The sixteenth edition of the Global Innovation Index, GII 2023, released recently, identifies India as the topmost innovation out-performer, given its level of economic development.

But while India has improved its position in the innovation output subindex from 39 in the previous year to 35, its position in the input subindex (institutional facilitators such as infrastructure, markets and human capital among others) has fallen from 42 to 46. As a result, India continues to remain at 40th position in the GII 2023, whereas it had climbed 6 positions in GII 2022.

This fall in the input subindex provides some key messages for the policymakers and industry in India.

In the R&D input sub-pillar, India’s position declined from 26 in 2022 to 32 in 2023 due to a fall in the R&D-GDP ratio from 0.7 per cent to 0.6 per cent. This despite the government efforts to raise it to above 2 per cent.

The corporate sector’s low R&D spending is the major reason for India lagging behind its peers in R&D-GDP ratio.

But there are issues regarding India’s R&D statistics. Improving the quality of R&D statistics will help in well-informed policymaking.

Tata’s journey

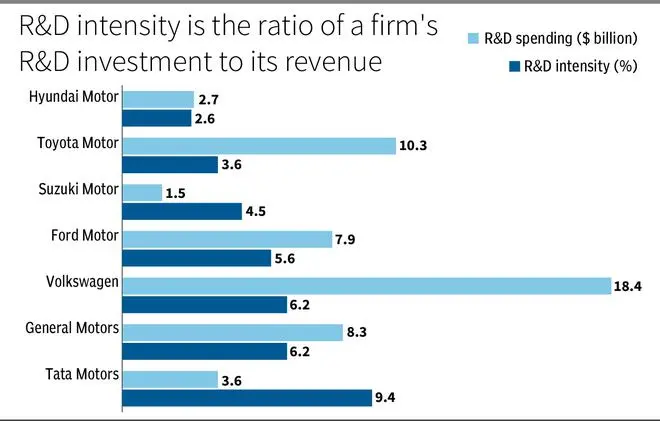

Out of the 112 firms listed by the GII report, the only firm from India is Tata Motors. The EU Industrial R&D Scoreboard of 2022 shows that Tata Motors has become the most R&D intensive automotive firm globally. The Scoreboard provides the details of globally leading 2,500 R&D performing firms, across sectors.

Tata Motors is more R&D intensive (percentage of R&D spending to sales) than global leaders such as Volkswagen and Toyota Motor and it has overtaken Hyundai Motor and Suzuki Motor in the quantum of R&D spending. What does the experience of Tata Motors on the R&D front tell us?

Ratan Tata’s move to enter into passenger vehicles and allocate resources for R&D for development of cars despite the resistance from a section of the shareholders needs to be acknowledged. Nano was a disruptive innovation, although it could not make an impact in the market.

The Tata group also made it to the sixth position in Boston Consultancy Group’s list of Most Innovative Companies in the World in 2008, just behind Apple, Google, Toyota, General Motors and Microsoft.

While acquiring the innovation capabilities, Tata Motors ventured into outward FDI, both in greenfield and brownfield, to establish a network of R&D centres to tap into global excellence in engineering, design and emerging technologies such as connected cars and electric vehicles.

The UK-based Tata Motors European Technical Centre Plc and Italy based Trilix Srl played a part in the development of Nano and the highly successful Nexon. The policy discussions in India on the enhancement of the innovation capability, however, do not find any mention of the potential role that outward FDI could play.

The other key message for India is to address the deep digital divide in India. India’s rank in the infrastructure input subindex has slipped from 78 to 84. In the information and communication technologies (ICT) subindices, India’s rank is extremely low.

It ranks 101 in ICT access and 103 in ICT use.Some reports say that a sizeable proportion of the Indian population does not own a phone and feature phones still account for 30 per cent of the mobile phone market share. The Digital India programme has some way to go.

The writer is an Associate Professor at Institute for Studies in Industrial Development, New Delhi

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.