By now, mutual fund investors must be aware that market regulator SEBI, in a consultation paper released on May 18, has proposed to rejig the expense ratios.

The move is aimed at bringing transparency and reducing the cost of investment. Costs for running and managing a mutual fund scheme are collectively referred to as TER or Total Expense Ratio and are expressed as a percentage of the fund’s daily net assets.

The daily NAV (Net Asset Value) of a mutual fund is disclosed after deducting the expenses. A lower TER could bring higher returns.

SEBI’s proposal is open for comments till June 1 and may or may not be implemented in the manner prescribed in the paper. However, this 40-pager has important findings for investors on the ways in which fund houses have been operating with respect to the charging of expense ratios.

Finding #1: Equity and hybrid funds worse off

Data as on March 31, 2023, shows that 60.06 per cent of the total assets under management (AUM) was held by individual investors. Individuals have put in more than 57.18 per cent of their investment in equity schemes and 17.49 per cent in hybrid schemes.

On the other hand, corporates have majority of their investment, i.e. 51.75 per cent, in debt schemes and 28.94 per cent in ETFs. However, even as various fund houses have significantly large AUMs (Assets Under Management) in equity and hybrid schemes, the TER charged is mostly close to the currently prescribed regulatory limits.

In case of debt schemes, though, with investors being mostly corporates/institutional investors having bargaining power, the TER is much lower than the prescribed limit.

Therefore, the benefit of economies of scale (AUMs of the industry grew sixfold from ₹6-lakh crore on March 31, 2012, to ₹39-lakh crore on March 31, 2023) accruing in the debt schemes appears to be passed on to the investors but not so in the equity and hybrid schemes.

Finding #2: Regular plans bear brunt of excessive additional expenses

Over and above the prescribed TER (called base TER), MFs are allowed to charge four additional expenses: brokerage and transaction costs, expenses for new investments from B-30 cities, for schemes which have exit load (on redemption within specified timelines) and for GST obligation on investment and advisory fee (investment and advisory fee are part of running/managing costs).

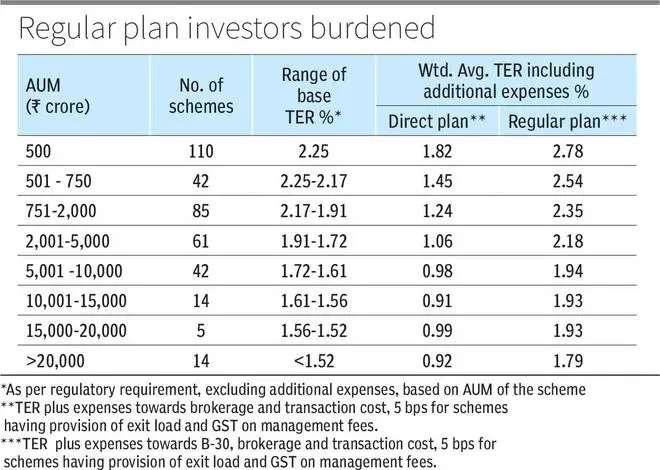

However, considering that there is no upper cap on additional expenses, SEBI has found that the actual expense to investor is considerably higher than the prescribed base TER limits for regular plan. In contrast, the cost of investment (including all additional expenses) for direct plan is well below the regulatory limits (see table).

Finding #2a: Brokerage and transaction costs more than maximum TER

Brokerage and transaction costs are part of recurring expenses that can be charged to a scheme. The additional expense limit is specified as up to 0.12 per cent of trade value in case of cash market transactions and 0.05 per cent of trade value in case of derivative transactions. However, any payment over and above the above limits is permitted to be charged to the schemes within the maximum limit of TER as prescribed.

In practice,the brokerage and transaction costs charged to the investors depend on the actual number and value of transactions undertaken by any scheme with no upper cap being applicable on total expenses towards such costs. As a result, there is no accountability for total spending under this head for any scheme. From the data shared by AMCs, it is observed that spending of some schemes towards brokerage and transaction cost is more than even the maximum TER limits prescribed. This has resulted in investors paying more than double the permissible TER limits prescribed for the scheme towards expenses, observes the report.

Finding #2b: Provision for higher expenses for B30 AUMs misused

MFs are permitted to charge expenses not exceeding of 0.30 per cent of daily net assets, if the new inflows from individual retail investors from beyond top 30 cities (B-30 cities) meet certain criteria. This additional expense is charged to unitholders of regular plans of a scheme, which is then utilised by AMCs for payment of distribution commission for bringing the inflows.

