I am a 53-year-old salaried professional from Ahmedabad. I am looking to invest in Nifty 50 Index fund for the large-cap portion of my portfolio. Should I invest in simple Nifty 50 Index fund or Nifty 50 Equal Weight index fund? Which between these two will give better returns in the next five-seven years? I have shortlisted SBI & UTI for Nifty 50 fund and DSP & HDFC for Nifty 50 Equal Weight fund. Are they OK? Do you suggest any other fund? Please advise.

Shailesh Singh

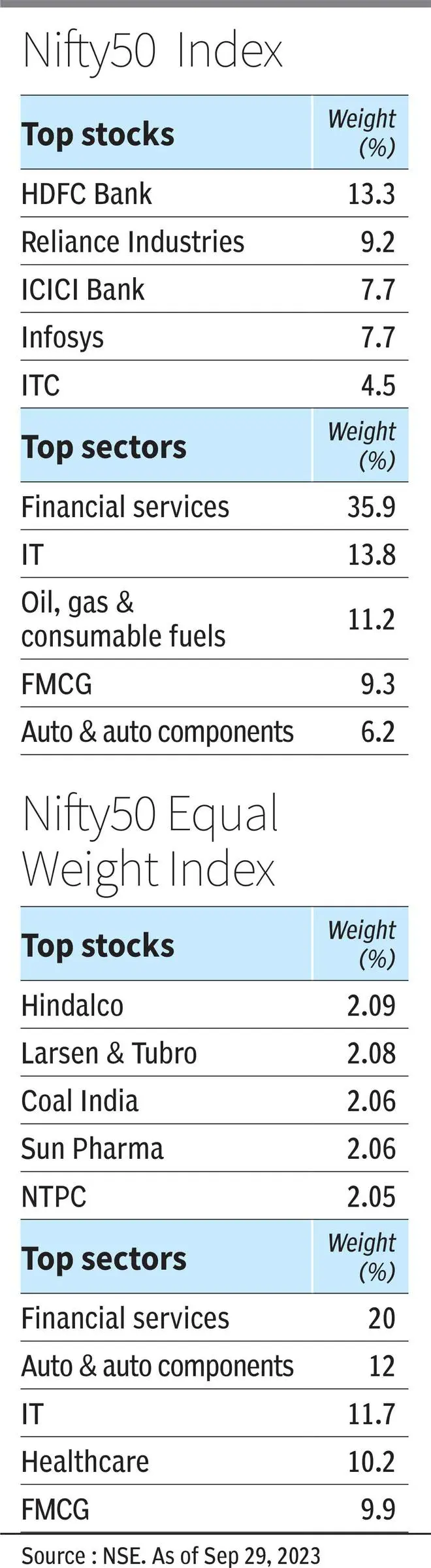

A Nifty50 index fund tracks the market closely and is suitable for your core portfolio. Considering that many actively-managed large-cap funds underperform the large-cap indices, a Nifty50 fund is a good low-cost passive alternative for your core portfolio, irrespective of whether you are new to investing in mutual funds or a veteran or whether you are young or old. A Nifty50 Equal Weight index fund belongs to the ‘smart beta’ category – something which falls in between a passive (beta) fund or a plain-vanilla index fund and an active fund (which is expected to generate alpha over the index). When this ‘smart beta’ strategy is applied to the Nifty50 index - which is otherwise weighted based on free-float market capitalisation of the stocks constituting the index - sector weights and stock weights for the very same 50 stocks become very different, as can be seen in the accompanying table.

Nifty50 may tend to do well in a polarised market where some names push up the returns. Nifty50 equal weight, on the other hand, will do well when there is broad-based rally in all stocks. For example, in 2019, DSP Nifty50 Equal Weight Index fund – the only fund in this category then – returned just 3.77 per cent, while Nifty 50 Index funds clocked about 13 per cent returns (direct plan). The contrast is visible in 2021, where the same DSP equal weight fund gained about 34 per cent, in contrast to the Nifty 50 index funds which brought in about 10 percentage points lower returns, at 24-25 per cent. However, in 2020, both categories of funds posted similar returns. Lumpsum and SIP returns over three-, five- or 10-year periods too vary widely for both categories of funds. Hence, you cannot consider them mutually exclusive.

Rather, you can have one Nifty Index fund for your core portfolio and an equal weight fund for your satellite portfolio. Among Nifty Index funds with a long track record, with SBI and UTI funds are decent choices, the Bandhan and ICICI Prudential funds make the cut due to relatively lower expense ratios and slightly better returns. For the equal weight exposure, you can consider the DSP fund.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.