Investors with a two-to-three year investment horizon can consider accumulating, on dips, the stock of South-based diversified textile player KPR Mill Ltd. The company, primarily a vertically integrated textile player, also has interests in textile, sugar, wind power and retail (through its brand Faso), which helps mitigate seasonality and fluctuations in any particular segment. Capacity expansion projects across segments — sugar/ethanol, textiles — and good growth prospects should help the company’s strong growth in the near to medium term.

At the current price of ₹698, the stock trades 30 times its twelve-month trailing earnings. Though historically the stock has traded around the same levels on a price-earnings basis, policy measures for higher ethanol blending, alongside vertical integration in the textile/apparel division and scaling up of its retail business should hold the company in good stead and possibly lead to re-rating in the near term. Peer Welspun India, which is into home textile retail and exports, trades at PE of 37 times.

Three reasons

We believe the stock to be a good investment bet for three reasons.

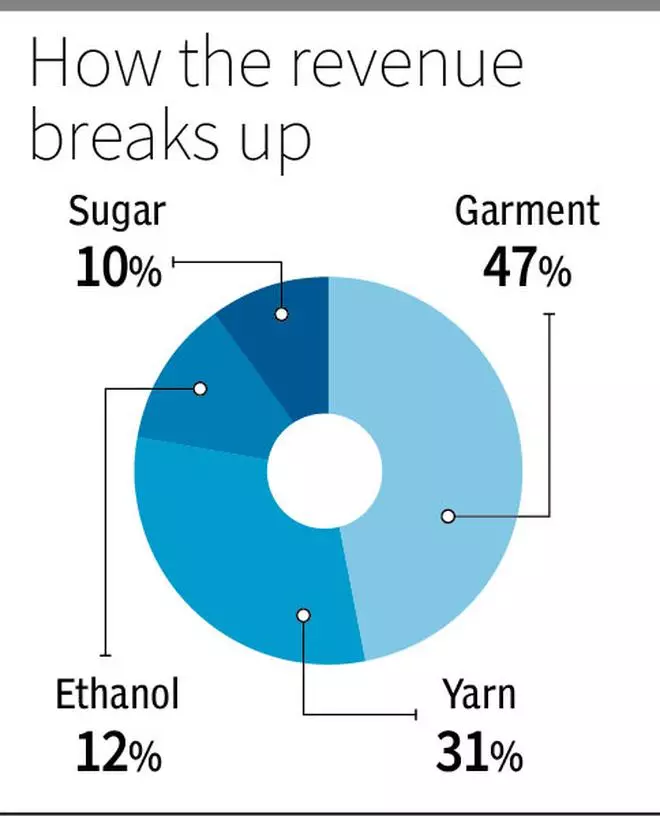

First, KPR Mill’s vertically integrated operations in the textile segment with focus on technology for cost optimisation will help even in times of volatility in raw material prices — cotton. With 6 spinning mills, the company has an annual yarn capacity of 1 lakh metric tonnes. The fabric unit capacity currently is at 40,000 tonnes per annum, while the total garment capacity at 115 million tonnes of garments makes the company one of the largest manufacturers of garments in the country.

The company is among the largest exporters of garments, catering to over 60 countries, with Europe and North America being its largest markets. Further, with the foray into retail through FASO brand, it will be able to capitalise on the entire value chain. Even amidst challenges such as cotton price volatility, import bans on cotton, demand softening in key markets such as Europe, the company is confident of sustaining growth in the apparel segment primarily on account of lean cost structure in the segment.

Its recent investment of ₹100 crore in the exclusive cortex spinning mill and processing and printing machine (₹50 crore) will add to revenue beginning FY24. Further, measures such as roof top solar plant (12 MW), in addition to existing co-Gen capacity of 90MW and wind power of 61.92 MW (which caters to 40 per cent of textile power requirement) will help reduce costs and improve operating performance, in the near to medium term.

Second, the company currently has a sugarcane crushing capacity of 20,000 tonnes per day in Karnataka and 360 KLPD ethanol capacity in Karnataka. KPR is investing ₹150 crore in augmenting ethanol production, which will increase the capacity to 500 KLPD resulting in a net additional ₹100 crore revenue annually. The government’s push for higher ethanol blending and a target of 20 per cent has brightened the prospects for Indian sugar/ethanol makers from a structural perspective.

While the ethanol pricing currently is still ad hoc and the industry has been clamouring for a favourable pricing policy, given that the government is keen to implement 20 per cent blending by 2025, we believe that the pricing regime will likely be in favour of ethanol producers. Expectation of better pricing is also bolstered by the fact that it is essential to attract additional investment in this space to meet government ethanol blending targets..

Third, good historical business/management track record, strong balance sheet and efficient capital management add to the attractiveness of the business. Despite the company investing over₹500 crore over the last few quarters, its net debt-equity ratio remains impressive at less than 0.17 times its shareholders’ funds, thanks to the strong operational cash generation and efficient working capital management.

As of June 2023 end, the company had cash of ₹366 crore and net debt of ₹655.9 crore in the books. Strong operating performance has also helped it sustain superior return ratios with return on capital employed of over 23 per cent.

In the April-June 2023 period, the company reported flat revenue growth of about 2 per cent to ₹1,584 crore, primarily on account of lower yarn realisation, which was largely mitigated by higher sugar and ethanol realisation. Lower cotton yarn spread during the quarter due to fall in yarn prices, coupled with slower than expected demand in Europe (accounting for 60 per cent of the exports), led to margin pressure. This will, however, stabilise over the next few quarters; further, better realisation for ethanol can help mitigate the weakness in the yarn segment. That said, the economic landscape in Europe as a market and cotton prices are key variables to keep a watch on.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.