SEBI has observed the following in this regard: One, B30 expenses are not charged to all schemes uniformly. B30 charges are often not included in schemes where the AMCs intend to keep low expense ratio. Thus, this incentive is often used as a mechanism to promote one scheme over another by showing lower expenses. Two, applications with investment amount higher than ₹2 lakh (threshold for classification as retail investment) are often split to make each application for investment of less than ₹2 lakh, so that B-30 expenses can be charged. Three, investments of B30 investors are often churned by way of withdrawal and re-investment after a year (one year is the minimum holding period requirement), which results in charging of additional expenses to schemes for the same investment. Four, the methodology of computing additional expenses for inflows from B-30 cities is not uniform across funds. Five, the expenses charged are usually based on projections of weekly or fortnightly inflows and not on actuals, which may be different from the projections.

Finding #2c: Under credit of exit load charged

Rules say that exit load charged to investors exiting from a scheme should be credited back to the scheme. The intent is that early redemptions by investors from the scheme has impact on the non-exiting investors and thus they should be compensated by crediting exit load to the scheme. For this purpose, AMCs are allowed to charge additional 5 bps (basis points) for schemes where SIDs (Scheme Information Documents) have a provision of charging of exit load.

Indirectly, this implied that AMCs can charge additional 5 bps to the scheme even if there is no claw back/exit load credited to the scheme, provided SIDs had the provision. The available data of additional expenses charged to schemes and the actual exit loads recovered from the investors was analysed and it is seen that in FY 2021-22, while the total amount of additional expenses charged to the schemes was ₹735 crore, the exit load recovered from exiting investors and credited to the schemes was around ₹611 crore.

Finding #3 : Distributors may be switching your schemes for more commission

Data gathered by SEBI regarding NFOs during April 1, 2021-September 30, 2022, reveals two things: One, switch transactions in regular plans amounted to 93 per cent of total switch transactions; Two, amount garnered by new active schemes was ₹82,733 crore, of which ₹22,437 crore, i.e. 27.12 per cent, was through switch transactions from regular plans of other schemes of the same AMC. In one of the schemes, up to 55 per cent of the fund garnered in NFO was through switch transactions from other schemes of the fund house.

Under the present rules, a new scheme with small AUM base can charge higher TER as compared to an existing scheme with higher AUM. Thus, AMCs can be motivated to give high distribution commission for NFOs wherein they can charge high TER and nudge the switch transactions from existing schemes with large-size AUM to the new schemes with smaller AUM size.

Secondly, SEBI says that though upfronting of commissions is prohibited, the trail commissions paid by AMCs is often higher in the first/initial year(s) of inflows/investments and reduces in subsequent years, somewhat upfronting the payment. This practice also encourages churning and/or mis-selling of products by distributors after the first year of investments. The fact that in FY 2021-22, around 71 per cent of the total MF units were redeemed within two years of investment and in 2022-23 again, 73 per cent of units were redeemed within two years puts this finding in perspective.

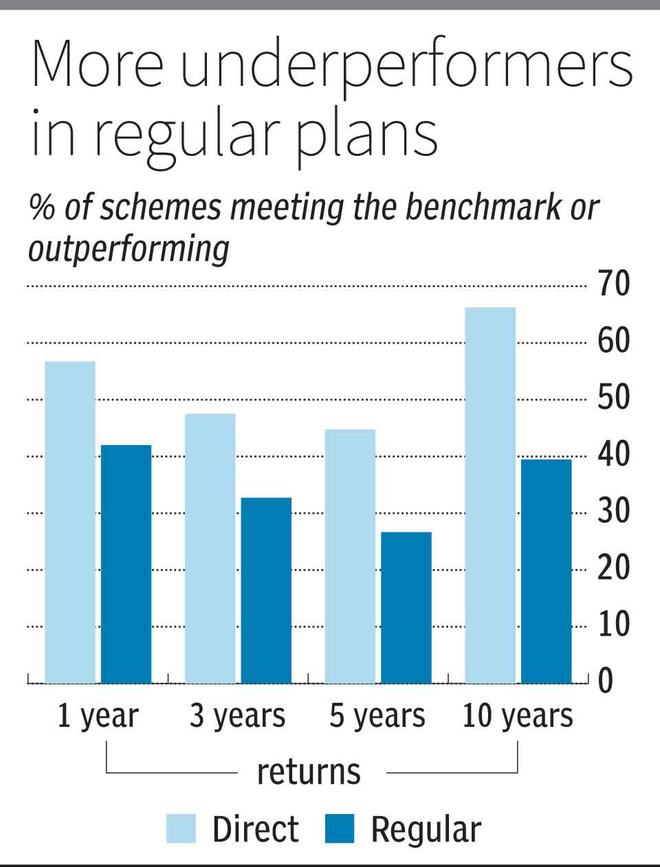

Finding #4: More regular plans underperform benchmarks

An analysis of the data of performance of active schemes over a period of one year, three years, five years and 10 years as of February 2023 shows that underperformance of regular plans is higher as compared to direct plans over all time periods. Further, more than 22 per cent of the regular plans of schemes have underperformance of more than 1.25 per cent(equivalent to maximum tracking difference permissible for debt ETFs/Index Funds) vis-à-vis the benchmark for all periods mentioned above.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.