The BSE Power Index lost about 60 per cent of its value during 2008-2020 (pre-Covid), on account of issues such as overzealous bidding for projects, subdued power demand growth, lack of fuel supplies and deteriorating financial health of distribution companies. However, since April 2020, BSE Power Index has been among the top gainers, moving up close to 200 per cent, outperforming BSE Sensex by around 84 per cent during the period. Rising power demand, favourable policies and increased capex planned for renewable energy (RE) have led to renewed investor interest in the power sector, post-Covid.

With the government announcing targets of reaching close to 500 GW of installed capacity from RE sources by 2030, power generation companies are looking to install RE-based capacities. To connect the generation capacities to the central grid, significant investments will be required in building the related transmission evacuation system. In the light of this, power advisory body Central Electricity Authority (CEA) has identified an incremental investment of close to ₹2.4 lakh crore in the inter-state transmission system (ISTS).

Here’s how the upcoming estimated capex can have a positive impact on the listed companies in the power transmission value chain.

Spillover effect on transmission developers

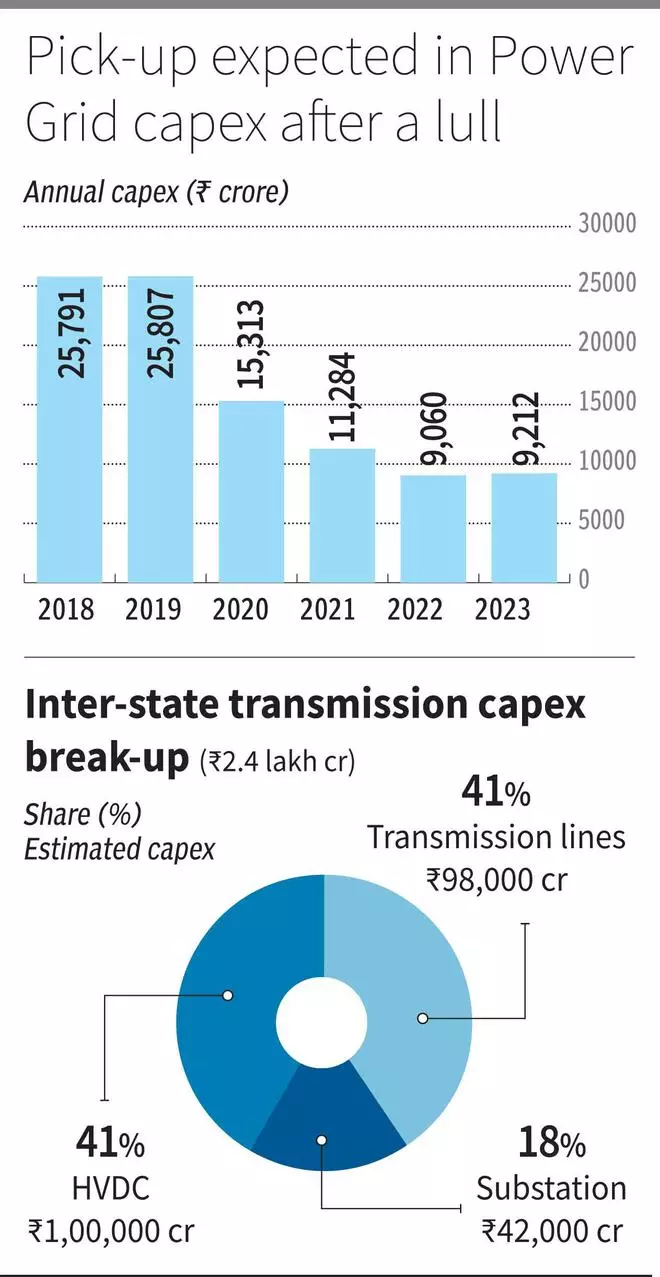

The capital expenditure of Power Grid Corporation (PGCIL) has been considered as the barometer of the country’s transmission capex. The annual capex made by PGCIL gradually increased to ₹25,800 crore in FY2018 from the level of ₹12,100 crore in FY11. It was driven by the addition in thermal-based generation capacities. However, the annual capex has gradually fallen over the last five years, to ₹9,212 crore in FY23, due to the fact that majority of the planned inter-regional transmission capacity relating to thermal has been completed.

