Dubbed as the local fund with global focus, Parag Parikh Flexi Cap Fund (formerly Parag Parikh Long Term Equity Fund) has completed 10 years. Investors sticking on since inception (May 2013) would have witnessed initial ₹10-lakh investment growing to over ₹50 lakh now. A pioneer in international investing arena, Parag Parikh Flexi Cap Fund (PPFCF) was among only a handful of Indian mutual fund schemes in those days to invest in a basket of Indian and foreign stocks.

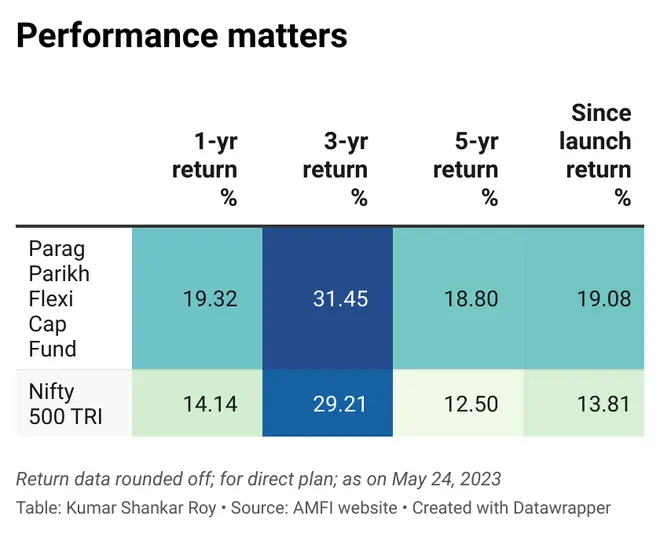

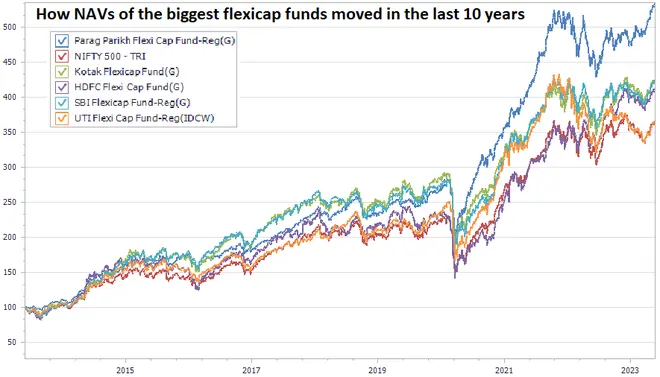

The ‘glocal’ strategy, combined with a strong investment process and stable fund management team, has resulted in good performance and over ₹35,000-crore assets under management (daily), putting it at a stone’s throw from the category leader. PPFCF figures in the top quartile among peers in five out of the last 10 years. It has also generated alpha in trailing one-, three- and five-year periods, putting it in an elite club among peers in the flexi-cap category that was created in November 2020. The big question now is whether this outperformance will sustain in future. Let’s dive in.

Also read: Funds that made ₹25,000 p.m SIP into ₹1 crore in 10 years

About the scheme

Flagship of its fund house, PPFCF is an open-ended equity oriented scheme with flexibility to invest a minimum of 65 per cent in Indian equities and up to 35 per cent in overseas equity security and domestic debt / money market securities. The scheme, by investing at least 65 per cent of its corpus in domestic equity, qualifies as an equity fund and gets investor-favourable taxation on gains on sale.

The fund’s investment stance has not depended much on the macro-economic situation but is focussed on individual companies. The fund prefers to buy quality companies at a reasonable price.

The fund considers factors such as quality of management, quality of the sector, and business and the valuation of the companies. The fund is noted for avoiding the temptation of betting on hot, popular stocks/sectors, and has stayed away when the opportunities are not attractive enough. Its portfolio turnover (excluding equity arbitrage) has been consistently lower than peers, indicating its buy-and-hold approach.

Before December 2020, PPFCF used to be a multi-cap fund but following SEBI recategorisation norms, it became a flexi-cap product to retain the freedom to invest without restrictions.

The fund has been managed since inception by CIO Rajeev Thakkar and thus has benefited from a stable fund management team (Raunak Onkar - dedicated fund manager for overseas securities).

The combined holding of ‘insiders’ in PPFCF amounts to ₹348.14 crore of AUM as on April 28, 2023, which is decent skin in the game.

Going international

One of the main positives of the scheme was the international investing part. This also paid rich dividends over the years, as the fund gained prominence owing to its ‘go anywhere’ nature. So far, the fund’s overseas exposure has been largely restricted to North America, Western Europe and developed Asia, and preference has been for multinationals with global operations.

Also read: HDFC Multi Asset Fund: Should you invest?

