Sovereign gold bonds (SGBs) were introduced in the country in FY16 against the backdrop of a forex crisis, which was fuelled partly by high gold imports.

The idea of SGB is simple. If people wish to hold gold as investors, the same can be provided through SGBs, which do not entail any physical import of gold. This way there would be a reduction in gold demand as the same advantage accrues to the buyer of the bond.

This was topped with an assured return of 2.5 per cent on the principal, besides capital gain that would be driven by market forces over a period of time.

The underlying premise was that people bought gold as it is considered to be a safe investment as the price of gold normally appreciates in the medium term. The SGB, which was denominated in rupees and directly linked to the domestic price, would not involve physical handling, storage or insurance cost.

More importantly, the bond is issued by the sovereign and carries zero risk of default. Logically this was a perfect product to steer people away from buying gold for investment purposes.

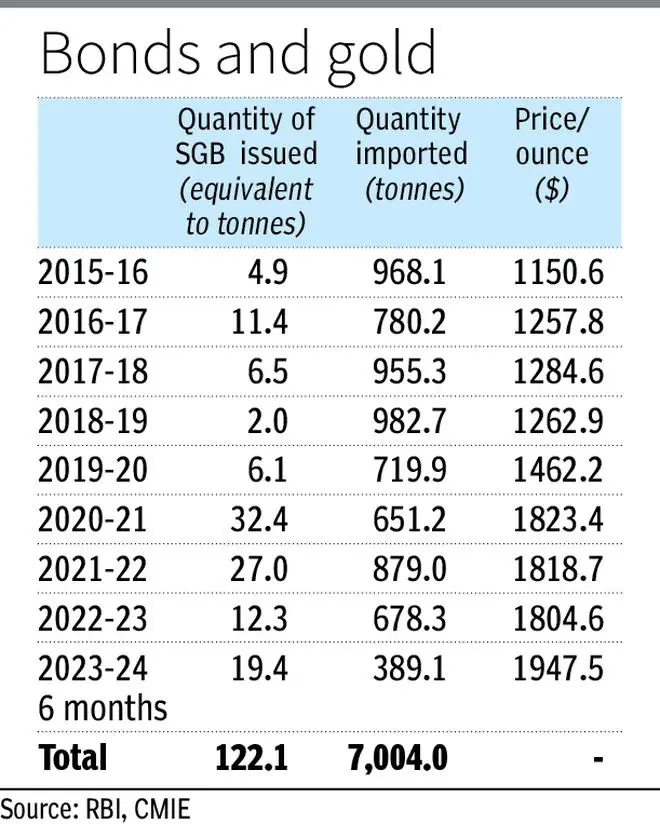

The SGB should have been an unqualified success if the prime motivation to hold gold was for investment purpose. Since the SGB was launched, a total of 122 tonnes of gold equivalent bonds were issued over an eight-year period.

The quantity purchased increased after the pandemic when those who invested in gold found this beneficial. The price of gold had also risen sharply when the lockdowns were imposed across the world and provided a fillip to the market.

This was a boom period, where gold was preferred as it was seen as a safe haven in uncertain times.

However, while 122 tonnes may sound impressive, the physical volume of gold that was imported during this period was 7,003 tonnes.

This means that the quantum of bonds issued was for an equivalent of 1.8 per cent of total imports in the last eight years or so (see Table).

The quantum of gold imported fell in 2020-21, which was also the period when there was an increase in SGB subscriptions, albeit at a low level. This was due to the lockdown, when there were physical restrictions on trade across the world.

Gold returns

Imports peaked again in 2021-22 before declining, as the price of gold also remained largely stable. Interestingly, for these nine years, the CAGR of gold price was only about 6.8 per cent. This is almost the same as the average inflation for the period and lower than the stock market returns, which grew 12.3 per cent.

Does this mean that the main purpose of SGB has not been achieved? The answer seems to be in the affirmative as the interest in these bonds has been limited. The reason is not hard to guess. First, the demand for gold or jewellery will rarely come down as it is traditionally bought as a store of value and kept in the locker or house.

This is part of the custom in Indian households, where gold is held for security as well as prestige, which is also the case with property. The difference is that while a dwelling may be used for residence or rental purpose, gold has no such value. Therefore, holding SGB is not really an alternative when there is an inclination to hold the physical metal.

Second, holding gold in physical form has the advantage of anonymity. This is not possible with SGB where the KYC norms are applied and followed as they are issued by the RBI through banks. Buying the physical form of gold and holding in the house or bank locker scores over the bond as there is no trail left for the taxman. Besides, gold has the ‘snob’ value, to impress neighbours and relatives.

Gold ETF

Third, gold ETFs too have not done as well as expected, even though there has been a steady growth in the assets under management (AUM). As of March 2016, the AUM was ₹6,346 crore, which increased to ₹22,737 crore in March 2023. As a proportion of total AUM for mutual funds, the ratio remained virtually unchanged at 0.5 per cent.

Gold ETFs carry the same advantages of SGBs without the fixed interest of 2.5 per cent. Though gold ETFs are managed by mutual fund houses, they have not been a preferred avenue of investment. Therefore, the financial alternatives have not quite matched the appeal of physical holding of gold.

It must be noted that there is already a vibrant futures market for gold derivatives on MCX. Hence those who are in the market as traders are already doing so in the futures market with the option of taking delivery, though is not preferred in practice. SEBI has also brought in the concept of electronic gold receipts (EGRs) which is an electronic version of spot trading where gold can be dematerialised by placing in an accredited vault. Trading will be in demat mode, just like shares, with the option to convert to the physical mode anytime by exchanging the EGR.

The government has made several attempts to wean away people from physical gold to financial instruments that give the same benefits as the former. In fact, it could be a more efficient and safe way of holding gold. Yet, the progress has not been good except for the derivative segment on MCX which is admittedly more for trading.

Here it is necessary to identify the buyer of gold from the perspective of being a saver or investor. An investor would find financial instruments including SGB attractive. But at the household level, gold is held more as a form of saving, in which case the financial options are not really an option.

Also, in conventional Indian weddings, it’s common to see brides decked in gold jewellery. Getting families to accept EGR/SGB as an equivalent seems far-fetched for now.

The writer is Chief Economist, Bank of Baroda. Views are personal

.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.