During this time, various engineering, procurement and construction (EPC) companies, such as KEC International and Kalpataru Projects International — which were seen as proxy plays on PGCIL’s capex — started diversifying both segment-wise and geography-wise, as opportunities in the space reduced.

Things are expected to change with the upcoming ₹2 lakh crore of capex estimated to be done till 2030 (adjusting for capex done during Q4FY23). To begin with, while the PGCIL management hasn’t given out a specific number, it has indicated that the annual capex can reach substantially higher than ₹11,000 crore by FY25 or FY26. Peak power demand has been hitting all-time high levels of 216-223 GW during April-June 2023. Hence, as per an April 2023 Nuvama report (Transmission & Railways: Decadal Thrust), it will be necessary to add generation capacity to the tune of atleast 400 GW by 2028-30 and subsequent investments in transmission capacity to avoid power deficit situation by then.

Transmission companies primarily earn availability-based revenue pursuant to long-term (35-year) transmission serviceagreements (TSAs). Till 2011, the inter-state transmission projects were awarded on the basis of regulated tariff mechanism (RTM) and a majority of the awards went to to PGCIL. On such projects, tariff earned is cost-plus based — which ensures recovery of all costs and a return of around 15.5 per cent subject to ensuring costs and technical availability (typically 95-98 per cent) within the normative parameters.

However, post that, tariff-based competitive bidding (TBCB) for all inter-state transmission lines was made mandatory (except for certain critical projects, which shall continue to be alloted to PGCIL under RTM basis), which has led to rising competition in the sector. Under TBCB scheme, tariffs for projects are not set on a cost-plus basis but, rather, bidders are required to quote for tariffs over a period of 35 years. While more than 90 per cent of TBCB bids till now have together been won by PGCIL (40 per cent), Sterlite Power (29 per cent) and Adani Transmission (23 per cent), other players like Tata Power, ReNew Power and GR Infra have also participated in the bids.

PGCIL and Adani Transmission are players who have power transmission as their core business and they can benefit from the upbeat capex plans. Other companies such as Kalpataru Power and Techno Electric participate in bids for BOOT projects wherein they manage the transmission assets for a certain period of time and hive them off later. Further, certain players undertake monetisation of seasoned transmission assets as it can help them finance new transmission infrastructure, by bringing in much-needed capital. Power Grid InvIT and IndiGrid are the two listed InviTs sponsored by PGCIL and Sterlite Power, respectively.

Benefits for EPC and equipment players

Along with the power transmission developers, such uptick in investments can benefit the transmission lines and towers engineering, procurement and construction (EPC) companies and power equipment manufacturers. Typically, a transmission system consists of transmission line package (including conductors, towers and insulators) and substation package (including power transformers, switchgears, circuit-breakers, reactors and other components).

The CEA transmission plan estimates an addition of around 51,000 ckm (in the alternate current) of transmission lines in the ISTS space, implying an absolute growth of around 30 per cent over the next seven years (JP Morgan report). With this, of the CEA estimated capex of around ₹2.4 lakh crore, around ₹98,000 crore (41 per cent) shall be spent on the transmission lines capacity addition, as per the Nuvama report. Some of the key EPC-based players in the space are KEC International, Kalpataru Projects International, L&T (small portion of revenue) and Tata Projects (unlisted). KEC International, which still garners a significant portion of its revenue (42 per cent) from the domestic T&D segment, remains a primary beneficiary of capex in the segment.

