Recent discussions on economic policy in the US and other high-income nations make it appear that there is only one domain and one instrument that really matter: monetary policy and interest rates.

Whether on the eve of meetings of the US Fed’s monetary policy committee, or in the interregnum between meetings, economic policy discussions largely focus on whether the Fed would begin cutting rates; whether the expectations of “the markets” on the likelihood of those cuts and their magnitude will be met; and whether investors have “factored” in the likelihood that those cuts would or would not occur.

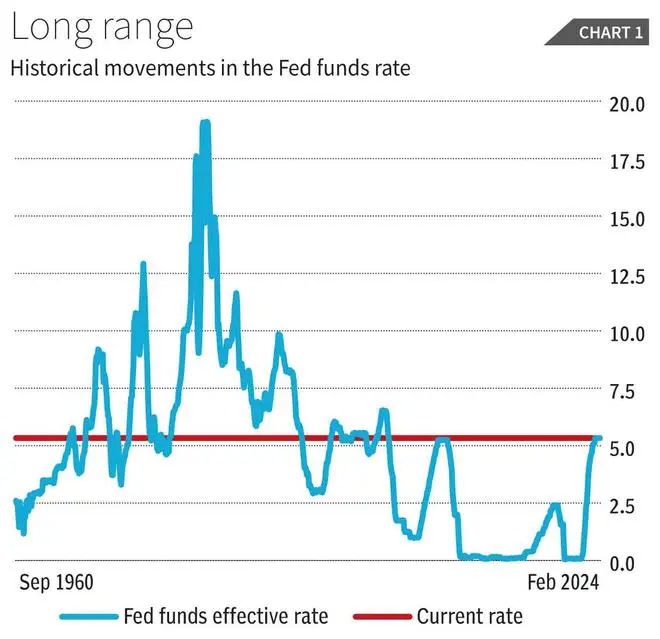

It is indeed true that the effective Fed Funds Rate has risen from a low of less than a tenth of a percentage point in early February 2022 to levels above 5 per cent over the 15 months ending May 2023 and currently stand at around 5.3 per cent (Chart 1).

But that spike has not taken interest rates anywhere close to peak levels seen over the last three decades.

In fact, taking a long historical view the current rate does not appear to be significantly inflated. Rather, what appear to be historically exceptional are the near zero rates that prevailed for a long period starting after the 2008 financial crisis (Chart 1).

Much-needed correction

Given that, the decision to raise interest rates from the exceptional, historic lows necessitated by the worst crisis since the Great Depression should be seen as nothing more than a much-needed correction.

In fact, well before the rate hikes began, organisations like the Bank for International Settlements had been flagging the need to move away from the “unconventional monetary policies” adopted after the crisis. As the recovery, however weak and uneven began, a retreat from such policies was seen as inevitable.

In addition, within the framework of a neoliberal policy regime, fiscal policy is subordinated to monetary policy, and monetary policy in turn, is expected to prioritise “inflation targeting”. That objective involves the adjustment of interest rates upwards whenever inflation is on the rise, with no reference to the factors underlying inflation and the impact of interest rate levels on those factors.

Since the period after the pandemic saw inflation rates rise above “target” levels and generated fear that inflation would not be transient, an increase in interest rates was the likely outcome. This should have been expected especially by “the markets” that believe in, advocate and benefit from, neoliberal policies.

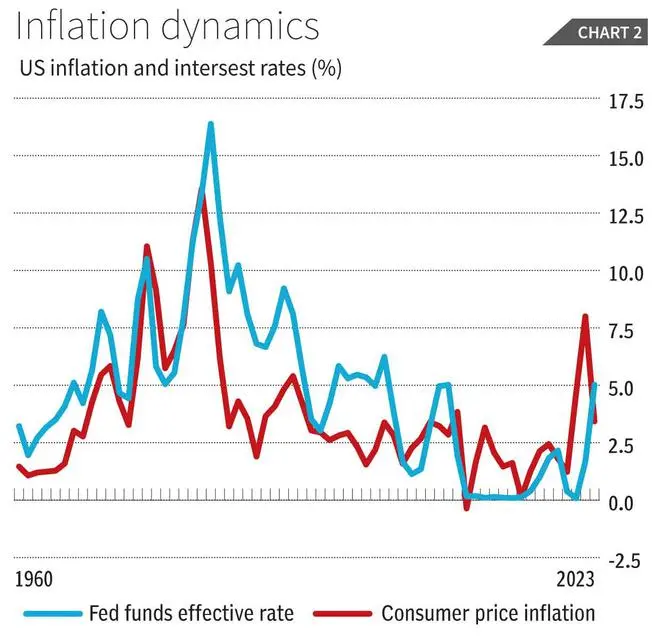

In practice, inflation and interest rates have tracked each other, probably because interest rate changes followed inflation, rather than the other way around (Chart 2).

These are not the only reasons why the fuss over interest rates and the Fed’s actions is intriguing. One claim is that high interest rates would slow growth by dampening demand. While this is likely to be generally true of debt financed housing, investment and consumption spending, the responsiveness of corporate investment to higher interest rates is likely to be the weakest.

Moreover, what happens to growth depends on a whole host of other factors, including government spending changes and the depletion of savings accumulated during the pandemic, for example.