However, since the overall limit on foreign investments by MF industry was hit over a year ago, incremental investments in the PPFCF continue to be in Indian equities. This has meant that overseas stock exposure of the fund dropped from 29.83 per cent in February 2022 to 17.15 per cent in April 2023. The fund’s management has argued that the main objective of the scheme to invest abroad is to reduce risk rather than necessarily earn a higher return. In any case, funds will have to operate in the environment given to them.

PPFCF hedges most of the currency exposure using currency futures.

Performance

PPFCF, over the last 10 years, has shown commendable performance. Since inception, the fund (regular plan) has delivered over 19 per cent CAGR versus benchmark Nifty 500 Total Return Index’s 13.8 per cent gains. The fund has generated alpha in trailing 1-, 3- and 5-year periods. Less than 30 per cent schemes in the flexi-cap category can boast of this record.

In terms of risk ratios, the fund fares well against category and peers. Its three-year and five-year standard deviation is among the lowest, meaning it has given consistent returns over the long term. Similarly, its high sharpe ratio (among peers) indicates higher risk-adjusted returns. Also, the fund’s down capture ratio of 52 per cent, which is the lowest among peers, signifies the strategy has outperformed the benchmark while the market is falling.

Also read: Baroda BNP Paribas Value Fund NFO: Should you invest?

Unlike many funds that start with promise but fail to sustain, PPFCF has managed to perform despite its growing size (AUM) that has become 200-fold in 10 years. We view this as a big positive.

Portfolio

The fund’s current core equity portfolio has over two dozen India-listed stocks. HDFC, ITC, Bajaj Holdings, ICICI Bank and Axis Bank are the top holdings (5-8 per cent each). Overseas stock allocation is in four stocks (Microsoft, Alphabet, Amazon and Meta).

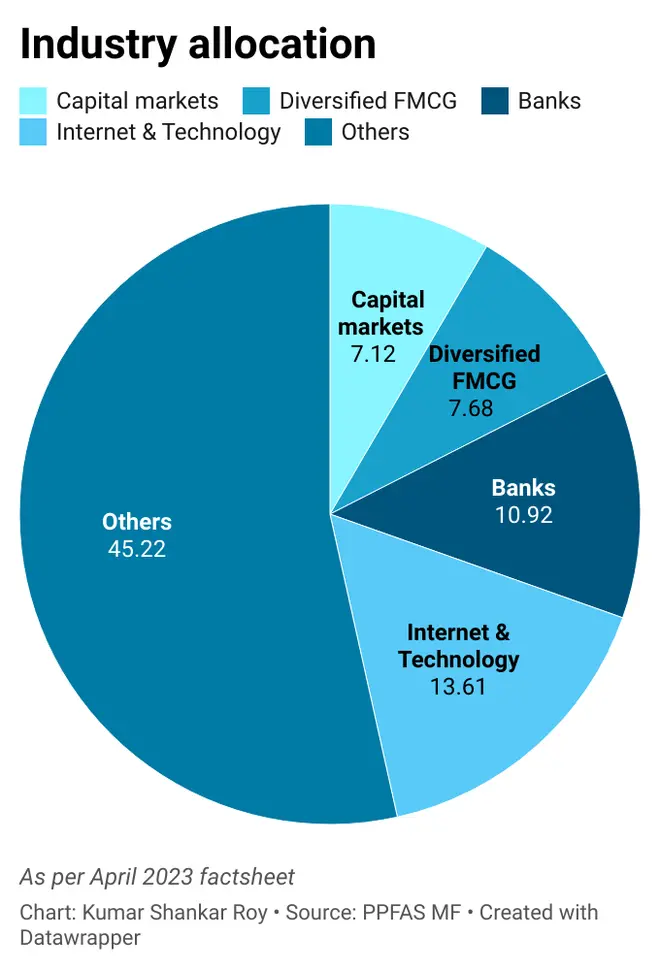

Fund portfolio wise, finance has the highest industry allocation (over 15 per cent), followed by internet and technology, banks, diversified FMCG, capital markets, IT - software, and power.

Currently, the fund has about 17.67 per cent in cash holdings, debt and money market instruments and arbitrage positions which can be deployed in long-term investments at appropriate levels. Previously, the fund’s calls on staying cautious have worked well.

Also read: Which type of SIP should you opt for?

For instance, in 2017, it stayed off some of the lesser-quality small- and mid caps, and consequently, its performance was hit in the short term. But when markets went down, the situation changed.

Similarly, not only did the fund contain losses well in the March 2020 quarter when the market crashed, it also participated strongly in the market surge that followed.

Our take

The fund’s investment process and stock picking has held it in good stead over the years, making it a top performer. While the combination of local and global stocks may change to a more pronounced Indian exposure till the cap on foreign exposure goes, its bias towards quality and value factors should help sustain its record.

Risks to our call are change in fund manager and deterioration in its track record of investment success.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.