About ₹42,000 crore (17 per cent) of investments are expected to be made in alternate current-based substations. As per a February 2023 JP Morgan report (Growth optionality with stable return), the existing sub-stations can absorb an additional 33.7GW. Thus, new substation capex is required for evacuating 294GW of RE power, which is equivalent to 433,575 MVA. The current capacity is 459,826 MVA, implying doubling of substation capacity in the next seven years.

Transformer is the most critical part of the substation which helps in stepping up or stepping down the voltage levels. For the transmission space, typically, power transformers with more than 66 kv (kilo volt) are required and are used for stepping up voltage levels. Transformers and Rectifiers India, Bharat Bijlee and Voltamp Transformers are pure-play transformer players in the listed space while Siemens Ltd, Hitachi Energy India, GE T&D, ABB India, CG Power and Techno Electric & Engineering Co typically provide comprehensive substation packages. However, given that investments are majorly coming in the 400-800 kv range, players such as ABB India, Voltamp Transformers and Bharat Bijlee may not enjoy opportunities in the ISTS space as they have capacities based in lower voltages.

While the above-mentioned investments are happening in the regular alternate current (AC) space, India also plans to add four large high-voltage direct current (HVDC) transmission corridors having a potential investment of about ₹1-lakh crore (42 per cent of CEA estimated ₹2.4-lakh crore). For transmission projects involving distances longer than, say, 350 km, HVDC can be an optimal solution on account of its cost efficiency compared to the regular HVAC-based transmission. For instance, as per CEA, about 1,100 km of HVDC lines is planned to be laid between Barmer and Jabalpur. Hitachi Energy, GE T&D and Siemens are broadly present in the equipment part (substation package) of these projects, which accounts for 50-60 per cent of estimated HVDC capex (₹1-lakh crore) i.e. ₹50,000-60,000 crore as per the management of these companies.

