An opportunity to transit from a developing to a developed economy comes once in a while. India is poised for such a transition in the next three decades. Debate has started on how quickly this would materialise. The year 2047-48 — the 100th year of India’s independence — is the earliest this transition is likely to be achieved. Would it be feasible within the stipulated time? If so, under what conditions?

Most developed countries today have been the biggest beneficiaries of the industrial revolution due to appropriate public policies pursued by them. They posted persistently high GDP growth before becoming developed countries. Japan for example grew more than 9 per cent almost for two decades from 1954 to 1973 due to input (both labour and capital) and total factor productivity (TFP) growth. South Korea registered a compound average growth rate (CAGR) of 17.9 per cent during 1966-1990. China, which is still not a high-income country, witnessed a CAGR of 10.9 per cent from 1983 to 2007.

In the 21st century, double-digit growth is probably not feasible on a medium-term basis for several reasons. First, global headwinds are strong due to deglobalisation, which limits the external sector’s contribution to GDP growth. Second, the prevalent geo-political conflicts prevent the free flow of factors of production across the countries. This limits the extent of foreign savings supplementing domestic savings.

Third, financial instability, which disrupts growth, is more frequent now than ever before as the underlying reasons are typically beyond the control of individual countries. Fourth, climate-related environmental problems are intricate and must be addressed upfront for sustainable development.

Potential growth

India’s potential growth is roughly around 7 per cent, which might have been dented due to Covid-related growth disruption since 2019-20. However, India achieved a high CAGR of 7.7 per cent from 2003-04 to 2007-08 with the external sector contributing significantly due to global tailwind.

The domestic growth driver during this period was mostly high investment as proportion to GDP, averaging 35.6 per cent. It may be difficult to raise the gross capital formation to a historic high of about 39.5 per cent of GDP as people now prefer to consume more than save.

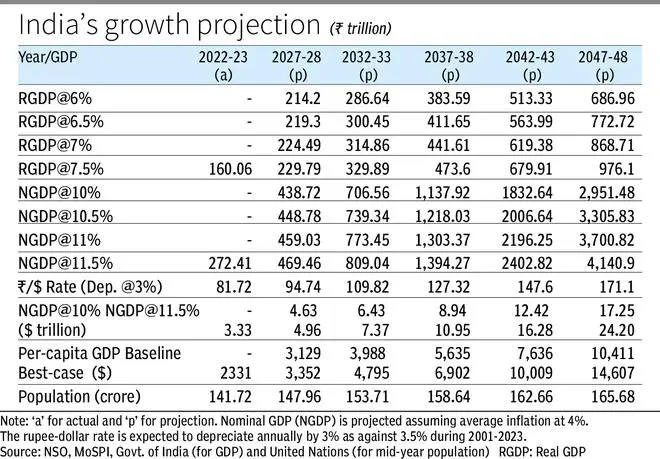

In the worst-case scenario, India may witness 6-6.5 per cent GDP growth in the medium term. In the best-case scenario, India’s CAGR may improve to 7-7.5 per cent in the next three decades. Assuming an average inflation of 4 per cent, the nominal GDP growth may vary between 10 and 11.5 per cent.

The rupee-dollar exchange rate on average depreciated by 3.5 per cent annually from 2001 to 2023. With high growth potential, expected low inflation and investor-friendly public policy, one would expect India to remain a preferred destination for foreign capital.

Therefore, the rupee-dollar rate may, on average, depreciate at a somewhat lower rate, say 3 per cent annually in the next three decades. With these assumptions, in the best-case scenario, India shall be a $5-trillion economy by FY28, $11-trillion by FY38, and $24-trillion by FY48 (see Table).

According to the United Nations, India will remain the most populous country in the world, at least for the next three decades, although annual population growth may gradually decline from 0.8 per cent now to 0.3 per cent in FY48. For the most populous country like India, it is difficult to meet the minimum criteria to be considered as a developed/high-income country in terms of per capita GDP.

Per capita path

According to the World Bank, a country is considered high-income if its per capita income is $13,205 or more in 2022-23. A high-income country’s minimum per capita income would be at least $21,000 by FY48 if it grows by 2 per cent annually.

In FY23, India’s per capita GDP was below $2,500 (see Table), which may reach $10,000 by FY43 and $14,600 in FY48 in the best-case scenario. Going by the current trend, it would not be possible for India by FY48 to achieve the required level of per capita income, needed for a developed country.

If India’s real GDP grows by 8.5 per cent (nominal GDP by 12.5 per cent) and the rupee depreciates by 2.5 per cent, instead of 3 per cent annually, India’s per capita GDP may be around $20,600 in FY48.

An additional one percentage point of real GDP growth may hopefully come from productivity improvement — both labour and capital and TFP. The productivity growth would also help prevent, at least partly, the annual rupee depreciation to around 2.5 per cent. The challenges are many and daunting.

Notable among them are energy transition, reduction of inequality to sustain high mass consumption, formalisation/industrialisation of the economy to absorb a growing workforce, adoption of technology, quality education, better public health etc.

Efforts made so far are not adequate to reach the target. India needs visionary leadership for the next three decades to convert these challenges into opportunities.

The writer is currently RBI Chair Professor at Utkal University and former Principal Adviser and Head of the Monetary Policy Department, RBI. The views are personal.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.