It’s hard to miss the India growth narrative in the market sentiments. From expectations of fast-paced growth in per capita income, to the rise of new middle-class or in the form of demographic dividend, growth expectations are strong across. One way to tap into this broad opportunity is to consider investing in consumption-focussed mutual funds. From Automobiles to Consumer Non-durables, Healthcare to Hotels, Pharmaceuticals to Media & Entertainment, these funds invest in companies where the growing disposable income is most likely to end up. While the premise sounds promising, we evaluate if the fund returns or even the index returns have beaten the broader market conclusively.

Nifty 50 Vs Nifty Consumption

The main benchmark for the category is Nifty India Consumption’s total return index (TRI) NSECON. This index picks 30 stocks based on free-float market capitalisation of companies in the consumption sector in the Nifty-500 universe. Any company’s weight is capped at 10 per cent. As on January 31, 2023, FMCG/Auto/Consumer durables/Telecom accounted for 37.7/18.5/16.2/9.7 per cent by weight. In terms of performance, Nifty-50 TRI returns have bettered NSECON on three-year and five-year periods by 136 bps and 260 bps respectively on a CAGR basis. It’s only in the last one year that NSECON managed to generate better returns compared with the broader index by 230 bps. But with active management, some funds have outperformed Nifty-50 index as well (see below).

One reason for the underperformance of NSECON could be attributed to Covid, supply disruption, input cost inflation — all impacting consumption stocks in the last three years more than the impact on the broader index, which gains from such disruption in certain pockets such as metals, commodities and export sectors.

Most consumption stocks trade at higher valuations, again owing to the under-penetration of consumption in Indian markets. NSECON trades at 34 times one-year forward earnings compared with 21 times for Nifty-50. But in the last three years, this multiple increased 16 per cent for Nifty-50 compared with 10 per cent for NSECON.

Fund performance

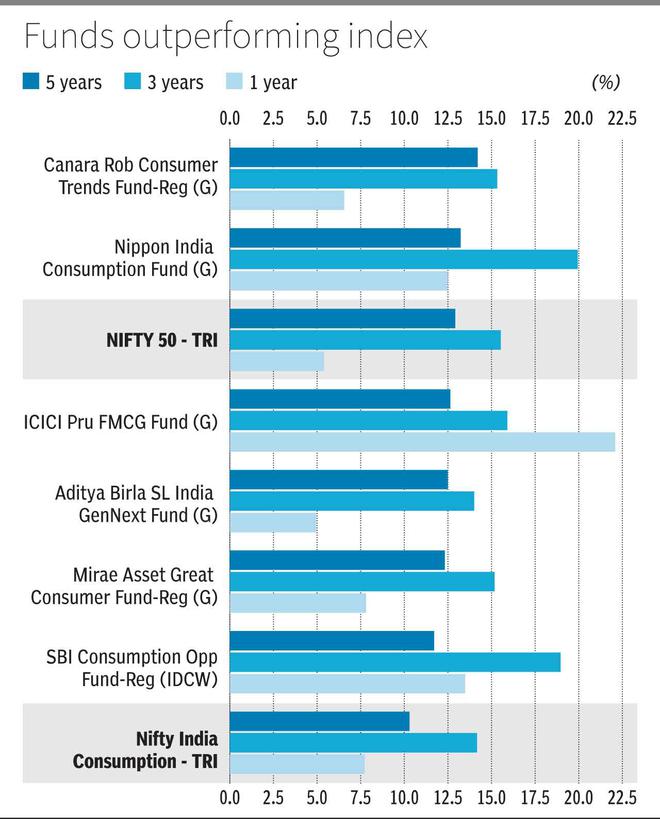

There are 14 funds operating in the consumption-based theme. Performance wise, half the funds have outperformed NSECON. This points to a significant scope for active management in the sector which most funds adhere to. Over a five-year period, only two funds have outperformed Nifty-50 — Canara Robeco Consumer Trends fund and Nippon India Consumption fund by 130 and 30 bps respectively. But just as the index, most funds have outperformed the broader Nifty-50 index in the last one year. ICICI Pru FMCG Fund and SBI Consumption Opportunities Fund have significantly outperformed Nifty-50 by 1,700 bps and 800 bps respectively in the last one year.

As consumption stocks overcome input cost inflation that immediately followed a period of volume recovery from Covid (restricting price pass-throughs), they should deliver better returns on possible deflation of commodity prices including oil, chemicals, raw materials and logistics costs.

Sector allocation

The current allocation amongst the leading funds is veered towards consumer non-durables led by ITC Ltd and Hindustan Unilever, which figure amongst the top-three holdings for all the leading funds. Overall, consumer non-durables accounts for the largest share in these mutual funds. Even though the benchmark index barely has banks/financial stocks, the funds have included BFSI segment led by ICICI Bank and HDFC Bank. Over the last five years, ICICI Bank has edged past HDFC bank in terms of allocation in the funds. With banks themselves veered towards retail credit growth over corporate credit, the consumption theme might be explored from credit growth angle with allocation to banks. But in the fund allocation, conspicuous by their absence are real estate companies or allied segments. None of the developers figure in the top holding of any of the mutual funds. But the Auto demand is reflected with allocation in the top-10 holdings. Amongst the Auto stocks, Maruti followed by M&M and TVS are in favour.

Considering a possible slowdown in input costs, consumption-themed mutual funds may be well positioned to deliver better returns. Also, the possible overheating in the broader markets in terms of forward valuations might work in favour of these mutual funds as valuations undergo mean reversion. Amongst the funds, Canara Robeco with a long-term outperformance against Nifty-50 and NSECON may be better placed. The fund overweight to consumer non-durables can benefit from any possible decline in raw material costs.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.