How financials and valuation stack up

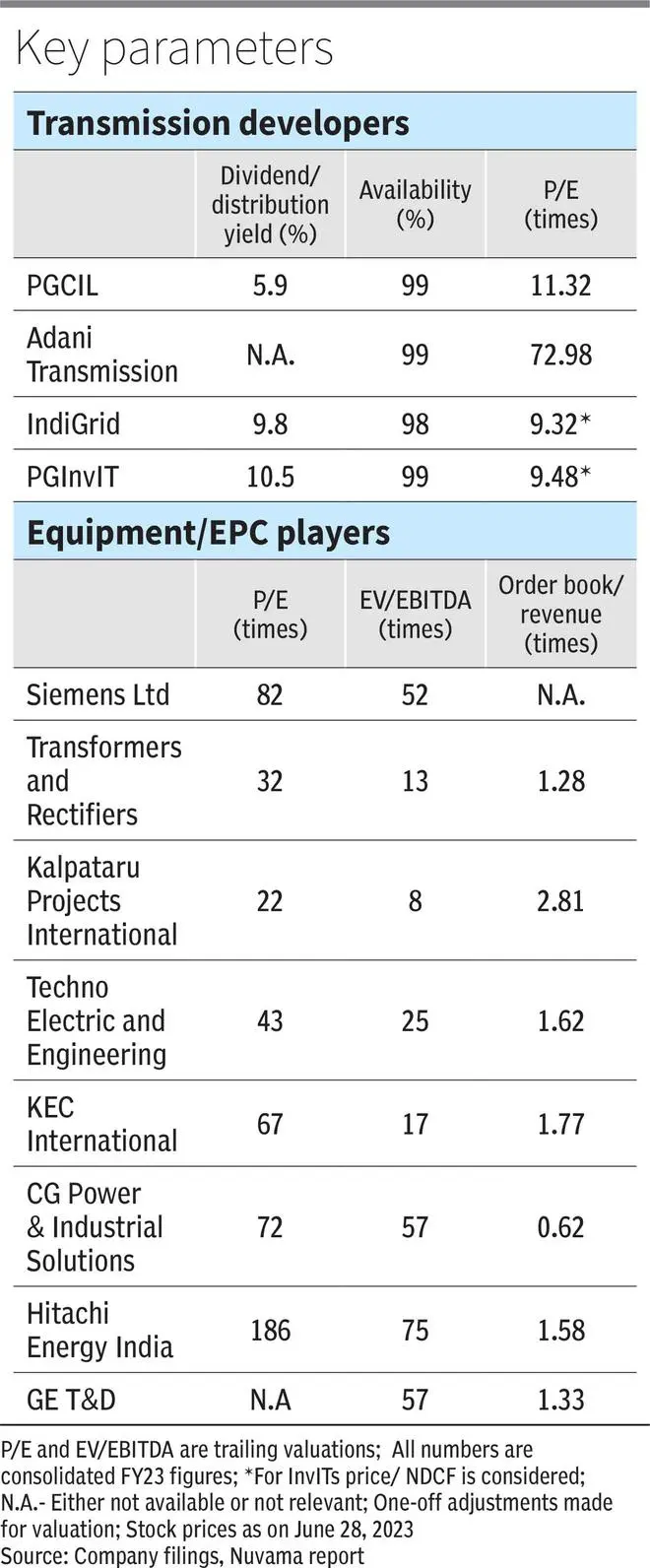

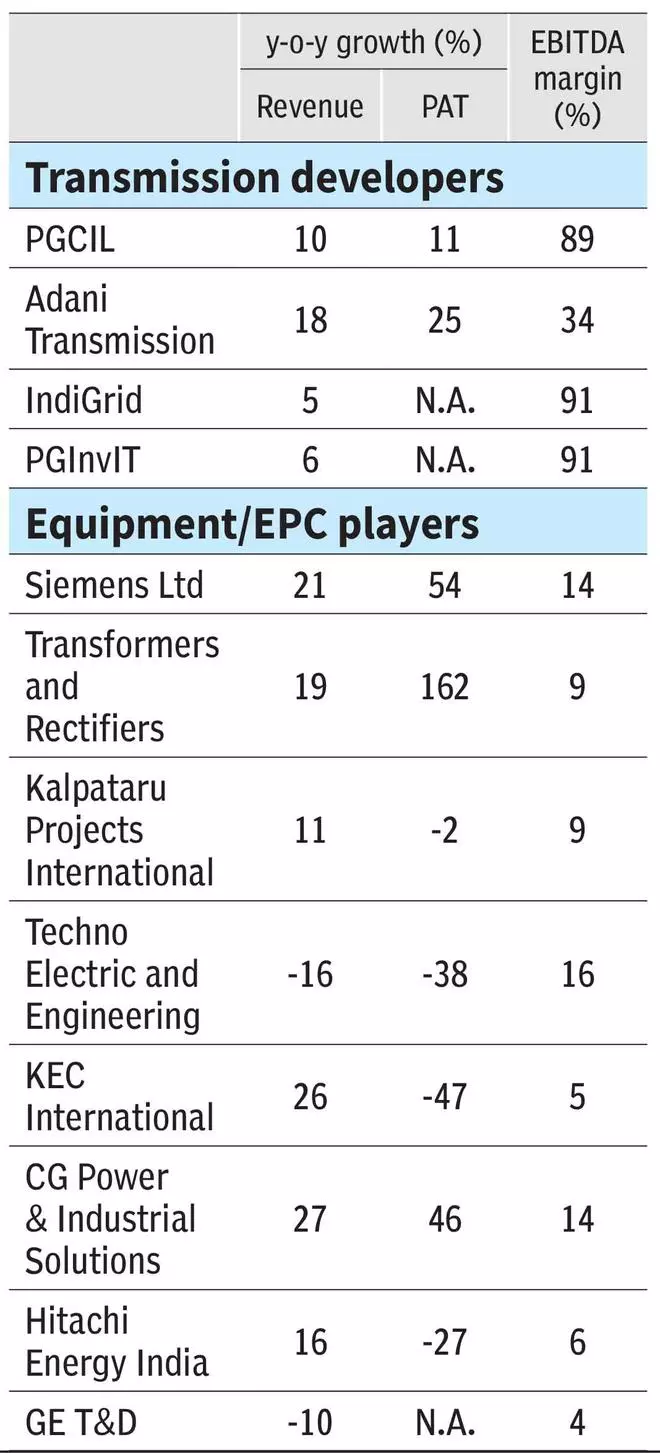

Despite TBCB coming in, risk-return profile of power transmission projects still remains favourable for the developers as the returns are only 100-150 basis points (bps) less than the RTM-based projects (JP Morgan report). PGCIL earns about 95 per cent of its revenues from the RTM projects, providing stability to the company’s EBITDA margins at about 87 per cent level. Post a decadal high double-digit growth, revenue CAGR moderated to around 5.4 per cent during FY2019-22 due to fewer opportunities.

However, double-digit growth might be seen, going forward, with increasing capex. Its listed peer, Adani Transmission, earns 30-40 per cent of its revenues from transmission business and has comparatively lower EBITDA margin due to the presence of distribution business. Post commissioning of an HVDC project, Adani Transmission shall be earning about 50 per cent of its transmission revenue from TBCB and rest from RTM. While PGCIL’s D/E is around 1.5 times, Adani’s is higher at 2.7 times.

Both power transmission EPC companies KEC International and Kalpataru Projects International are enjoying all-time high order book at ₹30,553 crore and ₹ 25,241 crore, led by strong YoY growth in order inflows to the tune of 29 per cent and 39 per cent respectively, in FY23. Domestic transmission orders account for around 40 per cent of KEC’s order book, making it a play on domestic transmission capex. For Kalpataru, it is just 6 per cent on account of significant diversification. However, as per Kalpataru’s management, the company may go for domestic orders, provided a favourable risk return profile is present. KEC’s EBITDA margin has taken a beating in recent times, reaching about 5 per cent against Kalpataru’s 9 per cent on account of execution of its legacy SAE Towers’ (Brazil) fixed price orders issues. However, margins are expected to recover in the coming year.

