There is a stark difference between the treatment meted out to foreign investors in equity and debt market in India. FPIs have been rolled out the red carpet in equity markets with investment limits being pushed higher over the years. They currently own one-fifth of Indian stocks and almost 40 per cent of the free-float market cap.

But it is quite different in the Indian bonds market, where regulators have continued to be quite wary about allowing foreign investors a free run. The caution has stemmed from the fear that allowing hot money to run amok in government bond market could cause volatility in government bond yields, which in turn can disrupt the economy.

The RBI has been quite explicit that it does not want G-sec yields to be entirely controlled by market forces. In October 2020, when the central bank was waging a war with ‘bond market vigilantes’, the Governor, Shaktikanta Das had stated that “financial market stability and the orderly evolution of the yield curve are public goods and both market participants and the RBI have a shared responsibility in this regard.”

It is this stance which is creating a stalemate in sovereign bond market. On one hand we need foreign investment into G-secs to create demand for Indian securities and to keep yields under check. But foreign investors prefer a market where yields are determined by the market.

Allowing market forces to dictate yields can bring more foreign investments in to the Indian market and this higher demand can help control sovereign yields.Is it time for a reset in the stance towards allowing greater FPI ownership and participation in government securities market?

A closed market

The issue of lack of liquidity and active participants in the government securities market has been discussed often in the recent past.

This is because the market for central government securities in India is a rather closed one. Of the ₹87 lakh crore securities outstanding as on June 2022, the largest portion, 38 per cent, is held by commercial banks as part of their statutory requirement. Insurance companies are the next largest holders with 26 per cent, followed by RBI which holds 16 per cent of the securities. Not too much churn or liquidity is likely to be provided by these holders.

Mutual funds own a relatively smaller share of 2.32 per cent and foreign portfolio investors own just 1.43 per cent, as of now. Others including retail and corporate investors own 6.30 per cent.

The only way in which demand for G-secs can get an immediate boost is through encouraging more foreign portfolio investors into Indian bond market. The RBI has been making several regulatory changes in recent times to attract higher foreign investor flows into the G-sec market. But FPI holding has been going down consistently over the last few years.

Why FPIs are not interested

The central bank allows foreign investors to hold up to 6 per cent of the outstanding paper of government securities. But their holding as of June 2022 was just ₹1,25,624 crore, which amounts to 1.43 per cent of the outstanding paper.

Also, FPIs have been net sellers in Indian government bonds for a while now. They net sold Indian debt of over ₹40,000 crore between 2018-19 and 2020-21. While they net purchased bonds worth ₹1,628 crore in FY22, they have once again turned net sellers in FY23, pulling out ₹8,225 crore so far this fiscal year.

The negative stance of FPIs towards Indian bonds could be due to various factors including the large fiscal deficit that has resulted in increasing outstanding government bonds from ₹64.8 lakh crore in March 2020 to ₹87.8 lakh crore in June 2022.

The figure is set to increase further as the market borrowing continues in the coming months. The weakness in the rupee due to expanding trade deficit is another reason as the returns on bonds erode due to currency depreciation.

India versus the rest

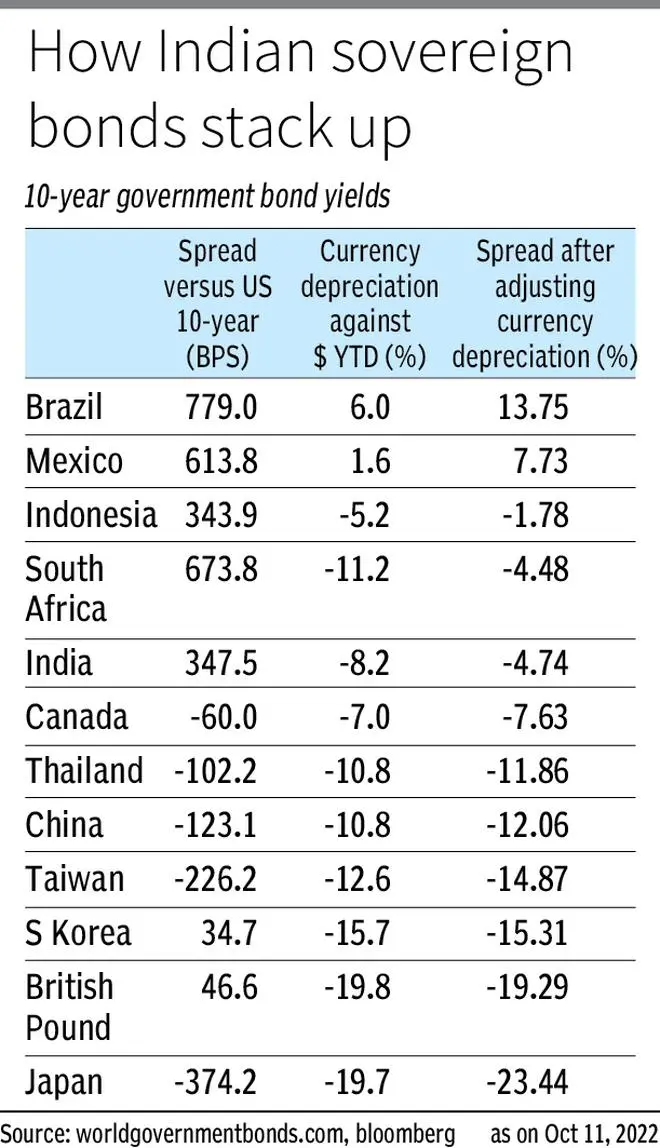

It can be argued that most emerging market currencies are in the same boat as the rupee. If we see the change in 10-year sovereign bond yields of a few peers (see table), most other countries have seen a sharp spike in yield over the last one year. Countries such as South Korea and Mexico have seen over 160 basis points increase in 10-year bond yield in the past year. The 108 bps increase in Indian G-sec yield is milder in comparison.

In terms of currency depreciation too India scores better than other EMs with year-to-date loss of just 8 per cent against the dollar while countries such as China, South Africa, South Korea are sporting double-digit losses.

The problem is that the US treasury yield has also been spiking and currently stands close to 4 per cent. Besides that, the dollar index has appreciated 17.6 per cent this calendar. The yield adjusted for currency movement for the US is therefore very attractive making global fixed income flows move away from EM economies towards the US.

Luring foreign investors

The above analysis shows that performance of Indian bonds are not too bad compared with their peers. Then why are FPIs turning away from Indian sovereign bonds and why is FPI holding at just 1.43 per cent while it is relatively high, between 20 and 45 per cent, in many emerging economies such as Indonesia, South Africa, Mexico and Brazil.

There is a strong case for inviting more foreign investors in to Indian bonds as discussed above.

Lessons can be drawn from our experience with FPIs in equity markets. Despite trepidations regarding large equity outflows from stocks impacting rupee, regulators went ahead and bit the bullet. Yes, there have been large outflows from equity and rupee has skidded due to these flows, but the market has survived and emerged stronger after each of these episodes.

It is probably time bond market followed their equity counterpart.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.