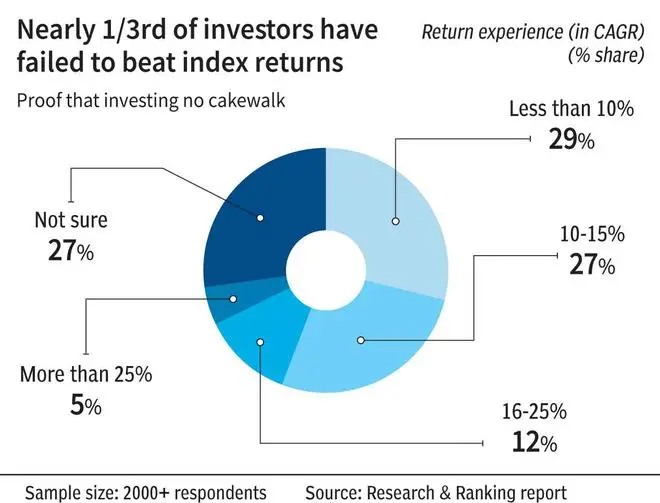

Portfolio performance

According to the study, as much as 56 per cent of investors confess to having achieved a Compound Annual Growth Rate (CAGR) of less than 10 per cent or being uncertain about their CAGR performance. This means almost 1 out of 3 investors have underperformed the index.

The report also reveals that over 50 per cent of the surveyed investors hail from non-metro cities, indicating a growing interest in financial markets beyond the major urban centres. A significant majority of around 60 per cent of Indian investors adopt a long-term investing approach, emphasizing their commitment to holding investments over extended periods..

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.