In this context, note that for certain EPC players and equipment manufacturers, margins have been susceptible to volatility in input costs. While copper and aluminium can largely be hedged through derivatives, companies find it difficult to hedge movement in steel prices in case of fixed price contracts.

On account of capex cycle revival, power equipment stocks have seen a re-rating in the last one year. The power transmission equipment (substation and tranformers) space remains highly competitive with the presence of various large Indian-based companies and Indian subsidiaries of MNCs. On account of strong technology support from MNC parent, Siemens Ltd and Hitachi Energy India trade at a significant premium than Indian counterparts such as Transformers and Recitifiers and Techno Electric and Engineering.

GE T&D has not been in a good position on account of losses due to surge in input prices, given fixed price nature of contracts and delay in TBCB ordering. Absence of any major HVDC order, resulting in decadal-low order book, is also another reason. Hitachi Energy has also faced such issues but it has started diversifying into other segments like railways and has witnessed significant jump (85 per cent) in its order inflows in FY23. The upcoming HVDC orders can give significant boost to the revenues and margins of Hitachi and GE T&D.

Another player, CG Power, has seen a turnaround ever since it came under Murugappa group as the company has turned debt-free and has been generating EBITDA margins to the tune of 12-14 per cent. Siemens Ltd can be considered as the one best placed in the power equipment space among these players on account of its presence across various voltage classes. It is a debt-free company and generates EBITDA margin to the tune of 11-13 per cent.

Further, if investors want to take exposure to the transmission space in a less risky manner, Infrastructure Investment Trusts or InvITs can be a good alternative. Both IndiGrid and PGInvIT have steady cashflows owing to stable nature of business. At distribution guidance of about ₹13.8 and ₹12 per unit for FY24, both IndiGrid and PGInvIT respectively can provide investors an attractive pre-tax yield of around 10 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.