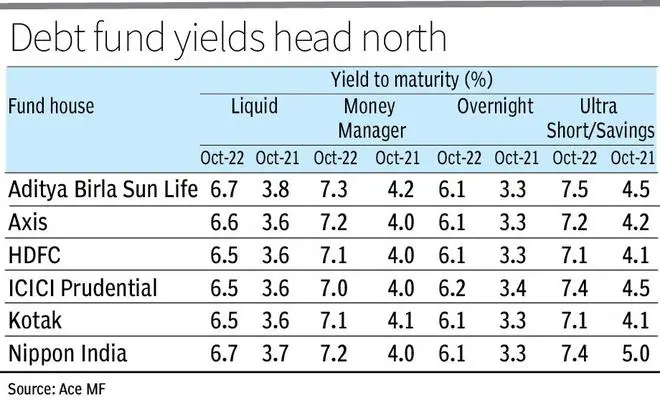

One-year returns of liquid, overnight, ultra-short term and money market funds stand at 3.5-5 per cent currently. A look at their portfolio yield to maturity (YTM) — the return investors would get if they stayed put till the maturity of the underlying fund holdings — tells us that returns could become much more attractive in the near-term. Going by their October 2022 portfolio, YTMs of funds in these categories stand at 6.1-7.5 per cent.

With the RBI increasing the repo rate by 190 basis points since May 2022, YTMs of such funds have increased by 250-320 basis points in the last year. The rise in yields make shorter maturity funds good investment options for investors.

Short-term funds attractive

Shorter maturity funds invest in instruments such as treasury bills, tri-party repos, commercial paper and certificates deposits, among others, with maturities ranging from a few weeks to a few months. In general, these funds invest in safe avenues.

Dev Ashish , a SEBI-registered RIA and founder of Stable Investor, says, “Given the current environment, it’s best for investors to stick to debt funds with shorter durations like liquid, money-market and ultra-short-duration funds. This approach during periods of rising rates has generally worked well as one can look at reasonably good returns without taking a lot of interest rate risk.”

Ashish also adds that those with goals 3-5 years away can consider the newer target maturity funds matching with this horizon, which are also offering attractive yields.

Time for long-term funds, too?

In contrast to the short-term yields, the rise in yields on five- and 10-year government securities has been lower at 100-140 basis points in the last year. However, experts suggest we are closer to the peak policy rates and hence investors can also begin considering longer-duration funds. Even though inflation is still high, despite the recent fall, and is outside the RBI’s comfort zone, many analysts and economists are of the view that price rise would take a downward trajectory. Hence, they feel that though interest rates will be hiked, the quantum of rise may not be high. Some experts also believe that the repo rate may peak at 6.25-6.5 per cent levels from 5.9 per cent currently.

Says Deepak Jasani, Head of Research at HDFC Securities, “We are close to the peak of the current rate hike cycle. We expect softer rate hikes from the RBI going ahead. High interest rate makes a case for higher allocation to long duration debt mutual funds or target maturity funds that invest in government securities and state development loans.”

“We might be close to the top of interest rates, but we are not yet there. Those looking at debt allocation for their long-term portfolio can consider a small allocation to gilts with a 10-year constant duration. But the investor should then be willing to take short-term pain due to MTM (mark-to-market) losses in the near future. But if the time horizon is shorter, say, just a few years, then it is best to avoid longer-duration funds completely for now,” says Ashish.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.