Growth spike

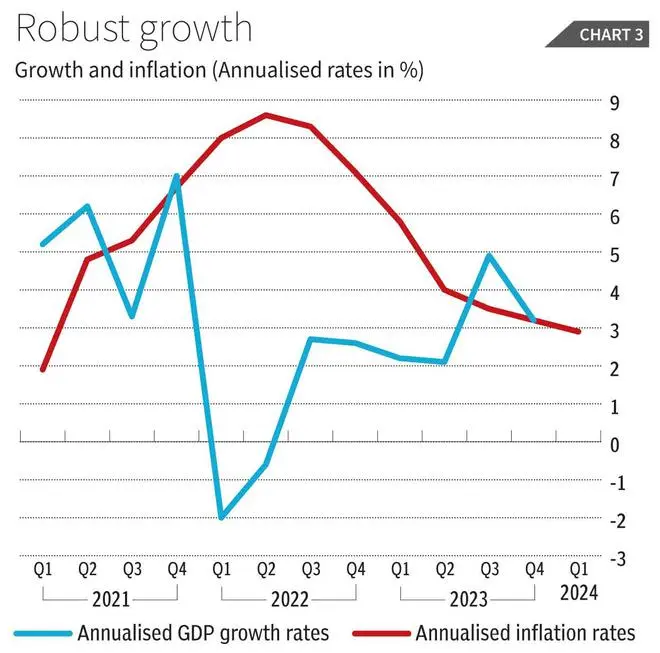

In practice, the recent period when interest rates rose has not been one of slowing growth, at least in the US, as Chart 3 illustrates.

Since the second quarter of 2022, while the rate of inflation has fallen, the rate of growth rose and has been at reasonable levels. Even if the decline in inflation is attributed to the hike in interest rates, which is questionable, that action has not had damaging effects on growth.

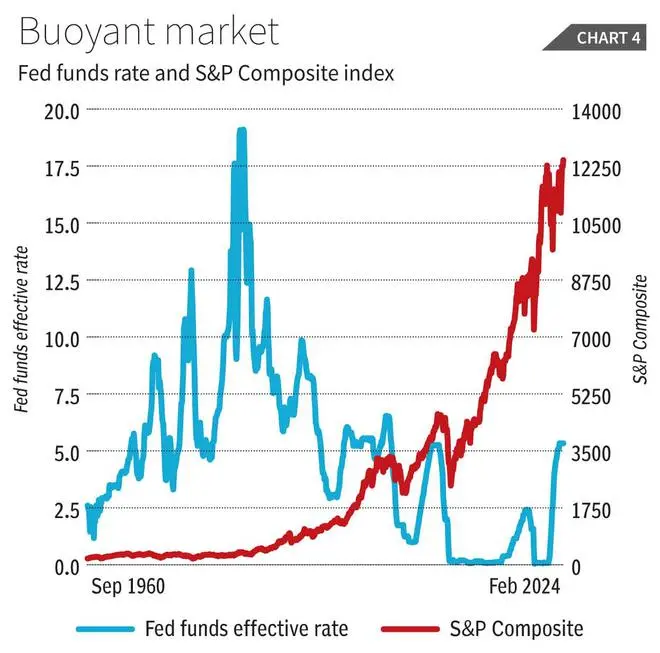

The campaign against higher interest rates is intriguing also because, not all players in capitalism’s many markets are losers from high interest rates. Specifically, equity markets should in principle benefit, as investors pull out of low yielding bonds and allocate more to equity investments.

That effect, however, would be counteracted by any withdrawal of speculative investors from markets following the rise in interest rates. Those investors tend to borrow cheap and buy into equity, driving up equity prices.

There were fears that they may pull out as the cost of capital rises. Interestingly, even this has not happened. As Chart 4 shows, the S&P Composite Index did not reverse its long term rise and remained at record highs, even as interest rates rose.

But the real twist to the story has been the developments in bond markets. Passive bond investors benefit from increases in interest rates, earning higher yields on new investments they make, while not losing capital on the bonds held to maturity.

Banks too normally benefit from higher interest rates, because of the larger spread between what they pay their depositors and what they charge those they lend to. Low interest rates on the other hand adversely impact bank profits.

Banks take a hit

However, this time around, many banks seem to have been damaged by higher interest rates. These are institutions that sought to divert a significant part of the short-term deposits they hold to bond investments, which appeared secure while promising a small return. Since they hardly paid their depositors anything, they earned an adequate spread on these investments without much risk exposure.

If they needed to dispose of their bond holdings when their own short-term debt fell due, they expected to be able to do so without loss because of expectations of stable (and relatively low) bond yields. This was the investment strategy adopted by many banks during the low growth years of the Great Recession.

But when interest rates rose and bond prices fell, they found themselves faced with potential or real losses that forced many medium sized banks to close or sell out to competitors on humiliating terms. If there is any set of players that needed to be upset with the Fed’s actions it was this group, that had made wrong investment decisions. The others seemed to have survived or even done well during the period of rising interest rates.

By contrast, the damage has been much greater outside the US. The balance of payments stressed less developed countries that had accumulated large volumes of dollar-denominated debt with yields linked to benchmark US interest rates have been badly hit.

Some of them have even been forced to default in debt servicing and accept severe austerity as the price for restructuring debt by creditors.

Unfortunately, their situation barely enters the discussions on macroeconomic policy in the high income countries.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.