While Indian G-Secsʼ introduction into the JP Morgan GBI-EM indices could lead to copious inflows, the country’s fisc will be under sharper scrutiny. Here are four charts that give you more insights.

Flow chart

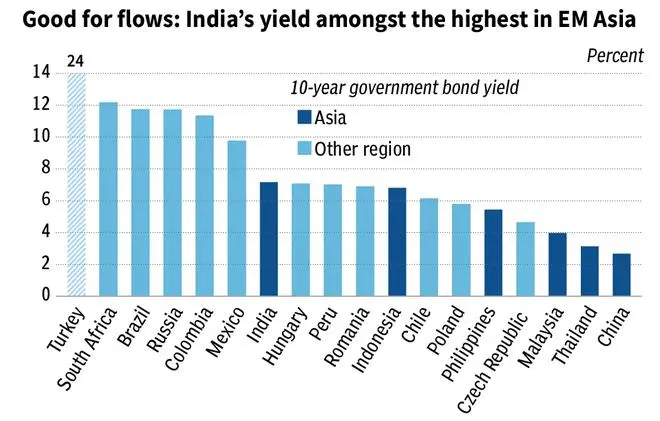

India’s forthcoming inclusion in the JPM GBI-EM Global Diversified Index effective June 28, 2024, is anticipated to result in substantial capital inflows. It is projected that passive inflows, attributed to a one-off stock adjustment, could reach approximately $30 billion during the scale-in period. Additionally, owing to India’s favorable yield and low volatility profile, it is conceivable that active investment could contribute an extra $10 billion, culminating in an aggregate potential influx of $40 billion into India’s fixed income markets over the ensuing eighteen months.

Given the preexisting establishment of numerous Emerging Market (EM) dedicated funds centered on India, these capital flows are expected to commence immediately as investors position themselves ahead of the impending inclusion in the index next year.

Foreign hand

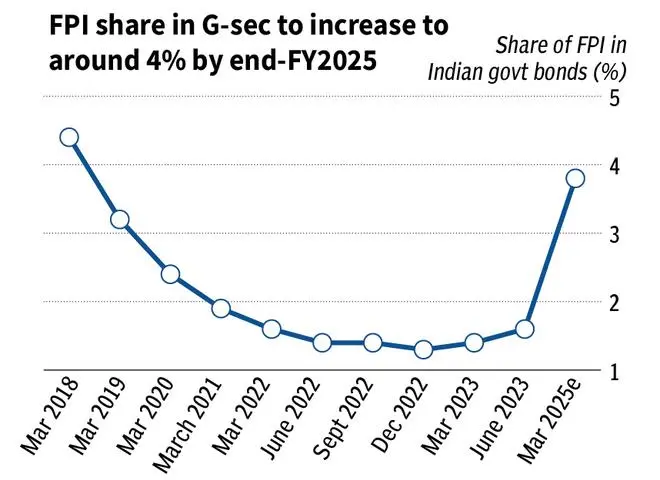

Inclusion in the index is restricted to Government of India bonds listed under the Fully Accessible Route (FAR) with maturities extending beyond December 2026. Presently, the total outstanding Government Securities (G-Secs) amount to $1.2 trillion, with eligible FAR bonds comprising approximately $330-335 billion.

These anticipated capital inflows are poised to elevate Foreign Portfolio Investor (FPI) holdings in G-Secs from their present levels to nearly 4 per cent by fiscal year 2025.

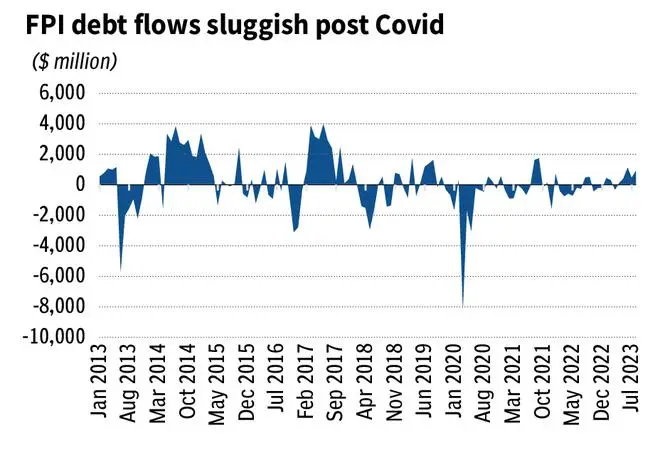

While FPI debt inflows were strong pre-covid, after the pandemic the trend has slowed.

Greater discipline needed

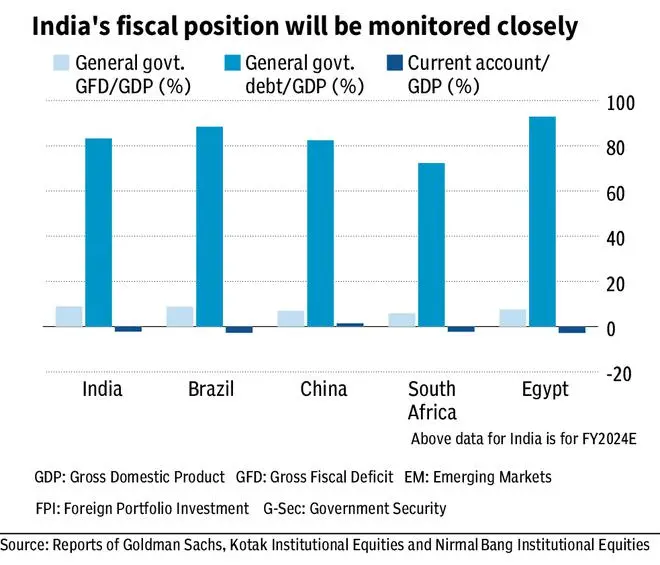

Moving beyond the initial excitement of bond inclusion, the incorporation into the index subjects India’s fiscal landscape to intensified scrutiny, where the quality of expenditure, the effectiveness of tax and revenue collection mechanisms, and commitment to the fiscal consolidation trajectory will be subjected to meticulous assessment. Notably, within the index constituents, India’s Gross Fiscal Deficit (GFD) as a percentage of Gross Domestic Product (GDP) and its government debt-to-GDP ratio stand notably elevated, warranting careful consideration.

The commitment of the central government to achieve a Gross Fiscal Deficit (GFD) as a percentage of Gross Domestic Product (GDP) target of approximately 4.5 per cent by fiscal year 2026 is a pivotal milestone that will be closely monitored. This objective will serve as a critical determinant for gauging the potential trajectory of expenditure growth and the level of tax buoyancy in the near to medium term.

While India’s inclusion in global bond indices offers notable opportunities, it is not devoid of risks. Passive capital flows resulting from index inclusion typically exhibit a lower susceptibility to rapid capital flight or “hot money” risks. Nevertheless, macroeconomic instability can lead to reduced weights within the index, potentially triggering outflows, and consequently, instigating volatility in the Indian Rupee (INR) exchange rate and yields, particularly during periods of vulnerability.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.